Singapore Airlines 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

SINGAPORE AIRLINES

136

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

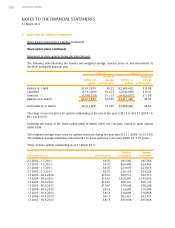

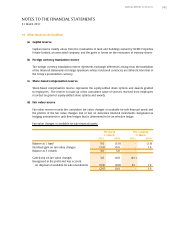

6 Operating Profit (in $ million)

Operating profit for the financial year was arrived at after charging/(crediting):

The Group

2010-11 2009-10

Interest income from short-term investments (0.8) (0.9)

Dividend income from short-term investments (0.9) (0.7)

Surplus on disposal of short-term investments (6.3) (3.6)

Income from operating lease of aircraft (91.8) (1.0)

Amortisation of deferred gain on sale and operating leaseback transactions (29.0) (64.7)

Bad debts written off 0.8 0.8

Writeback of impairment of trade debtors (1.5) -

Professional fees paid to a firm of which a director is a member 0.5 0.5

Remuneration for auditors of the Company

Audit fees 1.5 1.6

Non-audit fees 0.7 0.9

Exchange loss, net 71.5 54.3

Currency hedging loss 38.2 17.7

Fuel hedging loss recognised in “Fuel costs” 62.1 558.0

Ineffectiveness of fuel hedging contracts recognised in “Fuel costs” - 0.3

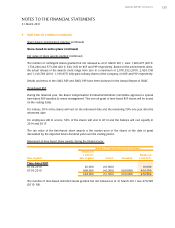

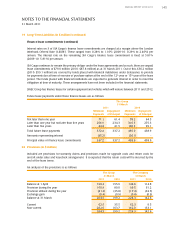

7 Finance Charges (in $ million)

The Group

2010-11 2009-10

Notes payable 52.3 39.9

Loans - 0.8

Finance lease commitments 9.9 10.9

Other receivables measured at amortised cost - 7.6

Realised loss on interest rate swap contracts accounted as cash flow hedges 7.1 9.5

Fair value gain on interest rate swap contracts accounted as fair value

through profit and loss (1.8) (2.1)

Commitment fees 2.6 2.3

70.1 68.9

8 Interest Income (in $ million)

The Group

2010-11 2009-10

Fixed deposits 26.7 19.3

Amortised interest income from other receivables 9.5 23.0

Others 1.1 7.2

37.3 49.5

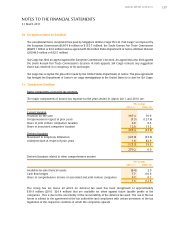

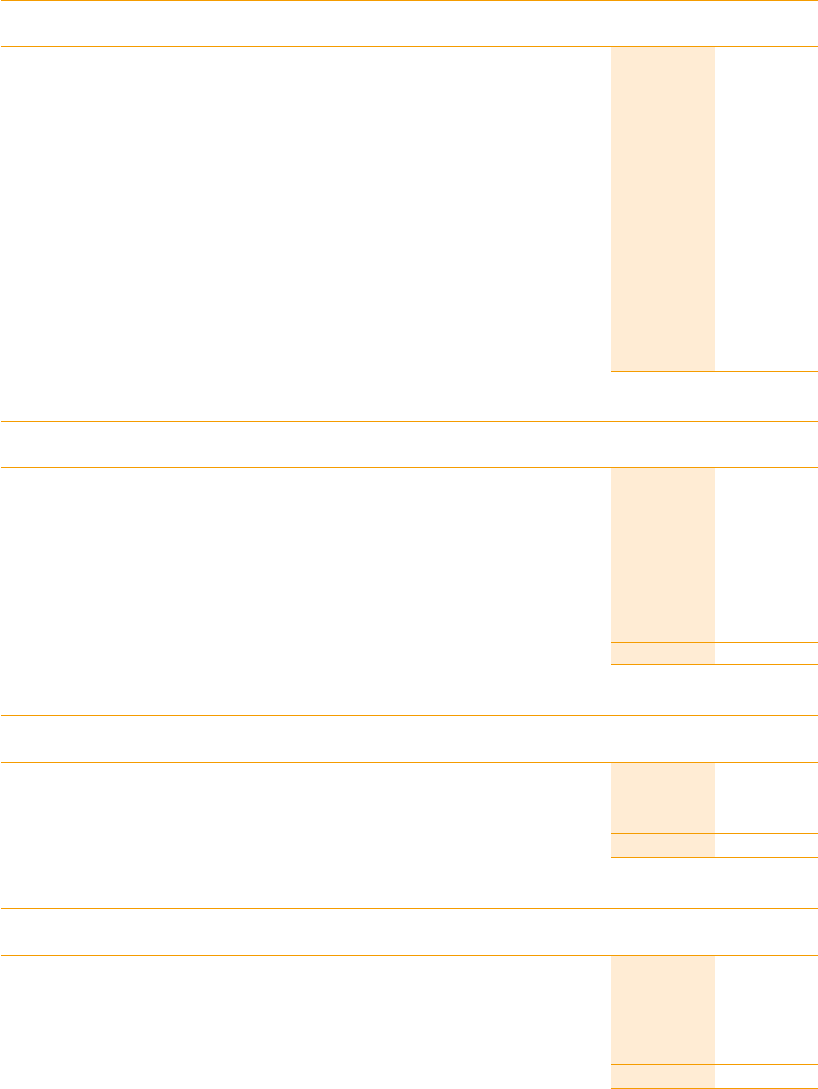

9 Other Non-operating Items (in $ million)

The Group

2010-11 2009-10

Recognition of liquidated damages 79.8 20.4

Surplus on disposal of other property, plant and equipment 1.0 6.9

Loss on sale of Service Quality (SQ) Centre Pte Ltd (0.7) -

Gain on disposal of SATS shares - 6.4

Amortisation of deferred gain on sale and finance leaseback transactions - 0.5

80.1 34.2