Singapore Airlines 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2010/2011 137

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

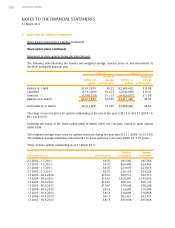

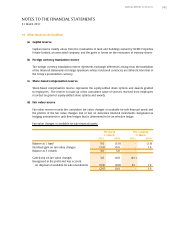

10 Exceptional Items (in $ million)

The exceptional items comprised fines paid by Singapore Airlines Cargo Pte Ltd (“SIA Cargo”) as imposed by

the European Commission (EUR74.8 million or $135.7 million), the South Korean Fair Trade Commission

(KRW3.1 billion or $3.6 million) and as agreed with the United States Department of Justice Antitrust Division

(USD48.0 million or $62.5 million).

SIA Cargo has filed an appeal against the European Commission’s decision. An appeal was also filed against

the South Korean Fair Trade Commission’s decision. In both appeals, SIA Cargo contests any suggestion

that it was involved in a conspiracy to fix surcharges.

SIA Cargo has accepted the plea offer made by the United States Department of Justice. The plea agreement

has brought the Department of Justice’s air cargo investigations in the United States to a close for SIA Cargo.

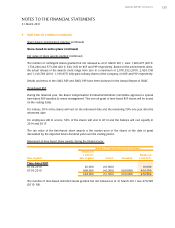

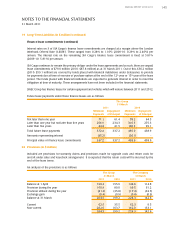

11 Taxation (in $ million)

Major components of income tax expense

The major components of income tax expense for the years ended 31 March 2011 and 2010 are:

The Group

2010-11 2009-10

Current taxation

Provision for the year 387.4 79.9

Overprovision in respect of prior years (7.5) (127.6)

Share of joint venture companies’ taxation 2.9 0.6

Share of associated companies’ taxation 12.6 13.2

395.4 (33.9)

Deferred taxation

Movement in temporary differences (127.0) (43.0)

Underprovision in respect of prior years 1.8 82.9

(125.2) 39.9

270.2 6.0

Deferred taxation related to other comprehensive income:

The Group

2010-11 2009-10

Available-for-sale financial assets (0.4) 2.0

Cash flow hedges 7.7 110.6

Share of comprehensive income of associated and joint venture companies 0.2 0.2

7.5 112.8

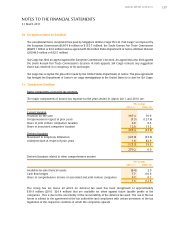

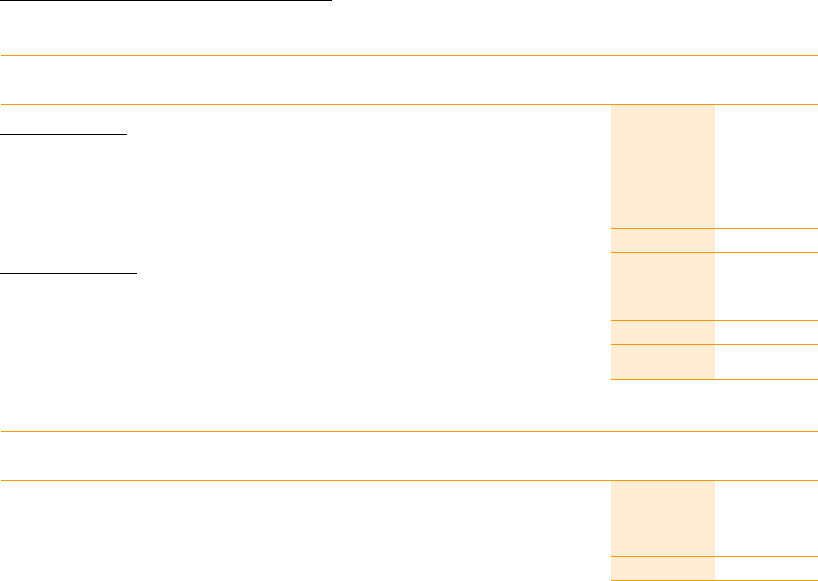

The Group has tax losses (of which no deferred tax asset has been recognised) of approximately

$30.9 million (2010: $24.4 million) that are available for offset against future taxable profits of the

companies. This is due to the uncertainty of the recoverability of the deferred tax asset. The use of the tax

losses is subject to the agreement of the tax authorities and compliance with certain provisions of the tax

legislation of the respective countries in which the companies operate.