Qantas 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Qantas Annual Report 2008

Directors’ Report

for the year ended 30 June 2008

Remuneration Report (Audited) continued

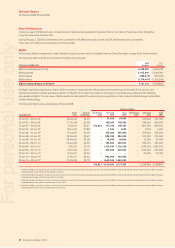

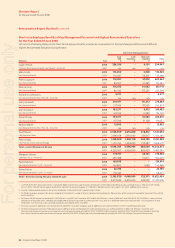

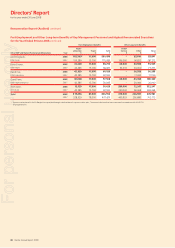

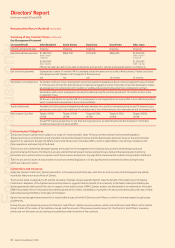

Short-term Employee Benefits of Key Management Personnel and Highest Remunerated Executives

for the Year Ended 30 June 2008 continued

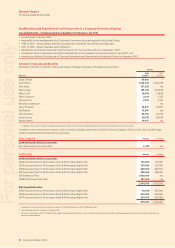

Short-term Employee Benefi ts

Other KMP and Highest Remunerated Executives Year

Cash

FAR

$

Cash

Incentives

$

Non-cash

Benefi ts

$

Total

$

John Borghetti, 2008 1,146,085 1,336,000 206,793 2,688,878

EGM Qantas 2007 1,119,474 1,380,000 183,720 2,683,194

Kevin Brown, 2008 722,821 674,000 213,566 1,610,387

EGM People 2007 673,573 625,000 186,114 1,484,687

David Cox, 2008 641,716 451,000 139,599 1,232,315

EGM Engineering 2007 607,076 505,000 102,211 1,214,287

Grant Fenn, 2008 740,690 642,000 210,615 1,593,305

EGM Freight Enterprises 2007 680,113 625,000 210,506 1,515,619

Alan Joyce, 2008 1,092,614 1,207,000 95,800 2,395,414

CEO Jetstar 2007 778,646 775,000 105,592 1,659,238

Total remuneration for Key Management Executives 2008 4,343,926 4,310,000 866,373 9,520,299

2007 3,858,882 3,910,000 788,143 8,557,025

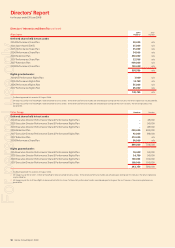

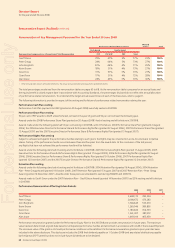

Share-based Payments

Performance Equity Plan

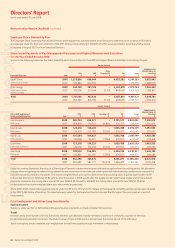

The Performance Equity Plan comprises the PSP (a medium-term

incentive) and the PRP (a long-term incentive). Both elements are

designed to strengthen the alignment of the interests of Executives

with those of shareholders.

The equity benefi ts under the Performance Equity Plan are delivered

under the Terms & Conditions and various rules of the DSP. The DSP

Terms & Conditions were initially approved by shareholders at the 2002

AGM. At the 2006 AGM, shareholders again approved the DSP as the

vehicle for the provision of equity benefi ts by Qantas.

Performance Share Plan

Purpose

The PSP is a medium-term deferred share incentive designed to reward

Executives when a Balanced Scorecard of key Qantas Group measures

(detailed below) is achieved over the year and to encourage retention

through a two year deferral period.

Approach

For each participating Executive, the target reward under the plan is

set as a percentage of FAR. This percentage varies according to the

Executive’s level of responsibility.

On an annual basis, the Qantas Board approves awards under the PSP

based on the achievement by the Qantas Group against the Balanced

Scorecard of Customer, Operational, People and Financial measures.

Each measure is assessed separately for performance against target

and threshold. There is also differentiated distribution of the pool

to Executives based on the IPF.

Shares are purchased on-market or issued and are held subject to a

holding lock for 10 years. However, Executives can call for the deferred

shares prior to the expiration of the holding lock, but not before the end

of one year from the completion of the performance period for up to

half of the deferred shares and the end of two years in relation to the

remaining deferred shares. The mandatory minimum holding lock

periods provide this Plan with its medium-term focus on share price.

Any dividends paid on the deferred shares during the holding lock

period will be distributed to the relevant Executive.

Generally, any deferred shares which remain subject to the holding lock

will be forfeited if the relevant Executive ceases employment with the

Qantas Group.

Performance Measures and Rationale

For 2007/08, the PSP target was a Balanced Scorecard of Customer,

Operational, People and Financial measures. Customer satisfaction

is measured by reference to an external Skytrax survey. The operational

performance (punctuality) is measured against an on-time arrivals

target. People performance is measured against a Lost Time Injury

Frequency Rate target. Financial performance uses an internal unit

cost reduction measure.

The Balanced Scorecard performance criteria aim to align Executive

remuneration with the key value drivers for the Qantas Group and

complement the short-term fi nancial targets which are the focus of

the PCP. The targets are set by the Qantas Board annually at the start

of the year.

At the conclusion of the year, the Balanced Scorecard results are

provided to the Qantas Board so it can make an assessment as to

whether the targets have been met and whether the deferred shares

are subsequently granted.

Determining Payment Pool

The ‘at target’ pool, i.e. the amount that would deliver the full PSP award

to all participating Executives, is available when the Balanced Scorecard

targets approved by the Qantas Board are met.

Determining Individual Payments

Each individual’s ‘at target’ payment is determined by Qantas Group

performance and the pool awarded as described above. An Executive’s

actual reward is calculated by multiplying their ‘at target’ PSP award

by their IPF.

The grant date and number of deferred shares awarded to KMP are

outlined on page 126 and 127.

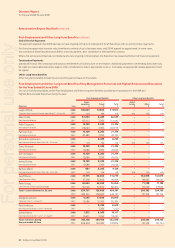

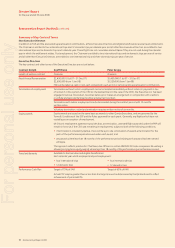

Performance Rights Plan

Purpose

The PRP is the long-term element of the Performance Equity Plan.

It has been implemented as a reward program that aligns the

interests of participating Executives with the longer-term interests

of shareholders. It also helps to retain participating Executives.

For personal use only