Singapore Airlines 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

SINGAPORE AIRLINES

072

FINANCIAL REVIEW

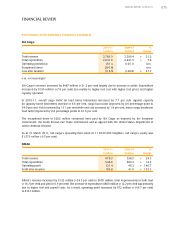

Performance of the Company (continued)

Expenditure (continued)

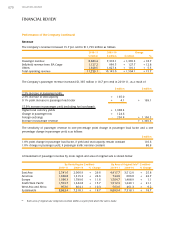

Staff costs were $175 million higher (+12.8 percent) largely from higher provision for profit-sharing bonus as a

result of better operating performance and the reinstatement of wage cut.

Sales cost increased $71 million (+14.6 per cent) mainly due to higher commission and incentives, in line with

the higher revenue.

Rentals on leased aircraft increased $44 million (+9.2 per cent), primarily attributable to lease of additional eight

A330-300 aircraft and one A380-800 aircraft, partially offset by the return of four B747-400 aircraft on expiry

of lease and the weakening of USD against SGD.

Other costs were up $60 million (+11.8 per cent), mainly from higher foreign exchange revaluation and hedging loss.

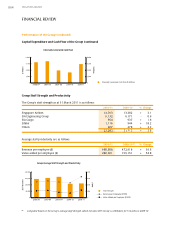

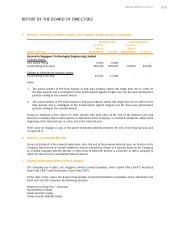

Fuel Productivity and Sensitivity Analysis

Fuel productivity as measured by load tonne-km per barrel (ltk/BBL) decreased 1.5 per cent over the previous

year to 425ltk/BBL. This was mainly due to a decline in the overall load factor.

A change in fuel productivity (passenger aircraft) of 1.0 per cent would impact the Company’s annual fuel cost

by about $36 million, before accounting for changes in fuel price, USD exchange rate and flying operations.

A change in the price of fuel of one USD per barrel affects the Company’s annual fuel cost by about $36 million,

before accounting for USD exchange movements, and changes in volume of fuel consumed.

Finance Charges

Finance charges were higher in 2010-11, mainly from interest expense incurred for the $500 million 10-year

bond (issued in July 2010) bearing interest of 3.22 per cent per annum and $300 million 5-year bond (issued

in September 2010) bearing interest of 2.15 per cent per annum.

Interest Income

Interest income was $11 million lower in 2010-11, largely because amortised interest on the A330-300

progress delivery payments decreased $14 million with the full delivery of the aircraft.