Singapore Airlines 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SINGAPORE AIRLINES

100

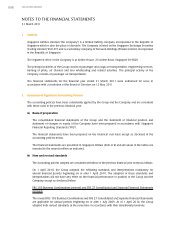

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

2 Summary of Significant Accounting Policies (continued)

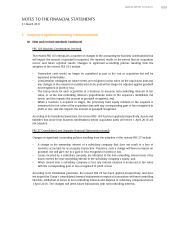

(b) New and revised standards (continued)

The Group has not adopted the following standards and interpretations that have been issued but not

yet effective:

Description Effective for annual periods

beginning on or after

Improvements to FRSs issued in 2010 1 January 2011

(unless otherwise stated)

INT FRS 119 Extinguishing Financial Liabilities with Equity Instruments 1 July 2010

Revised FRS 24 Related Party Disclosures 1 January 2011

Amendments to INT FRS 114 Prepayments of

a Minimum Funding Requirement 1 January 2011

Amendments to FRS 107 Financial Instruments:

Disclosures – Transfer of Financial Assets 1 July 2011

Amendments to FRS 12 Deferred Tax – Recovery of Underlying Assets 1 January 2012

Except for the revised FRS 24, the management expects that the adoption of the other standards and

interpretations above will have no material impact on the financial statements in the period of initial

application. The nature of the impending changes in accounting policy on adoption of the revised FRS

24 is described below.

Revised FRS 24 Related Party Disclosures

The revised FRS 24 clarifies the definition of a related party to simplify the identification of such

relationships and to eliminate inconsistencies in its application. The revised FRS 24 expands the

definition of a related party and would treat two entities as related to each other whenever a person

(or a close member of that person’s family) or a third party has control or joint control over the entity,

or has significant influence over the entity. The revised standard also introduces a partial exemption of

disclosure requirements for government-related entities. The Group is currently determining the impact

of the changes to the definition of a related party on the disclosure of related party transactions. As this

is a disclosure standard, it will have no impact on the financial position or financial performance of the

Group when implemented in 2011.

(c) Basis of consolidation

The consolidated financial statements comprise the separate financial statements of the Company

and its subsidiary companies as at the end of the reporting period. The financial statements of the

subsidiary companies used in the preparation of the consolidated financial statements are prepared for

the same reporting date as the Company. Consistent accounting policies are applied to like transactions

and events in similar circumstances. A list of the Group’s subsidiary companies is shown in Note 23 to

the financial statements.

All intra-group balances, transactions, income and expenses and unrealised profits and losses resulting

from intra-group transactions are eliminated in full.

Business combinations are accounted for by applying the acquisition method. Identifiable assets

acquired and liabilities and contingent liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date. Acquisition-related costs are recognised as expenses

in the periods in which the costs are incurred and the services are received.