Singapore Airlines 2011 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SINGAPORE AIRLINES

176

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

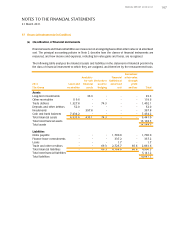

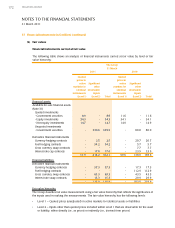

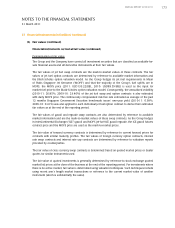

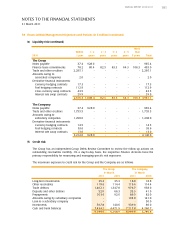

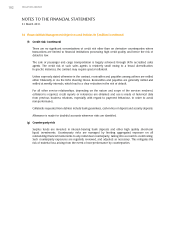

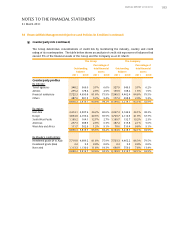

38 Financial Risk Management Objectives and Policies (in $ million) (continued)

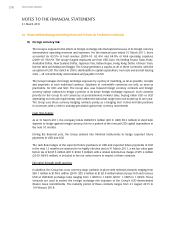

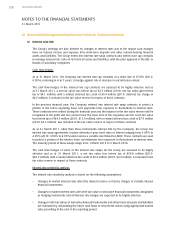

(b) Foreign currency risk

The Group is exposed to the effects of foreign exchange rate fluctuations because of its foreign currency

denominated operating revenues and expenses. For the financial year ended 31 March 2011, these

accounted for 63.5% of total revenue (2009-10: 62.4%) and 64.0% of total operating expenses

(2009-10: 58.6%). The Group’s largest exposures are from USD, Euro, UK Sterling Pound, Swiss Franc,

Australian Dollar, New Zealand Dollar, Japanese Yen, Indian Rupee, Hong Kong Dollar, Chinese Yuan,

Korean Won and Malaysian Ringgit. The Group generates a surplus in all of these currencies, with the

exception of USD. The deficit in USD is attributable to capital expenditure, fuel costs and aircraft leasing

costs – all conventionally denominated and payable in USD.

The Group manages its foreign exchange exposure by a policy of matching, as far as possible, receipts

and payments in each individual currency. Surpluses of convertible currencies are sold, as soon as

practicable, for USD and SGD. The Group also uses forward foreign currency contracts and foreign

currency option contracts to hedge a portion of its future foreign exchange exposure. Such contracts

provide for the Group to sell currencies at predetermined forward rates, buying either USD or SGD

depending on forecast requirements, with settlement dates that range from one month up to one year.

The Group uses these currency hedging contracts purely as a hedging tool. It does not take positions

in currencies with a view to making speculative gains from currency movements.

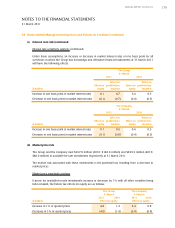

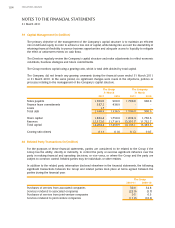

Cash flow hedges

As at 31 March 2011, the Company holds USD460.9 million (2010: USD158.3 million) in short-term

deposits to hedge against foreign currency risk for a portion of the forecast USD capital expenditure in

the next 10 months.

During the financial year, the Group entered into financial instruments to hedge expected future

payments in USD and SGD.

The cash flow hedges of the expected future purchases in USD and expected future payments in SGD

in the next 12 months are assessed to be highly effective and at 31 March 2011, a net fair value gain

before tax of $247.5 million (2010: $302.5 million), with a related deferred tax charge of $75.2 million

(2010: $84.6 million), is included in the fair value reserve in respect of these contracts.

Fair value through profit and loss

In addition, the Group has cross currency swap contracts in place with notional amounts ranging from

$30.1 million to $109.6 million (2010: $35.9 million to $128.6 million) where it pays SGD and receives

USD at USD/SGD exchange rates ranging from 1.3085 to 1.6990 (2010: 1.3085 to 1.6990). These

contracts are used to protect the foreign exchange risk exposure of the Group’s USD-denominated

finance lease commitments. The maturity period of these contracts ranges from 21 August 2015 to

14 February 2018.