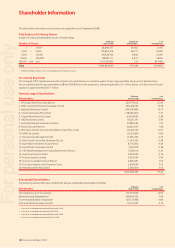

Qantas 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142 Qantas Annual Report 2008

Notes to the Financial Statements

for the year ended 30 June 2008

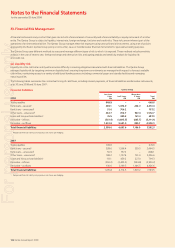

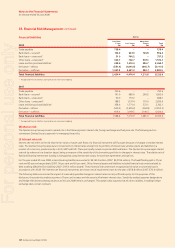

(E) Capital management

The Board’s policy is to maintain a strong capital base so as to maintain investor, creditor and market confi dence and to sustain future development

of the business. The Board monitors the return on total gross assets (RoTGA), which is based on the Qantas Group cost of capital and is defi ned as

earnings before interest, tax, depreciation and non-cancellable lease rentals (EBITDAR) divided by total gross assets, including capitalised operating

leases. The Board also monitors the level of dividends to ordinary shareholders.

The Board seeks to maintain a balance between the higher returns that might be possible with high levels of borrowings and the advantages and

security afforded by a sound capital position. The Qantas Group’s target is to achieve a minimum RoTGA of between 13 and 14 per cent. During the

year ended 30 June 2008 the return was 15.5 per cent (2007: 13.8 per cent). In comparison the weighted average interest expense on interest-

bearing borrowings (excluding liabilities with imputed interest) was 7.9 per cent (2007: 7.4 per cent).

From time to time the Qantas Group purchases its own shares on the market; the timing of these purchases depends on market prices. On 16 August

2007, Qantas announced its intention to undertake an on-market buy-back of up to approximately 10 per cent of issued capital. The on-market

buy-back was suspended on 28 April 2008. Prior to the suspension, Qantas bought back approximately 91.1 million shares, or 4.6 per cent of issued

capital for $505.7 million.

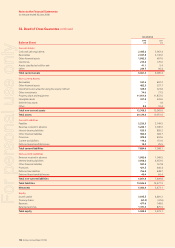

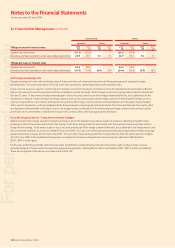

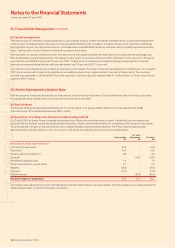

34. Events Subsequent to Balance Date

With the exception of the items disclosed below, there has not arisen in the interval between 30 June 2008 and the date of this report, any event

that would have had a material effect on the Financial Statements at 30 June 2008.

(A) Final dividend

The Directors declared a fully franked fi nal dividend of 17 cents per share on 21 August 2008 in relation to the year ended 30 June 2008.

The total amount of the dividend declared was $322.1 million.

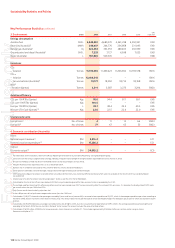

(B) Acquisition of a 58 per cent interest of Jetset Travelworld Ltd

On 25 July 2008, the Qantas Group completed the acquisition of a 58 per cent controlling interest in Jetset Travelworld Ltd in exchange for the

disposal of Qantas Holidays Limited and Qantas Business Travel Pty Limited to Jetset Travelworld Ltd. On completion of the transaction, the Qantas

Group recognised a net gain on disposal of 42 per cent of Qantas Holidays Limited and Qantas Business Travel Pty Limited of approximately

$90 million before tax and transaction costs. The impact on the Qantas Group Balance Sheet is set out in the table below:

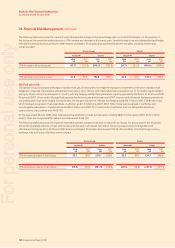

Carrying Value

$M

Fair Value

Adjustments

$M

Fair Value

$M

Net assets of Jetset Travelworld Ltd

Cash and cash equivalents 31.8 – 31.8

Receivables 19.6 – 19.6

Property, plant and equipment 0.8 – 0.8

Goodwill –147.5147.5

Identifi able intangible assets 7.9 – 7.9

Other current and non-current assets 0.7 – 0.7

Payables (26.6) – (26.6)

Provisions (11.4) – (11.4)

Minority interest – (80.0) (80.0)

Net asset impact of acquisition 22.8 67.5 90.3

The initial fair value adjustments set out in the table above have been determined on a provisional basis. The fi nal acquisition accounting adjustments

will be fi nalised within 12 months of the date of acquisition.

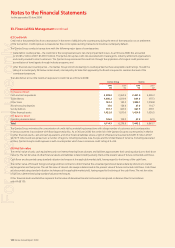

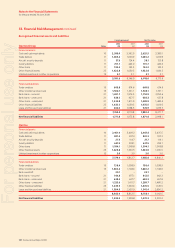

33. Financial Risk Management continued

For personal use only