Foot Locker 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies − (continued)

Accounting for Leases

The Company recognizes rent expense for operating leases as of the possession date for store leases or the

commencement of the agreement for a non-store lease. Rental expense, inclusive of rent holidays, concessions,

and tenant allowances are recognized over the lease term on a straight-line basis. Contingent payments based

upon sales and future increases determined by inflation related indices cannot be estimated at the inception of

the lease and accordingly, are charged to operations as incurred.

Foreign Currency Translation

The functional currency of the Company’s international operations is the applicable local currency. The

translation of the applicable foreign currency into U.S. dollars is performed for balance sheet accounts using

current exchange rates in effect at the balance sheet date and for revenue and expense accounts using the

weighted-average rates of exchange prevailing during the year. The unearned gains and losses resulting from

such translation are included as a separate component of accumulated other comprehensive loss within

shareholders’ equity.

Recent Accounting Pronouncements

In May 2014, Financial Accounting Standards Board issued Accounting Standards Update (‘‘ASU’’) 2014-09,

Revenue from Contracts with Customers, issued as a new Topic, Accounting Standards Codification Topic 606.

The core principle of this amendment is that an entity should recognize revenue to depict the transfer of

promised goods or services to customers in an amount that reflects the consideration to which the entity

expects to be entitled in exchange for those goods or services. ASU 2014-09 is effective for annual reporting

periods beginning after December 15, 2016, including interim periods within that reporting period, with earlier

adoption not permitted. ASU 2014-09 can be adopted either retrospectively to each prior reporting period

presented or as a cumulative-effect adjustment as of the date of adoption. The adoption of this guidance is not

expected to have a significant effect on our consolidated financial position, results of operations, or cash flows.

Other recently issued accounting pronouncements did not, or are not believed by management to, have a

material effect on the Company’s present or future consolidated financial statements.

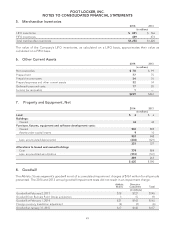

2. Segment Information

The Company has determined that its reportable segments are those that are based on its method of internal

reporting. As of January 31, 2015, the Company has two reportable segments, Athletic Stores and

Direct-to-Customers. The accounting policies of both segments are the same as those described in the

Summary of Significant Accounting Policies note.

The Company evaluates performance based on several factors, of which the primary financial measure is

division results. Division profit reflects income before income taxes, corporate expense, non-operating income,

and net interest expense.

2014 2013 2012

(in millions)

Sales

Athletic Stores $6,286 $5,790 $5,568

Direct-to-Customers 865 715 614

Total sales $7,151 $6,505 $6,182

46