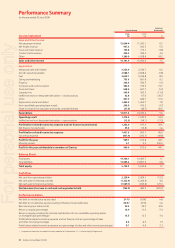

Qantas 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 Qantas Annual Report 2008

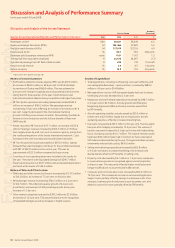

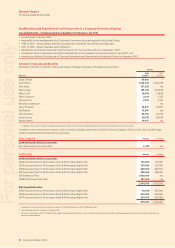

Discussion and Analysis of the Income Statement continued

Tours and travel costs decreased by $33.3 million to $608.4 million,

which is in line with the decline in revenue.

Capacity hire costs decreased by $33.4 million or 11.0 per cent largely

due to favourable foreign exchange (FX) movements and the

reduction of code-share costs on withdrawn routes.

Other expenditure increased by $202.3 million or 31.4 per cent.

This included $109.3 million of additional cost due to FX hedging

losses. Freight cartel costs and the operating costs of DPEX offset

lower consulting costs due to the APA takeover bid in the prior year.

Depreciation and amortisation costs increased by $106.6 million

or 7.8 per cent, largely due to accelerated depreciation and asset

write downs of $164.5 million.

Non-cancellable operating lease charges decreased by $15.4 million

or 3.7 per cent as a result of favourable FX gains.

The share of net profi t in associates and jointly controlled entities

decreased by $18.9 million to $27.6 million. Higher earnings from

Air Pacifi c were more than offset by lower earnings from Star Track

Express, Fiji Resorts and Australian air Express and losses on the

Jetstar Pacifi c investment.

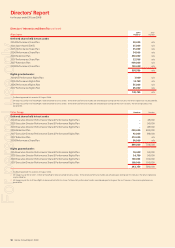

Review of Other Income Statement Items

The requirement to mark-to-market open derivative positions under

AASB 139 resulted in ineffective derivative losses of $12.3 million

in the current year compared to $54.1 million last year.

Net fi nance costs decreased by $56.4 million, primarily due to

a higher average cash balance and a higher cash rate. Higher

capitalised interest reduced interest expense by $17.4 million.

The favourable net impact of foreign exchange rate movements

on overall PBT was $239.5 million.

The effective tax rate increased from 30.3 per cent to 31.1 per cent.

Basic earnings per share increased by 16.2 cents to 50.2 cents per

share. This refl ected the increased profi t after tax for the year.

Discussion and Analysis of the Balance Sheet

The net assets of the Qantas Group increased by $95.1 million

to $5,734.9 million during the year. The major movements are

discussed below.

Review of Total Assets

Cash and cash equivalents have decreased by $763.9 million,

predominantly due to payments under the now suspended share

buy-back.

Total receivables increased by $217.2 million mainly due to an increase

in liquidated damages receivable.

Property, plant and equipment increased by $32.7 million. This

refl ected capital expenditure on new aircraft, modifi cations and

related equipment, including the purchase of two B737-800 aircraft,

three A330-200 aircraft and two Dash 8 Q400 aircraft, and progress

payments on A380, B787, B737-800, A330 and A320 aircraft.

The increase also refl ects capitalised interest, offset by depreciation

and amortisation charges.

•

•

•

•

•

•

•

•

•

•

•

•

•

Review of Total Liabilities

Total liabilities increased by 0.8 per cent to $13,965.2 million largely

due to higher payables, higher revenue received in advance offset

by debt repayments.

Total of Equity

Issued capital decreased by $505.7 million refl ecting the share

buy-back undertaken during the year. Reserves increased due

to the movements in the fair value of fuel and foreign exchange

derivatives during the year.

Gearing

Qantas Group gearing (including off Balance Sheet debt) at 30 June

2008 was 43:57 compared to 41:59 at 30 June 2007. The gearing

ratio has increased due to the share buy-back during the year

resulting in lower cash balances at year end compared to last year.

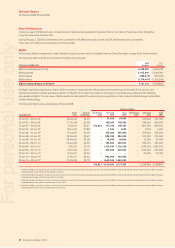

Discussion and Analysis of the Cash Flow Statement

Review of Cash Flows from Operating Activities

Cash fl ows provided from the operating activities decreased

by $295.7 million to $2,128.4 million mainly due to the non-cash

liquidated damages recognised during the year, higher tax payments

on higher profi ts and sale proceeds of $188.1 million on aircraft spare

parts which were included in last year’s cash fl ows.

Review of Cash Flows from Investing Activities

Cash fl ows used in investing activities increased by 4.4 per cent

or $56.2 million to $1,322.6 million.

Capital expenditure increased by $141.9 million to $1,424.0 million,

refl ecting aircraft deliveries, higher aircraft progress and delivery

payments combined with higher reconfi guration costs, engine

modifi cations and spares.

Proceeds from the disposal of investments represented the sale

of the investment in Air New Zealand which were received in the

2007/08 year while the profi t on the sale was recorded in the 2006/07

year.

Net payments for investments of $48.5 million included the

acquisition of Pacifi c Airlines and an increase in the ownership of the

DPEX Transport Group and Kilda Express.

Review of Cash Flows from Financing Activities

Cash fl ows used in fi nancing activities increased by $872.9 million

to a total of $1,569.7 million. Dividends, the share buy-back and

repayment of borrowings all contributed to the outfl ow.

The Qantas Group held cash of $2,599.0 million as at 30 June 2008

and had access to additional funding of $500.0 million in stand-by facilities.

•

•

•

•

•

•

•

•

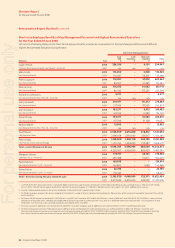

Discussion and Analysis of Performance Summary

for the year ended 30 June 2008

For personal use only