Qantas 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 Qantas Annual Report 2008

Notes to the Financial Statements

for the year ended 30 June 2008

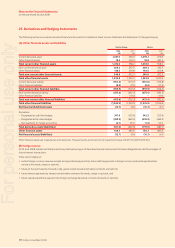

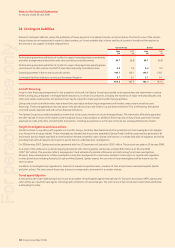

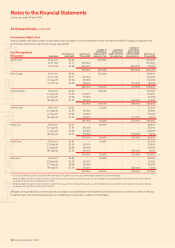

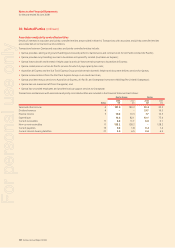

The Qantas Superannuation Plan (QSP) is a hybrid defi ned benefi t/defi ned contribution fund with 13 separate divisions which commenced operation

in June 1939. In addition to the QSP, there are a number of small offshore defi ned benefi t plans.

The Qantas Group makes contributions to defi ned benefi t superannuation plans that provide defi ned benefi t amounts for employees upon

retirement. Under the plans, employees are entitled to retirement benefi ts determined, at least in part, by reference to a formula based on

years of membership and salary levels. The total plan assets include fi nancial instruments issued by Qantas with a fair value of $18.1 million

(2007: $5.9 million). Plan assets also include an investment in a trust which owns a 50 per cent interest in property occupied by the Qantas Group.

The value of this investment is $17.4 million (2007: $17.4 million).

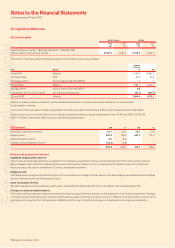

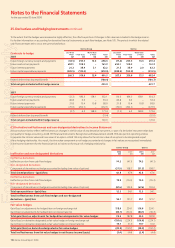

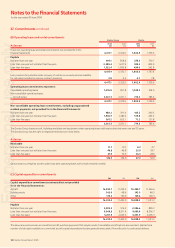

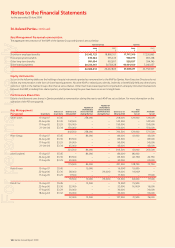

Qantas Group Qantas

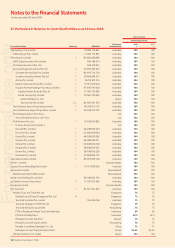

Changes in the present value of defined benefit obligations 2008

$M

2007

$M

2008

$M

2007

$M

Opening defi ned benefi t obligations 1,691.0 2,041.8 1,691.0 2,041.8

Current service cost 141.8 176.2 141.8 176.2

Interest cost 99.0 108.3 99.0 108.3

Actuarial losses/(gains) 180.5 (229.5) 180.5 (229.5)

Exchange differences on foreign plans (17.4) (13.4) (17.4) (13.4)

Transfer of retirement aged members to accumulation fund –(173.0) –(173.0)

Benefi ts paid (249.3) (219.4) (249.3) (219.4)

Closing defined benefit obligation 1,845.6 1,691.0 1,845.6 1,691.0

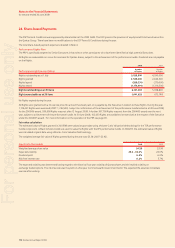

Changes in the fair value of plan assets

Opening fair value of plan assets 2,353.3 2,411.0 2,353.3 2,411.0

Expected return 177.8 169.1 177.8 169.1

Actuarial (losses)/gains (271.2) 27.0 (271.2) 27.0

Exchange differences on foreign plans (14.8) (11.5) (14.8) (11.5)

Contributions by employer 120.1 123.5 120.1 123.5

Contributions by plan participants 25.9 26.6 25.9 26.6

Transfer of retirement aged members to accumulation fund –(173.0) –(173.0)

Benefi ts paid (249.3) (219.4) (249.3) (219.4)

Closing fair value of plan assets 2,141.8 2,353.3 2,141.8 2,353.3

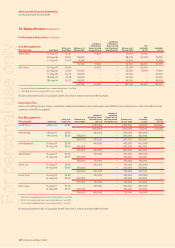

Expense recognised in the Income Statement

Service cost 130.7 158.8 130.7 158.8

Interest cost 99.0 108.3 99.0 108.3

Contributions by plan participants (25.9) (26.6) (25.9) (26.6)

Expected return on plan assets (177.8) (169.1) (177.8) (169.1)

Actuarial (gains)/losses (33.1) (11.4) (33.1) (11.4)

Increase in allowance for contributions tax on net liability 4.6 12.3 4.6 12.3

Expenses 6.5 5.1 6.5 5.1

Total included in manpower and staff related 4.0 77.4 4.0 77.4

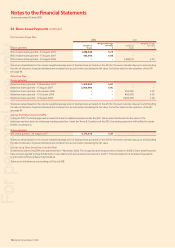

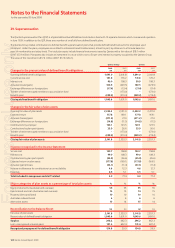

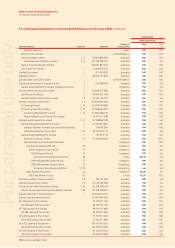

Major categories of plan assets as a percentage of total plan assets %%%%

Equity instruments (Australian and overseas) 55 55 55 55

Fixed interest and cash (Australian and overseas) 14 15 14 15

Property (direct and listed) 10 10 10 10

Australian indexed bonds 6666

Alternative assets 15 14 15 14

Reconciliation to the Balance Sheet $M $M $M $M

Fair value of plan assets 2,141.8 2,353.3 2,141.8 2,353.3

Present value of defi ned benefi t obligation 1,845.6 1,691.0 1,845.6 1,691.0

Surplus 296.2 662.3 296.2 662.3

Less: unrecognised actuarial gains 141.4 622.4 141.4 622.4

Recognised prepayment for defined benefit obligation 154.8 39.9 154.8 39.9

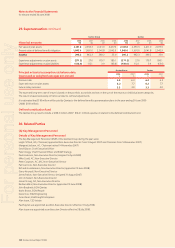

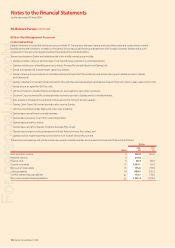

29. Superannuation

For personal use only