Singapore Airlines 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2010/2011 003

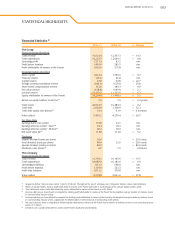

STATISTICAL HIGHLIGHTS

2010-11 2009-10 % Change

The Group

Financial Results ($ million)

Total revenue 14,524.8 12,707.3 + 14.3

Total expenditure 13,253.5 12,644.1 + 4.8

Operating profit 1,271.3 63.2 n.m.

Profit before taxation 1,419.0 285.5 n.m.

Profit attributable to owners of the Parent 1,092.0 215.8 n.m.

Financial Position ($ million)

Share capital 1,832.4 1,750.6 + 4.7

Treasury shares (43.0) (0.9) n.m.

Capital reserve 91.8 74.8 + 22.7

Foreign currency translation reserve (186.1) (137.0) - 35.8

Share-based compensation reserve 172.6 185.3 - 6.9

Fair value reserve (138.0) (140.9) + 2.1

General reserve 12,474.7 11,737.0 + 6.3

Equity attributable to owners of the Parent 14,204.4 13,468.9 + 5.5

Return on equity holders’ funds (%) R2 7.9 1.6 + 6.3 points

Total assets 24,544.5 22,484.3 + 9.2

Total debt 2,038.9 1,338.9 + 52.3

Total debt equity ratio (times) R3 0.14 0.10 + 0.04 times

Value added 5,419.2 4,276.4 + 26.7

Per Share Data

Earnings before tax (cents) 118.8 24.1 n.m.

Earnings after tax (cents) - basic R4 91.4 18.2 n.m.

Earnings after tax (cents) - diluted R5 90.2 18.0 n.m.

Net asset value ($) R6 11.89 11.30 + 5.2

Dividends

Interim dividend (cents per share) 20.0 - + 20.0 cents

Final dividend (cents per share) 40.0 12.0 + 28.0 cents

Special dividend (cents per share) 80.0 - + 80.0 cents

Dividend cover (times) R7 0.7 1.5 - 0.8 times

The Company

Financial Results ($ million)

Total revenue 11,739.1 10,145.0 + 15.7

Total expenditure 10,887.8 10,183.6 + 6.9

Operating profit/(loss) 851.3 (38.6) n.m.

Profit before taxation 1,194.0 233.3 n.m.

Profit after taxation 1,011.2 279.8 n.m.

Value added 4,218.8 3,061.0 + 37.8

Financial Statistics R1

R1 Singapore Airlines’ financial year is from 1 April to 31 March. Throughout this report, all figures are in Singapore Dollars, unless stated otherwise.

R2 Return on equity holders’ funds is profit attributable to owners of the Parent expressed as a percentage of the average equity holders’ funds.

R3 Total debt equity ratio is total debt divided by equity attributable to owners of the Parent as at 31 March.

R4 Earnings after tax per share (basic) is computed by dividing profit attributable to owners of the Parent by the weighted average number of ordinary shares

in issue excluding treasury shares.

R5 Earnings after tax per share (diluted) is computed by dividing profit attributable to owners of the Parent by the weighted average number of ordinary shares

in issue excluding treasury shares, adjusted for the dilutive effect on the exercise of all outstanding share options.

R6 Net asset value per share is computed by dividing equity attributable to owners of the Parent by the number of ordinary shares in issue excluding treasury

shares at 31 March.

R7 Dividend cover is profit attributable to owners of the Parent divided by total dividends.