Qantas 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137 Qantas Annual Report 2008

Notes to the Financial Statements

for the year ended 30 June 2008

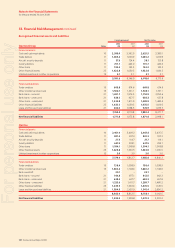

33. Financial Risk Management continued

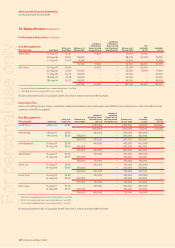

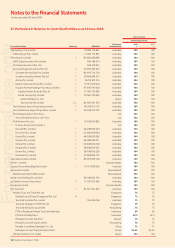

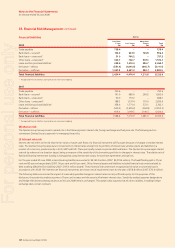

Financial liabilities Qantas

2008

Less than

1 Year

$M

1 to 5 Years

$M

More than

5 Years

$M

Total

$M

Trade payables 738.4 – – 738.4

Bank loans – secured1134.4 637.0 134.8 906.2

Bank loans – unsecured151.0 706.2 – 757.2

Other loans – unsecured1302.7 702.7 567.3 1,572.7

Lease and hire purchase liabilities1308.0 1,673.0 284.7 2,265.7

Derivative – infl ows (551.9) (1,893.5) (665.7) (3,111.1)

Derivative – outfl ows 1,451.8 2,651.0 890.7 4,993.5

Total financial liabilities 2,434.4 4,476.4 1,211.8 8,122.6

Recognised fi nancial liability carrying values are shown pre-hedging.

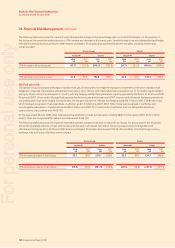

2007

Trade payables 790.6 – – 790.6

Bank loans – secured1141.9 689.6 260.5 1,092.0

Bank loans – unsecured150.9 757.2 – 808.1

Other loans – unsecured1188.2 1,137.4 701.0 2,026.6

Lease and hire purchase liabilities1358.6 1,771.4 572.1 2,702.1

Derivative – infl ows (550.2) (2,405.2) (994.8) (3,950.2)

Derivative – outfl ows 608.4 3,169.5 1,146.5 4,924.4

Total financial liabilities 1,588.4 5,119.9 1,685.3 8,393.6

Recognised fi nancial liability carrying values are shown pre-hedging.

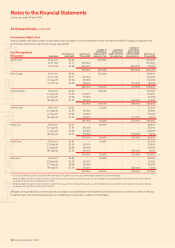

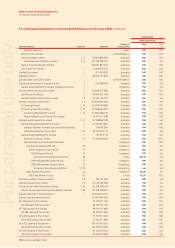

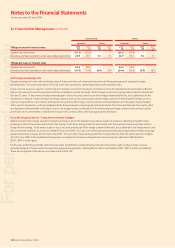

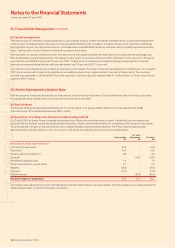

(B) Market risk

The Qantas Group has exposure to market risk in the following areas: interest rate, foreign exchange and fuel price risk. The following section

summarises Qantas Group’s approach to managing these risks.

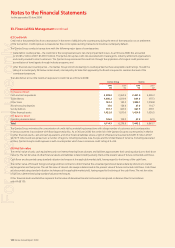

(i) Interest rate risk

Interest rate risk refers to the risk that the fair value or future cash fl ows of a fi nancial instrument will fl uctuate because of changes in market interest

rates. The Qantas Group has exposure to movements in interest rates arising from its portfolio of interest rate sensitive assets and liabilities in a

number of currencies, predominantly in AUD, GBP and EUR. These principally include corporate debt and leases. The Qantas Group manages interest

rate risk by reference to a duration target, being a measure of the sensitivity of the borrowing portfolio to changes in interest rates. The relative mix of

fi xed and fl oating interest rate funding is managed by using interest rate swaps, forward rate agreements and options.

For the year ended 30 June 2008, interest-bearing liabilities amounted to $4,160.0 million (2007: $5,074.6 million). The fi xed/fl oating split is 37 per

cent and 63 per cent respectively (2007: 50 per cent and 50 per cent). Other fi nancial assets and liabilities included fi nancial instruments related to

debt totalling $244.8 million (liability) (2007: $195.6 million (asset)). These fi nancial instruments are recognised at fair value or amortised cost in

accordance with AASB 139. Interest rate fi nancial instruments are shown net of impairment losses for the year of $58.8 million (2007: $70.6 million).

The following table summarises the impact of reasonably possible changes in interest rates on net profi t and equity. For the purposes of this

disclosure, the sensitivity analysis assumes a 10 per cent increase and decrease in all relevant interest rates. Sensitivity analysis assumes designations

and hedge effectiveness testing results as at 30 June 2008 remain unchanged. This analysis also assumes that all other variables, including foreign

exchange rates, remain constant.

1

1

For personal use only