Foot Locker 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

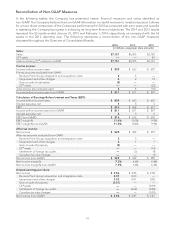

Overview of Consolidated Results

The following represents our long-term financial objectives and our progress towards meeting those objectives.

The following represents non-GAAP results for all the periods presented. In addition, the 2012 results are shown

on a 53-week basis.

Long-term

Objectives 2014 2013 2012

Sales (in millions) $7,500 $7,151 $6,505 $6,101

Sales per gross square foot $ 500 $ 490 $ 460 $ 443

EBIT margin 11.0% 11.4% 10.4% 9.9%

Net income margin 7.0% 7.3% 6.6% 6.2%

ROIC 14.0% 15.0% 14.1% 14.2%

Our results in 2014 were very strong and we achieved three of our long-term objectives. Highlights of our 2014

financial performance include:

• Sales and comparable-store sales, as noted in the table below, both increased and continued to

benefit from exciting assortments and enhanced store formats across our various banners, as well as

improved performance of the Company’s store banner.com websites.

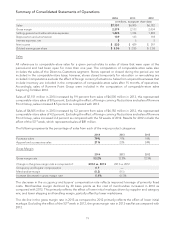

2014 2013 2012

Sales increase 9.9% 6.6% 8.5%

Comparable-store sales increase 8.0% 4.2% 9.4%

• Sales from Direct-to-Customers segment increased 21.0 percent to $865 million compared with

$715 million in 2013 and increased 110 basis points as a percentage of total sales to 12.1 percent. The

direct business has been steadily increasing over the last several years led by the growth in the store

banners’ e-commerce sales.

• Gross margin, as a percentage of sales, increased by 40 basis points to 33.2 percent in 2014. The

improvement was driven by the occupancy and buyers expense rate, which decreased 70 basis points,

reflecting effective leverage on higher sales.

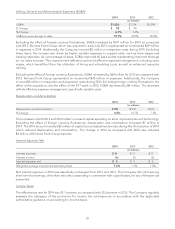

• SG&A expenses on a non-GAAP basis were 19.9 percent of sales, a decrease of 50 basis points as

compared with the prior year, as we carefully managed expenses.

• Net income on a non-GAAP basis was $522 million, or $3.58 diluted earnings per share, an increase of

24.7 percent from the prior-year period.

• The Company ended the year in a strong financial position. At year end, the Company had $833 million

of cash and cash equivalents, net of debt and obligations under capital leases. Cash and cash

equivalents at January 31, 2015 were $967 million, representing an increase of $100 million as

compared with last year. This reflects both the execution of various key initiatives noted in the items

below and the Company’s strong performance.

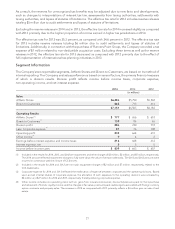

• Cash capital expenditures during 2014 totaled $190 million and were primarily directed to the

remodeling or relocation of 319 stores, the build-out of 86 new stores, as well as other technology and

infrastructure projects.

• Dividends totaling $127 million were declared and paid during 2014, returning significant value to our

shareholders.

• A total of 5.9 million shares were repurchased under our 2012 share repurchase program at a cost of

$305 million.

• ROIC increased to 15.0 percent as compared to the prior year result of 14.1 percent, reflecting

profitability improvements and a disciplined approach to capital spending.

18