Qantas 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95 Qantas Annual Report 2008

Notes to the Financial Statements

for the year ended 30 June 2008

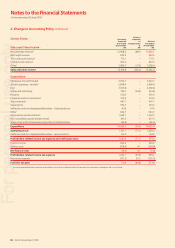

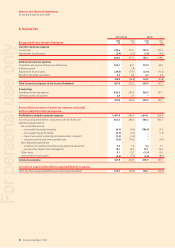

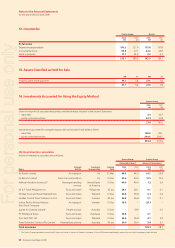

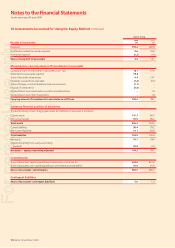

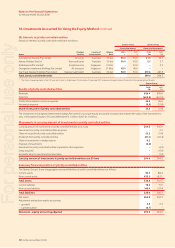

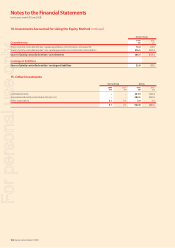

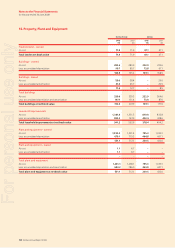

Qantas Group Qantas

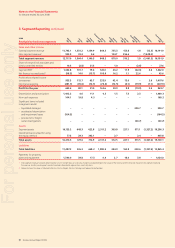

Recognised in the Income Statement 2008

$M

2007

$M

2008

$M

2007

$M

Current income tax expense

Current year 270.6 319.1 141.5 227.3

Adjustments for prior years (2.6) (2.0) (2.8) (8.4)

268.0 317.1 138.7 218.9

Deferred income tax expense

Origination and reversal of temporary differences 188.1 45.1 191.9 45.0

Entities acquired –1.8 ––

Adjustments for prior years (20.4) (75.1) (27.0) (70.2)

Benefi t of tax losses recognised 2.2 3.4 2.3 3.4

169.9 (24.8) 167.2 (21.8)

Total income tax expense in the Income Statement 437.9 292.3 305.9 197.1

Comprising:

Australian income tax expense 435.5 290.2 305.9 197.1

Overseas income tax expense 2.4 2.1 ––

437.9 292.3 305.9 197.1

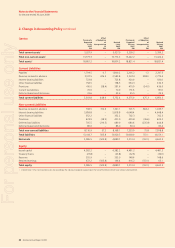

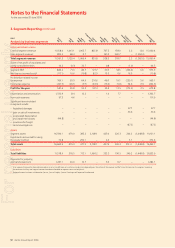

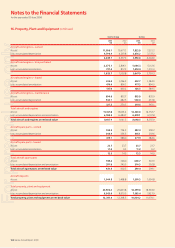

Reconciliation between income tax expense and profit

before related income tax expense

Profit before related income tax expense 1,407.6 965.1 1,614.1 610.4

Income tax using the domestic corporate tax rate of 30 per cent 422.3 289.5 484.2 183.1

Add/(less) adjustments for:

Non-assessable income

non-taxable Australian dividends–(6.3) (6.6) (186.9) (3.1)

non-taxable foreign dividends–(0.7) (2.3) –(1.4)

share of associates’ and jointly controlled entities’ net profi t–(1.2) (5.2) ––

utilisation of previously unrecognised losses–(5.2) (10.3) –(3.4)

Non-deductible expenditure

writedown of investments and property, plant and equipment–3.4 1.3 4.2 3.1

provisions for freight cartel investigations–19.1 14.2 19.1 14.2

Other items 9.1 13.7 (11.9) 13.0

Over provision in prior years (2.6) (2.0) (2.8) (8.4)

Income tax expense 437.9 292.3 305.9 197.1

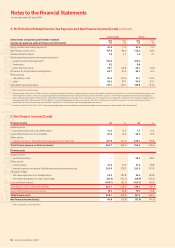

Income tax expense/(benefit) recognised directly in equity

Other net fi nancial assets/liabilities and interest-bearing liabilities 128.7 (93.5) 128.7 (93.5)

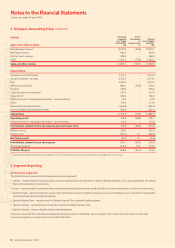

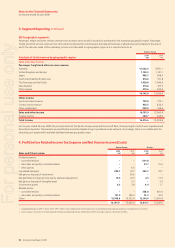

6. Income Tax

For personal use only