Foot Locker 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

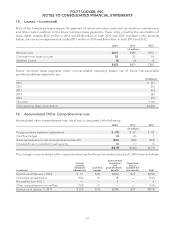

20. Retirement Plans and Other Benefits − (continued)

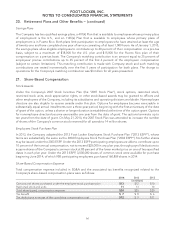

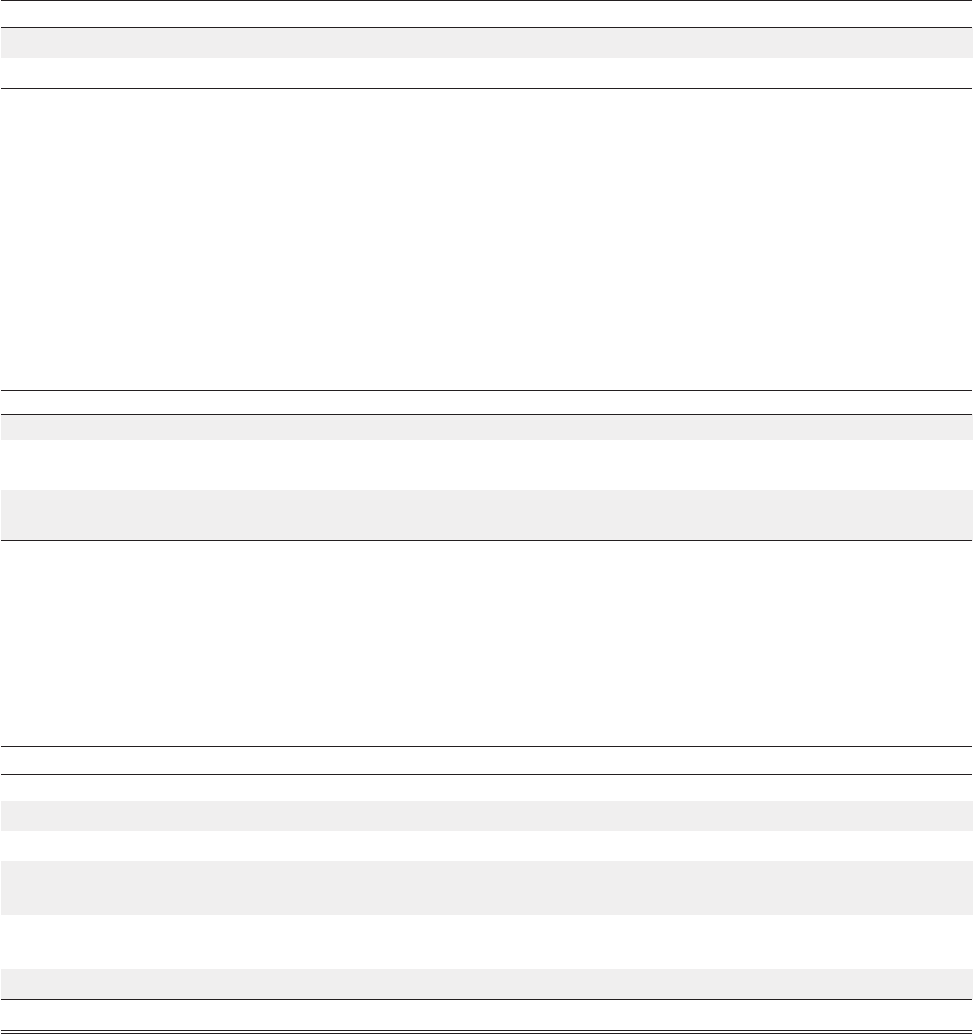

The following weighted-average assumptions were used to determine the benefit obligations under the plans:

Pension Benefits Postretirement Benefits

2014 2013 2014 2013

Discount rate 3.43% 4.32% 3.40% 4.20%

Rate of compensation increase 3.67% 3.69%

Pension expense is actuarially calculated annually based on data available at the beginning of each year. The

expected return on plan assets is determined by multiplying the expected long-term rate of return on assets by

the market-related value of plan assets for the U.S. qualified pension plan and market value for the Canadian

qualified pension plan. The market-related value of plan assets is a calculated value that recognizes investment

gains and losses in fair value related to equities over three or five years, depending on which computation

results in a market-related value closer to market value. Market-related value for the U.S. qualified plan was

$557 million and $579 million for 2014 and 2013, respectively.

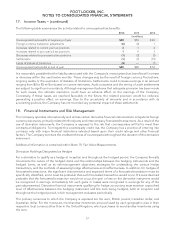

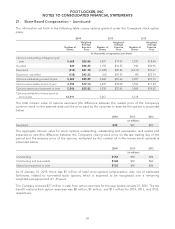

Assumptions used in the calculation of net benefit cost include the discount rate selected and disclosed at the

end of the previous year as well as other assumptions detailed in the table below:

Pension Benefits Postretirement Benefits

2014 2013 2012 2014 2013 2012

Discount rate 4.33% 3.79% 4.16% 4.20% 3.70% 4.00%

Rate of compensation

increase 3.67% 3.69% 3.68%

Expected long-term rate of

return on assets 6.25% 6.24% 6.63%

The expected long-term rate of return on invested plan assets is based on the plans’ weighted-average target

asset allocation, as well as historical and future expected performance of those assets. The target asset

allocation is selected to obtain an investment return that is sufficient to cover the expected benefit payments

and to reduce future contributions by the Company.

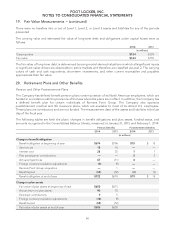

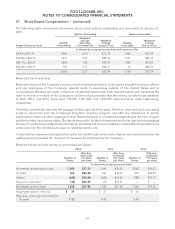

The components of net benefit expense (income) are:

Pension Benefits Postretirement Benefits

2014 2013 2012 2014 2013 2012

(in millions)

Service cost $15 $14 $13 $— $— $—

Interest cost 28 25 28 11—

Expected return on plan

assets (38) (39) (40) ———

Amortization of prior service

cost ——— ———

Amortization of net loss (gain) 15 17 17 (3) (3) (4)

Net benefit expense (income) $20 $17 $18 $ (2) $ (2) $ (4)

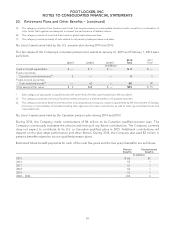

Beginning with 2001, new retirees were charged the expected full cost of the medical plan and then-existing

retirees will incur 100 percent of the expected future increases in medical plan costs. Any changes in the health

care cost trend rates assumed would not affect the accumulated benefit obligation or net benefit income, since

retirees will incur 100 percent of such expected future increase.

62