Singapore Airlines 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SINGAPORE AIRLINES

102

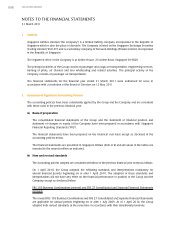

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

2 Summary of Significant Accounting Policies (continued)

(d) Subsidiary, associated and joint venture companies

In the Company’s separate financial statements, investment in subsidiary and associated companies

are accounted for at cost less accumulated impairment losses.

A subsidiary company is defined as an entity over which the Group has the power to govern the

financial and operating policies so as to obtain benefits from its activities, generally accompanied by a

shareholding giving rise to the majority of the voting rights.

An associated company is defined as an entity, not being a subsidiary company or joint venture

company, in which the Group has significant influence, but not control, generally accompanied by

a shareholding giving rise to not less than 20% of the voting rights. A list of the Group’s associated

companies is shown in Note 24 to the financial statements.

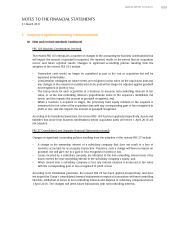

The Group’s investments in associated companies are accounted for using the equity method. Under

the equity method, the investment in associated company is measured in the statement of financial

position at cost plus post-acquisition changes in the Group’s share of net assets of the associated

company. Goodwill relating to an associated company is included in the carrying amount of the

investment and is neither amortised nor tested individually for impairment. Any excess of the Group’s

share of the net fair value of the associated company’s identifiable assets, liabilities and contingent

liabilities over the cost of investment is deducted from the carrying amount of the investment and is

recognised as income as part of the Group’s share of profit or loss of the associated company in the

period in which the investment is acquired.

When the Group’s share of losses in an associated company equals or exceeds its interest in the

associated company, the Group does not recognise further losses, unless it has incurred obligations or

made payments on behalf of the associated company.

After application of the equity method, the Group determines whether it is necessary to recognise

an additional impairment loss on the Group’s investment in its associated companies. The Group

determines at the end of each reporting period whether there is any objective evidence that the

investment in the associated company is impaired. If this is the case, the Group calculates the amount

of impairment as the difference between the recoverable amount of the associated company and its

carrying value and recognises the amount in the profit and loss account.

A joint venture company is a contractual arrangement whereby two or more parties undertake an

economic activity that is subject to joint control, where the strategic financial and operating decisions

relating to the activity require the unanimous consent of the parties sharing control. A list of the

Group’s joint venture companies is shown in Note 25 to the financial statements.

The Group’s share of the results of the joint venture companies is recognised in the consolidated

financial statements under the equity method on the same basis as associated companies.

The most recently available audited financial statements of the associated and joint venture companies

are used by the Group in applying the equity method. Where the dates of the audited financial

statements used are not co-terminous with those of the Group, the share of results is arrived at from

the last audited financial statements available and unaudited management financial statements to the

end of the accounting period. Where necessary, adjustments are made to bring the accounting policies

in line with those of the Group.