Qantas 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79 Qantas Annual Report 2008

Qantas Airways Limited (Qantas) is a company limited by shares

incorporated in Australia whose shares are publicly traded on the ASX

and which is subject to the operation of the Qantas Sale Act as described

in the Corporate Governance Statement.

The consolidated Financial Report of Qantas for the year ended

30 June 2008 comprises Qantas and its controlled entities (together

referred to as the Qantas Group) and the Qantas Group’s interest

in associates and jointly controlled entities.

The Financial Report of Qantas for the year ended 30 June 2008 was

authorised for issue in accordance with a resolution of the Directors

on 22 September 2008.

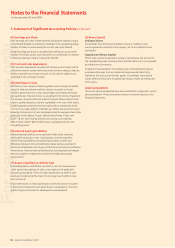

(A) Statement of Compliance

The Financial Report is a general purpose fi nancial report which has

been prepared in accordance with Australian Accounting Standards

(AASB) adopted by the Australian Accounting Standards Board and the

Corporations Act. The Financial Report also complies with International

Financial Reporting Standards (IFRS) and interpretations adopted by

the International Accounting Standards Board.

(B) Basis of Preparation

The Financial Report is presented in Australian dollars and has been

prepared on the basis of historical costs except in accordance with

relevant accounting policies where assets and liabilities are stated

at their fair values. Assets classifi ed as held for sale are stated at

the lower of carrying amount and fair value less costs to sell.

Qantas is a company of the kind referred to in Australian Securities and

Investments Commission (ASIC) Class Order 98/100 dated 10 July 1998

(updated by CO 05/641 effective 28 July 2005 and CO 06/51 effective

31 January 2006) and in accordance with the Class Order, amounts

in the Financial Report have been rounded to the nearest hundred

thousand dollars, unless otherwise stated.

The accounting policies set out below have been consistently applied

to all periods presented in the consolidated Financial Report.

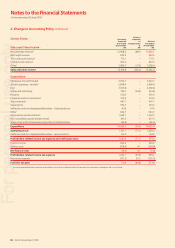

Qantas has elected to early adopt all Australian Accounting

Standards, Amendments and Interpretations that had been issued

by the Australian Accounting Standards Board as of 30 June 2008,

except as noted below. Other than Interpretation 13 Customer

Loyalty Programmes, no standards adopted early had a material

impact on the Financial Report. The impact of early adopting

Interpretation 13 is set out in Note 2.

The following AASB Amendments and Interpretations were not

adopted early:

AASB 8 Operating Segments (AASB 8) and the consequential

amendments in A ASB 2007-3 Amendments to Australian Accounting

Standards arising from AASB 8 [AASB 5, AASB 6, AASB 102, AASB

107, AASB 119, AASB 127, AASB 134, AASB 136, AASB 1023 &

AASB 1038] (AASB 2007-3), applicable on or after 1 January 2009;

Revised AASB 3 Business Combinations (AASB 3), applicable for

annual reporting periods beginning on or after 1 January 2009;

Revised AASB 101 Presentation of Financial Statements (AASB 101),

applicable for annual reporting periods beginning on or after

1 January 2009;

Revised AASB 127 Consolidated and Separate Financial Statements

(AASB 127), applicable for annual reporting periods beginning on

or after 1 January 2009;

•

•

•

•

AASB 2008-1 Amendments to Australian Accounting Standard –

Share based Payment: Vesting Conditions and Cancellations (AASB

2008-1) applicable for annual reporting periods beginning on or

after 1 January 2009;

AASB 2008-2 – Amendments to Australian Accounting

Standard- Puttable Financial Instruments and Obligations

arising on Liquidation [AASB 7, AASB 101, AASB 132, AASB 139

& Interpretation 2] (AASB 2008-2) applicable for annual reporting

periods beginning on or after 1 January 2009; and

AASB 2008-3 – Amendments to Australian Accounting Standard

arising from AASB 3 and AASB 127 [AASBs 1, 2, 4, 5, 7, 101, 107,

112, 114, 116, 121, 128, 131, 132, 133, 134, 136, 137, 138 & 139

& Interpretations 9 & 107] (AASB 2008-3) applicable for annual

reporting periods beginning on or after 1 January 2009.

AASB 8 and AASB 2007-3 will have an impact on the disclosure

of operating segments within the Financial Report. Owing to ongoing

restructuring of the Qantas Group, it is not considered appropriate

to early adopt the Standard and its consequential amendments.

AASB 3, AASB 127 and AASB 2008-3, which must be early-adopted

together, will have an impact on the acquisition accounting for

business combinations and the accounting of non-controlling

interests. The Qantas Group is yet to determine the effect of

these Standards on the Financial Report.

AASB 101 introduces as a fi nancial statement the “statement of

comprehensive income”. The revised Standard does not change the

recognition, measurement or disclosure of transactions and events

that are required by other AASBs. The Qantas Group is yet to

determine the potential effect of the revised Standard on the Financial

Report.

AASB 2008-1 changes the measurement of the share-based

payments that contain non-vesting conditions. The Qantas Group is

yet to determine the effect of this Standard on the Financial Report.

AASB 2008-2 amends the defi nition of a fi nancial liability with

respect to certain puttable fi nancial instruments. The Qantas Group

is yet to determine the effect of this Standard on the Financial Report.

(C) Critical Accounting Estimates and Judgements

The preparation of a Financial Report conforming with AASB requires

management to make judgements, estimates and assumptions that

affect the application of policies and reported amounts of assets,

liabilities, income and expenses. The estimates and associated

assumptions are based on historical experience and various other factors

that are believed to be reasonable under the circumstances, the results

of which form the basis of making the judgements about carrying values

of assets and liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the period in

which the estimate is revised if the revision affects only that period,

or in the period of the revision and future periods if the revision affects

both current and future periods. Judgements made by management

in the application of AASB that have a signifi cant effect on the Financial

Report and estimates with a signifi cant risk of material adjustment

in the next year are highlighted in the specifi c accounting policies

detailed below.

•

•

•

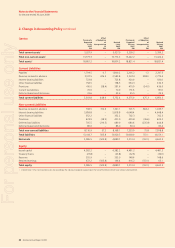

Notes to the Financial Statements

for the year ended 30 June 2008

1. Statement of Significant Accounting Policies

For personal use only