Qantas 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69 Qantas Annual Report 2008

Directors’ Report

for the year ended 30 June 2008

Remuneration Report (Audited) continued

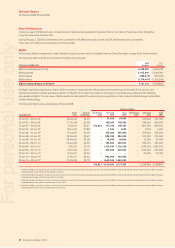

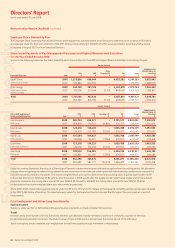

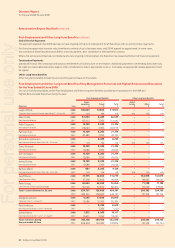

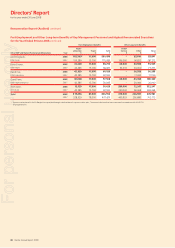

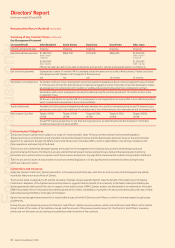

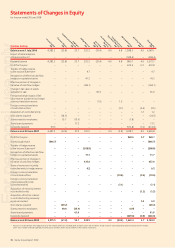

Remuneration of Key Management Personnel for the Year Ended 30 June 2008

Performance Related Remuneration

FAR and

Other1Total

Cash-based Equity-based

Remuneration Components as a Proportion of Total Remuneration PCP PSP & RP PRP Total

Geoff Dixon 25% 47% 5% 77% 23% 100%

Peter Gregg 24% 44% 5% 73% 27% 100%

John Borghetti 23% 44% 4% 71% 29% 100%

Kevin Brown 18% 51% 4% 73% 27% 100%

David Cox 13% 57% 3% 73% 27% 100%

Grant Fenn 17% 51% 4% 72% 28% 100%

Alan Joyce 24% 43% 3% 70% 30% 100%

Other remuneration consists of travel entitlements, the annual accrual of end of service payments and other benefi ts.

The total percentages are derived from the remuneration tables on pages 63 to 68. As the remuneration table is prepared on an accrual basis and

the equity benefi t is valued at grant date in accordance with Accounting Standards, the percentages disclosed do not refl ect the annual allocation

of performance related remuneration. To understand the target annual reward mixes of each of the Executives, refer to page 61.

The following information is provided in respect of the vesting and forfeiture of performance related remuneration during the year:

Performance Cash Plan vesting

Performance Cash Plan payments to KMP (granted on 20 August 2008) were fully vested in 2007/08.

Performance Share Plan vesting

50 per cent of PSP awards to KMP, unless forfeited, will vest in the year of grant and 50 per cent will vest the following year.

Awards under the 2008 Performance Share Plan (granted on 20 August 2008 ) had nil vesting and nil forfeiture in 2007/08.

Awards made under the following plans had 50 per cent vesting in 2007/08, with nil forfeiture: 2006 Performance Share Plan (granted 22 August

2006), the 2006 Executive Director Performance Share & Performance Rights Plan (granted 22 August 2006), 2007 Performance Share Plan (granted

15 August 2007) and the 2007 Executive Director Performance Share & Performance Rights Plan (granted 15 August 2007).

Performance Rights Plan vesting

Subject to achievement against the performance hurdles relating to each grant, the Rights may be converted (on a one-for-one basis) to Qantas

shares. Testing of the performance hurdle occurs between three and fi ve years from the award date. At the conclusion of the test period,

any Rights that have not achieved the performance hurdle will be forfeited.

Awards under the following plans had nil vesting and nil forfeiture in 2007/08: 2005 Performance Rights Plan (granted 17 August 2005), 2005

Executive Director Performance Share & Performance Rights Plan (granted 17 August 2005), 2006 Performance Rights Plan (granted 22 August

2006), 2006 Executive Director Performance Share & Performance Rights Plan (granted 19 October 2006), 2007 Performance Rights Plan

(granted 12 December 2007) and the 2007 Executive Director Performance Share & Performance Rights Plan (granted 12 December 2007).

Retention Plan vesting

Awards under the following plans had nil vesting and nil forfeiture in 2007/08: 2006 Retention Plan (granted 16 August 2006), 2006 Retention

Plan – Peter Gregg Award (granted 19 October 2006), 2007 Retention Plan (granted 15 August 2007) and 2007 Retention Plan – Peter Gregg

Award (granted 14 November 2007). Awards under these plans are scheduled to vest during 2008/09 and 2009/10.

Awards made to Geoff Dixon under the 2007 Retention Plan – Geoff Dixon Award (granted 14 November 2007) had 25% vesting and nil forfeiture

in 2007/08.

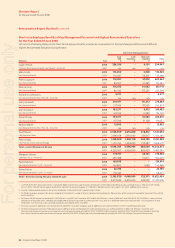

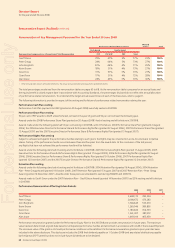

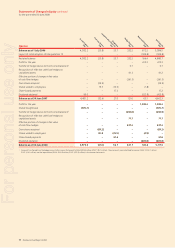

Performance Remuneration Affecting Future Periods

2009

$

2010

$

2011

$

Geoff Dixon 3,608,170 783,394 –

Peter Gregg 2,098,672 473,283 –

John Borghetti 1,708,645 533,670 –

Kevin Brown 1,269,046 389,895 –

David Cox 1,183,666 354,733 –

Grant Fenn 1,261,007 387,072 –

Alan Joyce 1,469,919 465,959 –

Performance remuneration granted under the Performance Equity Plan for the 2007/08 year provides remuneration in future years. The maximum

value has been determined at grant date based on anticipated performance hurdles and amortised in accordance with AASB 2 Share-based Payment.

The minimum value of the grant is nil should performance conditions not be satisfi ed. Performance remuneration granted in prior years has been

included in the above disclosure. This disclosure includes the 2008 fi nal dividend payable on 1 October 2008 (and any related distributions payable

by the Qantas DSP Trustee) but does not include future dividends yet to be declared.

1

For personal use only