Singapore Airlines 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2010/2011 153

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

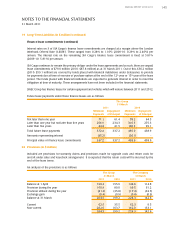

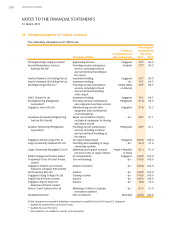

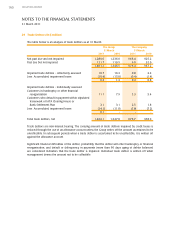

23 Subsidiary Companies (in $ million)

The Company

31 March

2011 2010

Investment in subsidiary companies (at cost)

Quoted equity investments # #

Unquoted equity investments 1,772.4 1,772.4

1,772.4 1,772.4

Accumulated impairment loss (16.6) (16.6)

1,755.8 1,755.8

Loan to a subsidiary company - 50.0

1,755.8 1,805.8

Funds from subsidiary companies (1,418.8) (1,166.7)

Amounts owing to subsidiary companies (110.2) (131.3)

(1,529.0) (1,298.0)

Amounts owing by subsidiary companies 194.0 141.0

Market value of quoted equity investments 3,523.5 3,088.5

# The value is $1.

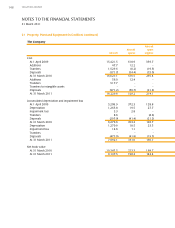

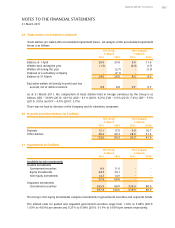

During the financial year, SIAEC invested an additional $1.9 million and $11.6 million in NexGen Network

(1) Holding Pte Ltd (“NGN1”) and NexGen Network (2) Holding Pte Ltd (“NGN2”) respectively, in accordance

to the agreement.

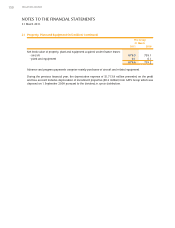

There are no existing loans to subsidiary companies as at 31 March 2011. The two unsecured loans to a

subsidiary company that were due for repayment in 2011 and 2014 have been repaid earlier, in December

2010. There are two lines of credit (denominated in SGD) extended to two subsidiary companies for a

maximum amount of $50.0 million and $12.9 million respectively. Commitment fees on these lines of

credit are charged at 0.0625% per annum on the available commitment and interest on any drawdown is

computed using an interest rate equal to SGD Swap-Offer Rate (prevailing at the time of each drawdown)

plus 0.80% margin. As at 31 March 2011, there has been no drawdown under either of the lines of credit.

Funds from subsidiary companies are unsecured and have varying repayment terms. Interest on funds

from subsidiary companies are computed using prevailing market rates which range from 0.01% to 0.55%

(2009-10: 0.03% to 1.00%) per annum for SGD funds, from 0.14% to 0.73% (2009-10: 0.09% to 1.85%)

per annum for USD funds and from 4.10% to 4.87% (2009-10: 2.80% to 4.03%) per annum for AUD funds.

As at 31 March 2011, the composition of funds from subsidiary companies held in foreign currencies by

the Company is as follows: USD – 10.8% (2010: 21.0%) and AUD – 0.3% (2010: 0.7%).

Amounts owing to/by subsidiary companies are unsecured, trade-related, non-interest bearing and are

repayable on demand. The amounts owing by subsidiary companies are neither overdue nor impaired.