Qantas 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Qantas Annual Report 2008

Directors’ Report

for the year ended 30 June 2008

Remuneration Report (Audited) continued

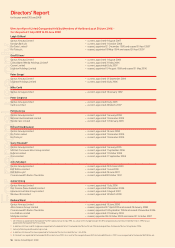

Employee Share Ownership Plan

The Employee Share Ownership Plan allows Directors and employees to purchase shares at no discount to market price on a salary sacrifi ce basis,

and operates under the Terms & Conditions of the DSP. After an initial offering in 2006/07, this Plan was suspended in December 2006 and was

re-instated in August 2007 for Non-Executive Directors.

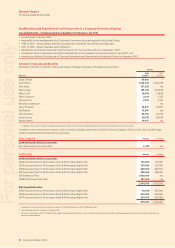

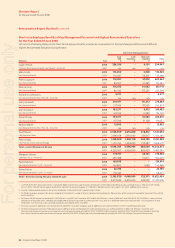

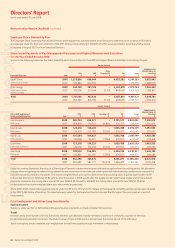

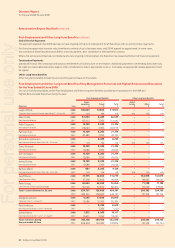

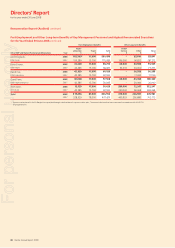

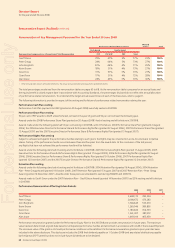

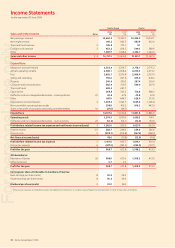

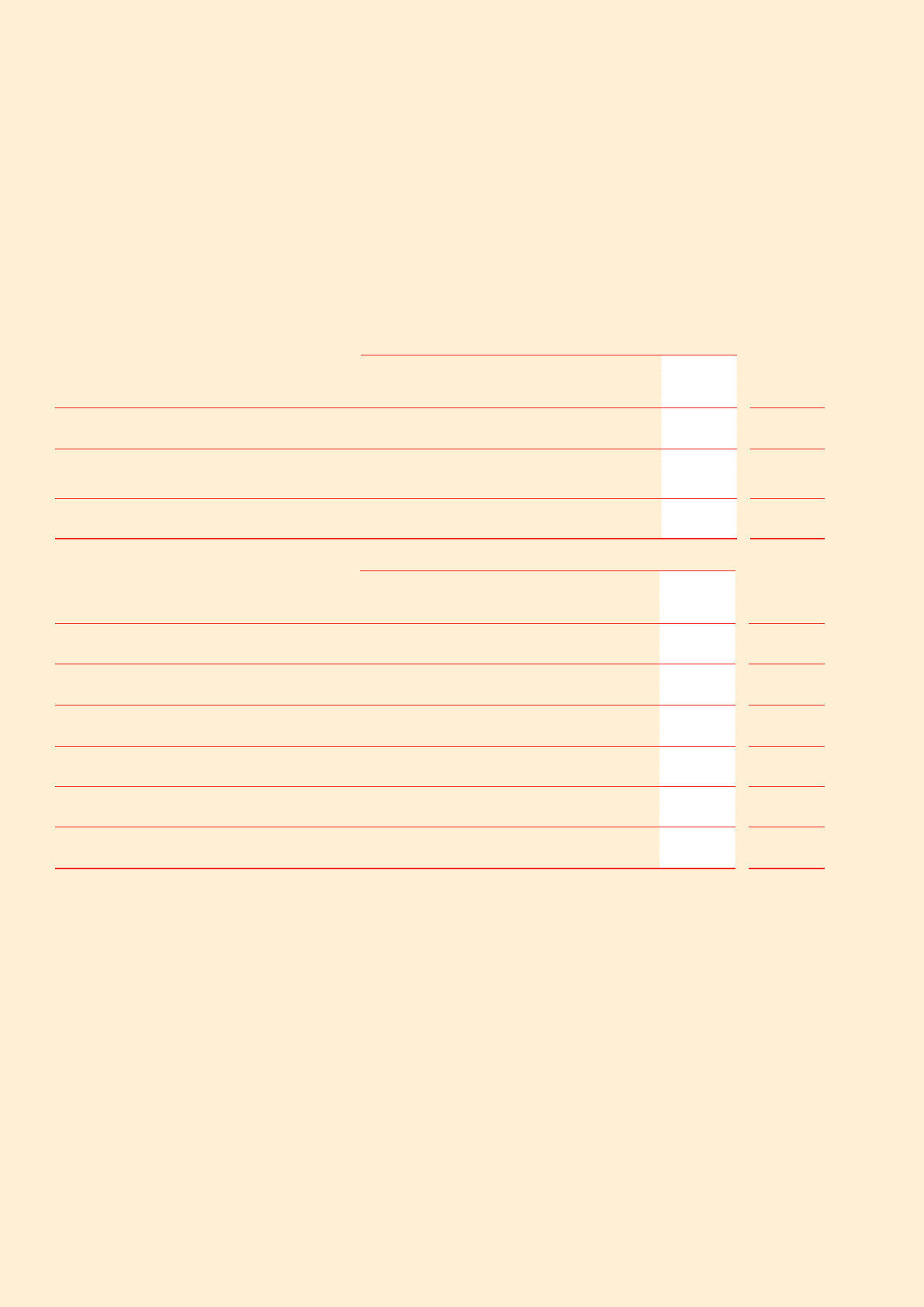

Share-based Payments of Key Management Personnel and Highest Remunerated Executives

for the Year Ended 30 June 2008

Set out in the following tables are the Share-based Payment remuneration for the KMP and Highest Remunerated Executives during the year:

Equity Settled

Executive Directors Year

PSP

$

PRP

$

Exec

Director LTI

$

RP

$

Total

$

Supplemental

Market Value at

Year End

$

Geoff Dixon, 2008 1,275,836 656,044 – 4,455,383 6,387,263 3,855,843

Chief Executive Offi cer 2007 532,843 622,500 – – 1,155,343 1,488,505

Peter Gregg, 2008 465,704 281,576 – 2,232,478 2,979,758 1,990,902

Chief Financial Offi cer

and EGM Strategy 2007 319,706 219,094 27,174 465,050 1,031,024 1,385,871

Total 2008 1,741,540 937,620 – 6,687,861 9,367,021 5,846,745

2007 852,549 841,594 27,174 465,050 2,186,367 2,874,376

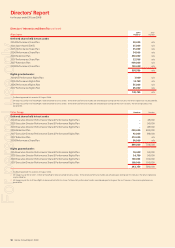

Equity Settled

Other KMP and Highest

Remunerated Executives Year

PSP

$

PRP

$

Sen Mgr LTI

$

RP

$

Total

$

Supplemental

Market Value at

Year End

$

John Borghetti, 2008 465,704 236,571 – 2,101,577 2,803,852 1,999,512

EGM Qantas 2007 288,858 170,353 46,800 430,317 936,328 1,382,979

Kevin Brown, 2008 123,218 134,233 – 1,835,788 2,093,239 1,493,533

EGM People 2007 136,950 105,368 35,100 376,527 653,945 972,062

David Cox, 2008 101,584 109,827 – 1,835,788 2,047,199 1,454,143

EGM Engineering 2007 115,868 95,321 17,786 376,527 605,502 910,418

Grant Fenn, 2008 123,218 134,233 – 1,835,788 2,093,239 1,493,533

EGM Freight Enterprises 2007 136,950 109,338 35,100 376,527 657,915 976,033

Alan Joyce, 2008 138,572 146,209 – 2,036,130 2,320,911 1,632,195

CEO Jetstar 2007 142,861 101,397 17,786 376,527 638,571 949,986

Total 2008 952,296 761,073 – 9,645,071 11,358,440 8,072,916

2007 821,487 581,777 152,572 1,936,425 3,492,261 5,191,478

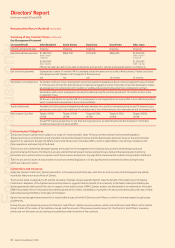

Under Accounting Standards, the value of a Share-based Payment is determined at grant date and recognised over the vesting period. No allowance

is made when recognising the value of these awards for any movement in the share price after grant date before vesting conditions are met and the

Executive becomes entitled to the shares. The volume weighted share price used to determine the accounting value of grants issued under the RP

to Executive Directors in 2008 was $5.82 (and to other Executives in 2008 was $5.45). The supplemental market value at year end of Share-based

Payments is based on the closing share price at 30 June 2008 of $3.04 and for 2006/07 the closing share price at 29 June 2007 of $5.60 as

a substitute for the volume weighted share price determined at grant date.

At the 2007 AGM, shareholders approved grants under the RP to the CEO and CFO. Details of these awards, including vesting periods, were detailed

in the 2007 AGM Notice of Meeting. The reported equity values for the Executive Directors are signifi cantly higher than prior years as a result of

these awards.

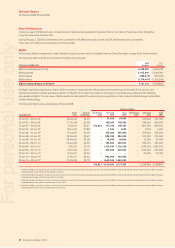

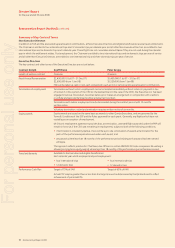

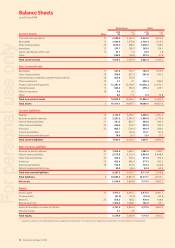

Post-Employment and Other Long-term Benefits

Superannuation

Statutory, salary sacrifi ce or defi ned benefi t superannuation payments are made on behalf of Executives.

Travel

Directors and a small number of Senior Executives and their specifi ed direct family members or parties are entitled to a number of free trips

for personal purposes after retirement. The present value of these entitlements is accrued over the service period of the individual.

Travel concessions are also available post-employment for staff who qualify through retirement or redundancy.

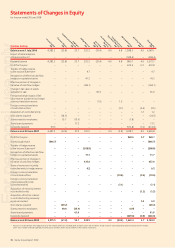

For personal use only