Singapore Airlines 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SINGAPORE AIRLINES

138

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

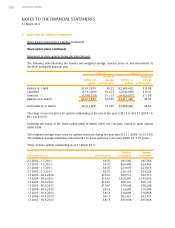

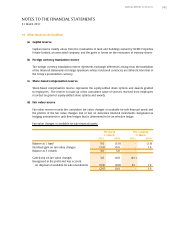

11 Taxation (in $ million) (continued)

A reconciliation between taxation expense and the product of accounting profit multiplied by the applicable

tax rate for the years ended 31 March is as follows:

The Group

2010-11 2009-10

Profit before taxation 1,419.0 285.5

Taxation at statutory corporate tax rate of 17.0% 241.2 48.5

Adjustments

Income not subject to tax (35.3) (48.3)

Expenses not deductible for tax purposes 67.0 35.7

Higher effective tax rates of other countries 6.1 7.6

Overprovision in respect of prior years, net (5.7) (44.7)

Income subject to concessionary tax rate (4.6) -

Tax benefit not recognised 1.7 6.3

Others (0.2) 0.9

Taxation 270.2 6.0

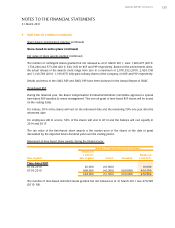

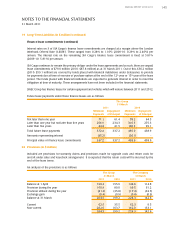

12 Earnings Per Share

The Group

2010-11 2009-10

Basic Diluted Basic Diluted

Profit attributable to owners of the Parent (in $ million) 1,092.0 1,092.0 215.8 215.8

Adjustment for dilutive potential ordinary shares

of subsidiary companies (in $ million) - (2.3) - (1.0)

Adjusted net profit attributable to owners of

the Parent (in $ million) 1,092.0 1,089.7 215.8 214.8

Weighted average number of ordinary shares

in issue (in million) 1,194.9 1,194.9 1,184.8 1,184.8

Adjustment for dilutive potential ordinary

shares (in million) - 13.3 - 11.7

Weighted average number of ordinary shares in issue

used for computing earnings per share (in million) 1,194.9 1,208.2 1,184.8 1,196.5

Earnings per share (cents) 91.4 90.2 18.2 18.0

Basic earnings per share is calculated by dividing the profit attributable to owners of the Parent by the

weighted average number of ordinary shares in issue during the financial year.

For purposes of calculating diluted earnings per share, the profit attributable to owners of the Parent is

adjusted to take into account effects of dilutive potential ordinary shares of subsidiary companies and the

weighted average number of ordinary shares of the Company in issue is adjusted to take into account

effects of dilutive options of the Company.

11.3 million (2009-10: 28.4 million) of the share options granted to employees under the existing employee

share option plans have not been included in the calculation of diluted earnings per share because they are

anti-dilutive for the current and previous years presented.