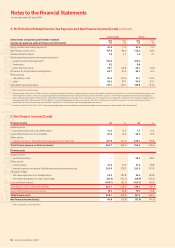

Qantas 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Qantas Annual Report 2008

Notes to the Financial Statements

for the year ended 30 June 2008

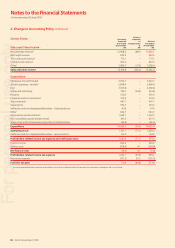

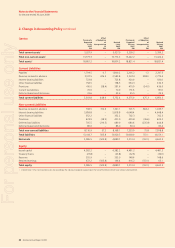

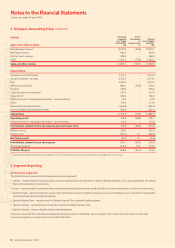

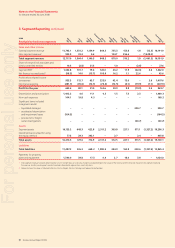

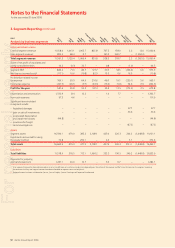

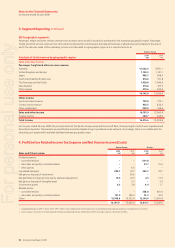

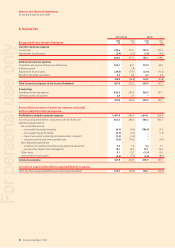

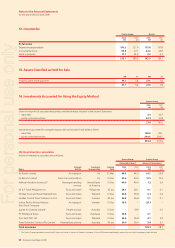

3. Segment Reporting continued

2007

Analysis by business segments

Sales and other income

External segment revenue 11,158.0 1,061.1 1,065.7 835.8 767.5 158.0 2.3 12.0 15,060.4

Inter-segment revenue1803.3 68.3 0.7 – 161.0 360.7 – (1,394.0) –

Total segment revenue 11,961.3 1,129.4 1,066.4 835.8 928.5 518.7 2.3 (1,382.0) 15,060.4

Share of net profi t of associates and

jointly controlled entities 14.3 (0.3) 32.7 – 0.8 – (1.0) – 46.5

Segment EBIT 886.2 71.3 84.7 127.7 30.5 18.5 (246.6) 3.6 975.9

Net fi nance income/(costs)2(117.1) 10.6 (19.8) 82.9 15.5 0.6 16.5 – (10.8)

Profi t before related income

tax expense 769.1 81.9 64.9 210.6 46.0 19.1 (230.1) 3.6 965.1

Income tax expense (227.5) (26.1) (9.7) (63.3) (13.6) (5.6) 54.6 (1.1) (292.3)

Profit for the year 541.6 55.8 55.2 147.3 32.4 13.5 (175.5) 2.5 672.8

Depreciation and amortisation 1,332.9 8.4 12.3 – 1.4 7.7 – – 1,362.7

Non-cash expenses 97.34.6–––– ––101.9

Signifi cant items included

in segment results:

liquidated damages–––––––97.7–97.7

gain on sale of investments–––––––30.6–30.6

accelerated depreciation

and impairment losses

–

(44.8)–––––– –(44.8)

provisions for freight

cartel investigations

–

––––––(47.2)–(47.2)

Assets

Segment assets 16,590.1 479.0 385.2 2,108.1 435.0 326.3 246.2 (1,448.8) 19,121.1

Investments accounted for using

the equity method 72.8 – 292.1 – 2.6 – 5.1 – 372.6

Total assets 16,662.9 479.0 677.3 2,108.1 437.6 326.3 251.3 (1,448.8) 19,493.7

Liabilities

Total liabilities 11,518.9 318.5 712.1 1,960.2 253.3 190.5 349.2 (1,448.8) 13,853.9

Payments for property,

plant and equipment 1,241.1 20.0 10.7 – 3.6 6.7 – – 1,282.1

Inter-segment revenue has been determined on an arm’s length basis or a cost plus margin basis depending on the nature of the revenue and the fi nancial impact on the segment receiving

the revenue. Ancillary and support services have been allocated to segments on a cost only basis.

Notional interest has been attributed to Qantas, Qantas Freight, Qantas Catering and Corporate/Unallocated.

1

2

Qantas

$M

Jetstar

$M

Qantas

Frequent Flyer

$M

Qantas

Holidays

$M

Qantas

Catering

$M

Corporate/

Unallocated

$M

Consolidated

$M

Eliminations

$M

Qantas

Freight

$M

For personal use only