Qantas 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123 Qantas Annual Report 2008

Notes to the Financial Statements

for the year ended 30 June 2008

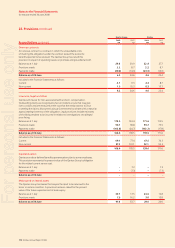

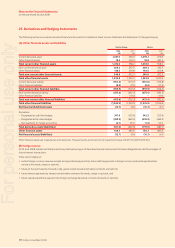

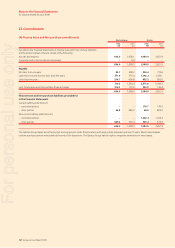

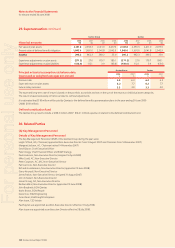

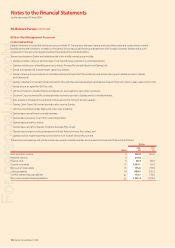

Details of contingent liabilities, where the probability of future payments is considered remote, are set out below. The Directors are of the opinion

that provisions are not required with respect to these matters, as it is not probable that a future sacrifi ce of economic benefi ts will be required or

the amount is not capable of reliable measurement.

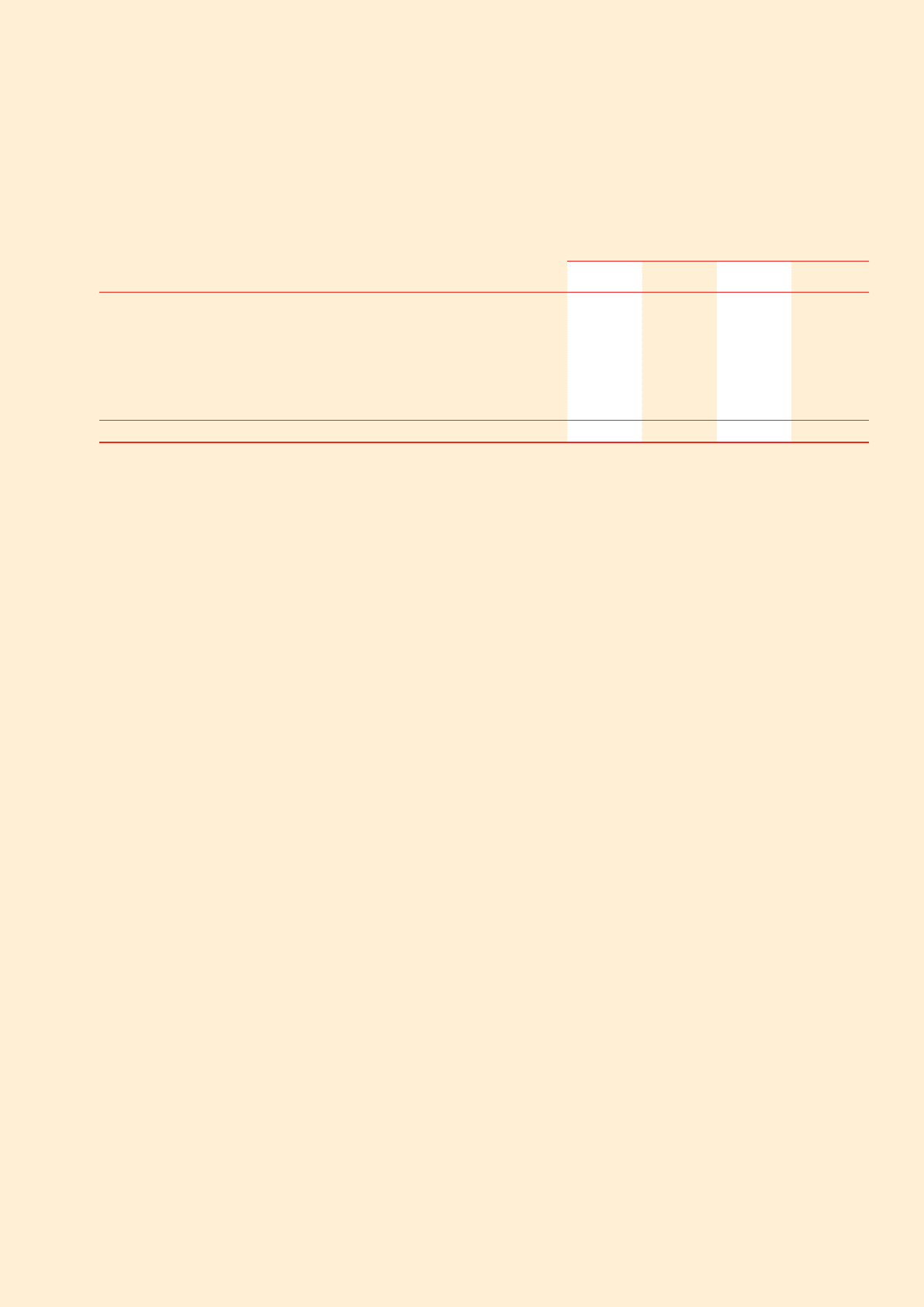

Qantas Group Qantas

2008

$M

2007

$M

2008

$M

2007

$M

Performance guarantees and letters of comfort to support operating lease commitments

and other arrangements entered into with other parties by controlled entities 30.7 26.8 30.7 26.8

Performance guarantees and letters of comfort to support leveraged and operating lease

commitments to other parties on behalf of associates and jointly controlled entities 0.2 0.3 0.2 0.3

General guarantees in the normal course of business 149.7 129.1 149.7 129.1

Contingent liabilities relating to current and threatened litigation 3.7 6.1 3.7 6.1

184.3 162.3 184.3 162.3

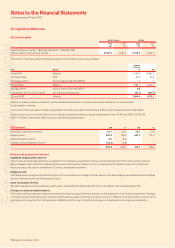

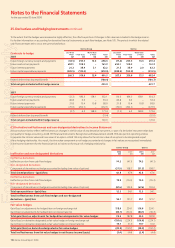

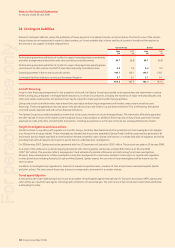

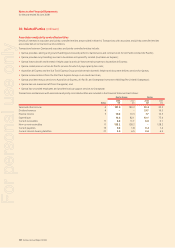

Aircraft financing

As part of the fi nancing arrangements for the acquisition of aircraft, the Qantas Group has provided certain guarantees and indemnities to various

lenders and equity participants in leveraged lease transactions. In certain circumstances, including the insolvency of major international banks and

other AAA rated counterparties, the Qantas Group may be required to make payments under these guarantees.

Qantas and certain controlled entities have entered into asset value underwriting arrangements with lenders under certain aircraft secured

fi nancings. These arrangements protect the value of the aircraft security to the lenders to a pre-determined level. This is refl ected by the balance

of aircraft security deposits held with certain fi nancial institutions.

The Qantas Group has provided standard tax indemnities to the equity investors in certain leveraged leases. The indemnities effectively guarantee

the after-tax rate of return of the investors and the Qantas Group may be subject to additional fi nancing costs on future lease payments if certain

assumptions made at the time of entering the transactions, including assumptions as to the rate of income tax, subsequently become invalid.

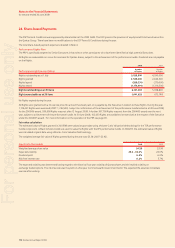

Freight investigations and class actions

Qantas has been co-operating with regulators in the USA, Europe, Australia, New Zealand and other jurisdictions in their investigation into alleged

price fi xing in the air cargo market. These investigations revealed that the practice adopted by Qantas Freight and the cargo industry generally to fi x

and impose fuel surcharges was likely to have breached relevant competition laws. Qantas continues to co-operate fully with all regulators and will be

providing them with all relevant information to permit them to undertake their investigations.

On 28 November 2007, Qantas reached an agreement with the US Department of Justice for US$61 million. This amount was paid on 29 January 2008.

As a result of this settlement, as well as ongoing discussions with other regulators, Qantas has provided $40 million as at 30 June 2008

(2007: $47 million). This provision refl ects management’s best estimate of potential settlements and costs arising from these investigations.

However, future developments in these investigations may alter management’s current view. Qantas is continuing to co-operate with regulators

in other jurisdictions including Australia, Europe and New Zealand. Qantas expects the outcome of these investigations will be known over the

next two years.

In addition to investigations by regulators for breaches of relevant competition laws, a number of class actions have commenced against Qantas

and other airlines. The outcomes of these class actions is not expected to be known for a number of years.

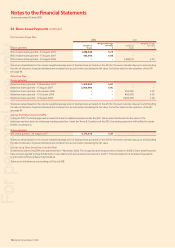

Travel agent litigation

A class action claim was made during the prior year by a number of travel agents against International Air Transport Association (IATA), Qantas and

other airlines as a result of travel agents not being paid commission on fuel surcharges. The claim amount has not yet been determined and Qantas

is defending the claim.

28. Contingent Liabilities

For personal use only