Singapore Airlines 2011 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2011 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SINGAPORE AIRLINES

178

NOTES TO THE FINANCIAL STATEMENTS

31 March 2011

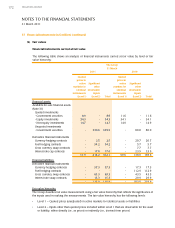

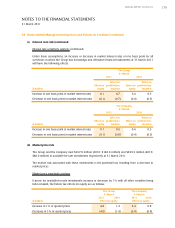

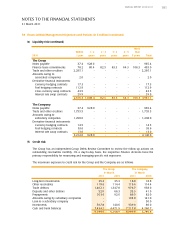

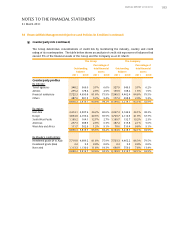

38 Financial Risk Management Objectives and Policies (in $ million) (continued)

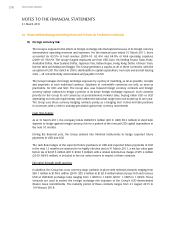

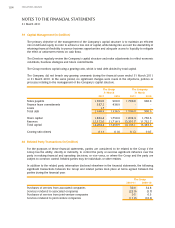

(c) Interest rate risk

The Group’s earnings are also affected by changes in interest rates due to the impact such changes

have on interest income and expense from short-term deposits and other interest-bearing financial

assets and liabilities. The Group enters into interest rate swap contracts and interest rate cap contracts

to manage interest rate costs on its financial assets and liabilities, with the prior approval of the BEC or

Boards of subsidiary companies.

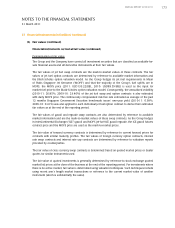

Cash flow hedges

As at 31 March 2011, the Company has interest rate cap contracts at a strike rate of 6.50% (2010:

6.50%), maturing in 6 to 7 years, to hedge against risk of increase in aircraft lease rentals.

The cash flow hedges of the interest rate cap contracts are assessed to be highly effective and as

at 31 March 2011, a net fair value loss before tax of $2.3 million (2010: net fair value gain before

tax of $4.1 million), with a related deferred tax credit of $0.4 million (2010: deferred tax charge of

$0.7 million), is included in the fair value reserve in respect of these contracts.

In the previous financial year, the Company entered into interest rate swap contracts to protect a

portion of the future operating lease rent payments from exposure to fluctuations in interest rates.

These contracts were settled during the financial year and the balance in the fair value reserve will be

recognised in the profit and loss account over the lease term of the respective aircraft. A net fair value

loss before tax of $44.9 million (2010: $13.0 million), with a related deferred tax credit of $7.6 million

(2010: $2.2 million), was included in the fair value reserve in respect of these contracts.

As at 31 March 2011, other than those instruments entered into by the Company, the Group has

interest rate swap agreements in place whereby it pays fixed rates of interest ranging from 3.00% to

4.95% (2010: 3.00% to 4.95%) and receives a variable rate linked to LIBOR. These contracts are used

to protect a portion of the finance lease commitments from exposure to fluctuations in interest rates.

The maturity period of these swaps range from 1 March 2014 to 5 March 2016.

The cash flow hedges of some of the interest rate swaps for the Group are assessed to be highly

effective and as at 31 March 2011, a net fair value loss before tax of $56.8 million (2010:

$22.7 million), with a related deferred tax credit of $9.6 million (2010: $2.2 million), is included in the

fair value reserve in respect of these contracts.

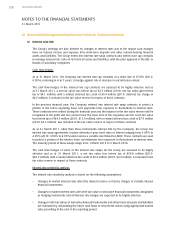

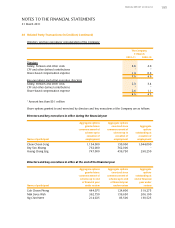

Interest rate sensitivity analysis

The interest rate sensitivity analysis is based on the following assumptions:

• Changes in market interest rates affect the interest income or finance charges of variable interest

financial instruments.

• Changes in market interest rates affect the fair value of derivative financial instruments designated

as hedging instruments and all interest rate hedges are expected to be highly effective.

• Changes in the fair values of derivative financial instruments and other financial assets and liabilities

are estimated by discounting the future cash flows to net present values using appropriate market

rates prevailing at the end of the reporting period.