Singapore Airlines 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2010/2011 145

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

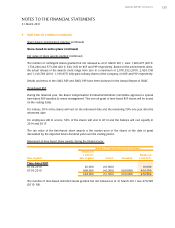

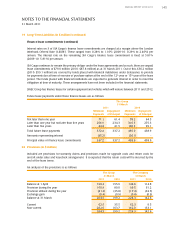

19 Long-Term Liabilities (in $ million) (continued)

Finance lease commitments (continued)

Interest rates on 3 of SIA Cargo’s finance lease commitments are charged at a margin above the London

Interbank Offered Rate (“LIBOR”). These ranged from 0.28% to 1.16% (2009-10: 0.29% to 2.46%) per

annum. The interest rate on the remaining SIA Cargo’s finance lease commitment is fixed at 5.81%

(2009-10: 5.81%) per annum.

SIA Cargo continues to remain the primary obligor under the lease agreements and as such, there are unpaid

lease commitments of $79.0 million (2010: $87.8 million) as at 31 March 2011. Out of this, $56.2 million

(2010: $59.1 million) are covered by funds placed with financial institutions under defeasance to provide

for payments due at time of exercise of purchase option at the end of the 12th year or 15th year of the lease

period. The funds placed with financial institutions are expected to generate interest in order to meet the

obligation at time of maturity. These arrangements have not been included in the financial statements.

SIAEC Group has finance leases for certain equipment and vehicles which will mature between 2011 and 2012.

Future lease payments under these finance leases are as follows:

The Group

31 March

2011 2010

Minimum Repayment Minimum Repayment

Payments of Principal Payments of Principal

Not later than one year 71.1 61.4 78.2 64.5

Later than one year but not later than five years 256.9 234.3 310.5 275.3

Later than five years 44.4 41.5 106.3 99.1

Total future lease payments 372.4 337.2 495.0 438.9

Amounts representing interest (35.2) - (56.1) -

Principal value of finance lease commitments 337.2 337.2 438.9 438.9

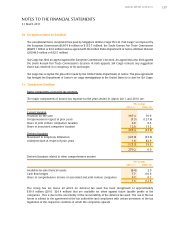

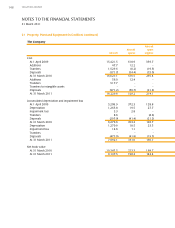

20 Provisions (in $ million)

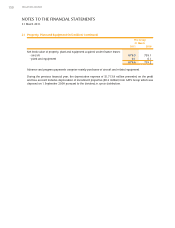

Included are provisions for warranty claims and provisions made for upgrade costs and return costs for

aircraft under sales and leaseback arrangement. It is expected that the return costs will be incurred by the

end of the lease terms.

An analysis of the provisions is as follows:

The Group The Company

31 March 31 March

2011 2010 2011 2010

Balance at 1 April 199.2 155.9 142.6 114.8

Provision during the year 106.9 80.0 99.5 61.2

Provision utilised during the year (41.2) (35.8) (17.4) (32.5)

Exchange gain (0.4) (0.9) (0.4) (0.9)

Balance at 31 March 264.5 199.2 224.3 142.6

Current 62.5 35.5 62.3 9.5

Non-current 202.0 163.7 162.0 133.1

264.5 199.2 224.3 142.6