Qantas 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65 Qantas Annual Report 2008

Directors’ Report

for the year ended 30 June 2008

Delta Airlines is excluded from the airline basket for the 2006/07 award as in September

2005 Delta Airlines fi led voluntary petitions for reorganisation under Chapter 11 of the US

Bankruptcy Code.

1

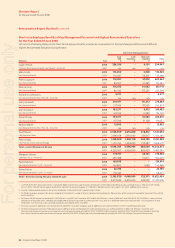

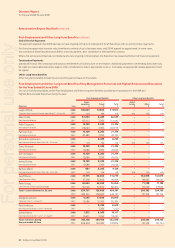

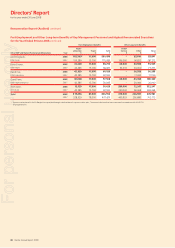

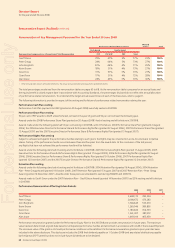

Remuneration Report (Audited) continued

Performance Rights Plan continued

Approach

Annual grants of Rights are awarded to selected individuals. Subject

to achievement against the three year performance hurdle relating

to each grant, the Rights may be converted (on a one-for-one basis)

to Qantas shares. Shares are purchased on-market or issued.

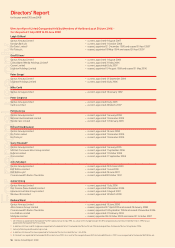

Performance Measures and Rationale

2004/05, 2005/06 and 2006/07 Awards

The performance hurdle set by the Qantas Board for these awards

is the TSR of Qantas over the performance period in comparison to:

companies with ordinary shares included in the S&P/ASX 100 Index

at the date of each respective grant (excluding Qantas) in relation

to one half of the Rights; and

a basket of global listed airlines comprising Air France-KLM,

Air New Zealand, AMR Corporation (American Airlines), British

Airways, Cathay Pacifi c, Delta Airlines1, Japan Airlines, Lufthansa,

Ryanair, Singapore Airlines, Southwest Airlines and Virgin Blue in

relation to the other half of the Rights.

The S&P/ASX 100 Index represents the broader Australian market, while

the basket of global airlines represents a mix of Qantas’ competitors.

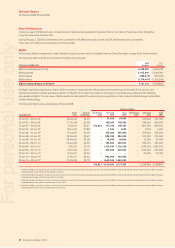

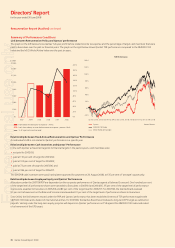

TSR testing for the 2004/05 award is being performed quarterly over

the two years from 30 June 2007 until 30 June 2009, or until the tests

indicate that full vesting has been achieved. This refl ects the Plan

conditions outlined to shareholders when approval was obtained

for awards to Executive Directors in October 2004. TSR testing for

the 2005/06 award commenced on 30 June 2008. As at 30 June 2008,

80 per cent of the performance hurdle set by the Qantas Board

under the 2004/05 award has been achieved with 72.5 per cent

achieved under the 2005/06 award.

Similarly, TSR testing for the 2006/07 awards occurs during the period

between three and fi ve years from award, in accordance with the

conditions of the awards approved by shareholders.

Testing over these timeframes recognises that Qantas is exposed to

a high degree of business and share price volatility compared to many

other major Australian companies. As the award date remains the base

point for comparison, it ensures that there is no reduction in the rigour

of the performance requirement.

The performance hurdle will be considered satisfi ed in accordance with

the following table:

Qantas TSR Performance Compared

to the Relevant Peer Group

Satisfaction of the Performance Hurdle

Relating to Each Half of the Rights

0 to 49th percentile Nil

50th to 74th percentile 50% – 99%

75th to 100th percentile 100%

The Qantas Board resolved at its October 2005 Meeting that it will not

exercise its discretion in relation to the performance hurdle for the 25th

to 49th percentile.

A progressive vesting scale prevents payment for below median

performance and does not deliver full reward until 75th percentile

performance is achieved.

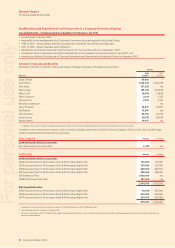

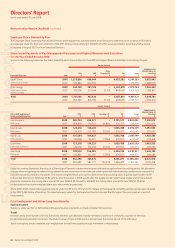

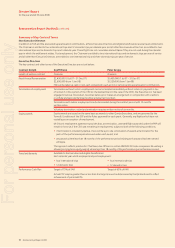

2007/08 Awards

Following a review of the performance hurdles applicable to awards of

Performance Rights, the Qantas Board at its December 2007 Meeting

fi nalised the hurdles for the 2007/08 awards.

•

•

The relative TSR measure in comparison to companies with ordinary shares

included in the S&P/ASX 100 Index (as outlined above) was retained in relation

to one half of the award of 2007/08 Rights. Testing of the hurdle occurs on a

bi-annual basis during the period between three and fi ve years from award.

There is no relaxation of the rigour of the performance requirement.

In relation to the other half of the Rights, the Qantas Board set an EPS

hurdle expressed as a compound annual growth rate (CAGR) target which

is assessed at the end of three years.

By adopting these dual hurdles, Qantas has a framework that relates

reward to shareholder returns relative to other major Australian

companies as well as the earnings achieved by management against a

challenging long-term target.

The vesting scale for Rights based on Qantas EPS growth is outlined

in the below table:

EPS Performance

vs Target EPS CAGR

Satisfaction of the

Performance Hurdle

EPS result below

threshold Below 9.5% Nil

EPS result between

threshold and

stretch target 9.5% to 12.4%

Linear scale:

50% to

99% satisfi ed

EPS result at or

above stretch target 12.5% or above 100% satisfi ed

The setting by the Qantas Board of the above EPS targets does not

represent an earnings forecast nor is it a disclosure of targets under

Qantas’ long-term budget.

Any Rights which have not vested will lapse if the relevant Executive

ceases employment with the Qantas Group, except in special

circumstances where Remuneration Committee approval would be

sought. Rights will also lapse if the Executive is guilty of gross misconduct.

The grant dates and number of Rights awarded to KMP is outlined

on page 128.

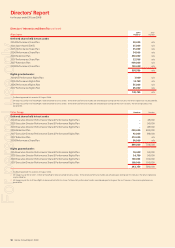

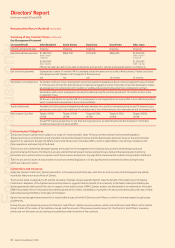

Retention Plan

The Qantas Board regularly reviews Qantas’ talent needs for achieving

its long-term business objectives. It has implemented a Retention

Plan with a required service period. The Retention Plan is focused

on less than 1 per cent of Executives whose roles and contribution

are identifi ed as critical to the continued success of the Qantas Group.

The award to any individual under the Retention Plan can be delivered

either in deferred shares or by way of a deferred cash payment.

Satisfactory performance, which involves achievement of personal KPIs

set during the period, is a further requirement under this Plan. The most

recent of these were the awards approved by Shareholders at the 2007

AGM to the Executive Directors.

The vesting schedule for the awards made under the Retention Plan

means that 2007/08 is the year in which the majority of grant value

of the award is recognised under accounting rules. This is the primary

reason for the increase in disclosed value of Share-based Payments

for 2007/08. The 2007/08 accounting accrual of the 2006/07 Retention

Plan award is substantially higher than the accrual that will be incurred

in 2008/09, as refl ected in the table set out on page 69.

The grant dates and number of shares awarded to KMP is outlined

on page 127.

For personal use only