Foot Locker 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

18. Financial Instruments and Risk Management − (continued)

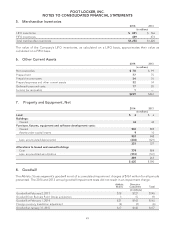

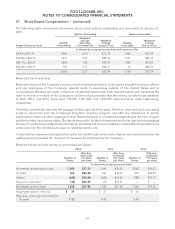

Notional Values and Foreign Currency Exchange Rates

The table below presents the notional amounts for all outstanding derivatives and the weighted-average

exchange rates of foreign exchange forward contracts at January 31, 2015: Contract Value

(U.S. in millions) Weighted-Average

Exchange Rate

Inventory

Buy €/Sell British £ $63 .7996

Intercompany

Buy €/Sell British £ $32 .7640

Buy US/Sell CAD $ 2 1.1912

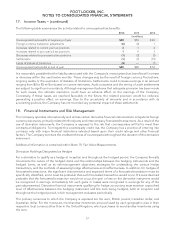

Business Risk

The retailing business is highly competitive. Price, quality, selection of merchandise, reputation, store location,

advertising, and customer service are important competitive factors in the Company’s business. The Company

operates in 23 countries and purchased approximately 89 percent of its merchandise in 2014 from its top 5

suppliers. In 2014, the Company purchased approximately 73 percent of its athletic merchandise from one

major supplier, Nike, Inc. (‘‘Nike’’), and approximately 11 percent from another major supplier. Each of our

operating divisions is highly dependent on Nike; they individually purchased 47 to 84 percent of their

merchandise from Nike.

Included in the Company’s Consolidated Balance Sheet at January 31, 2015, are the net assets of the Company’s

European operations, which total $883 million and are located in 19 countries, 11 of which have adopted the

euro as their functional currency.

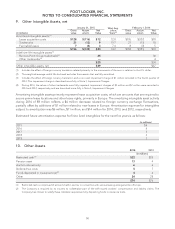

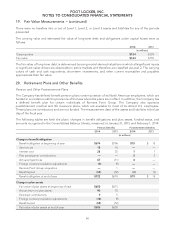

19. Fair Value Measurements

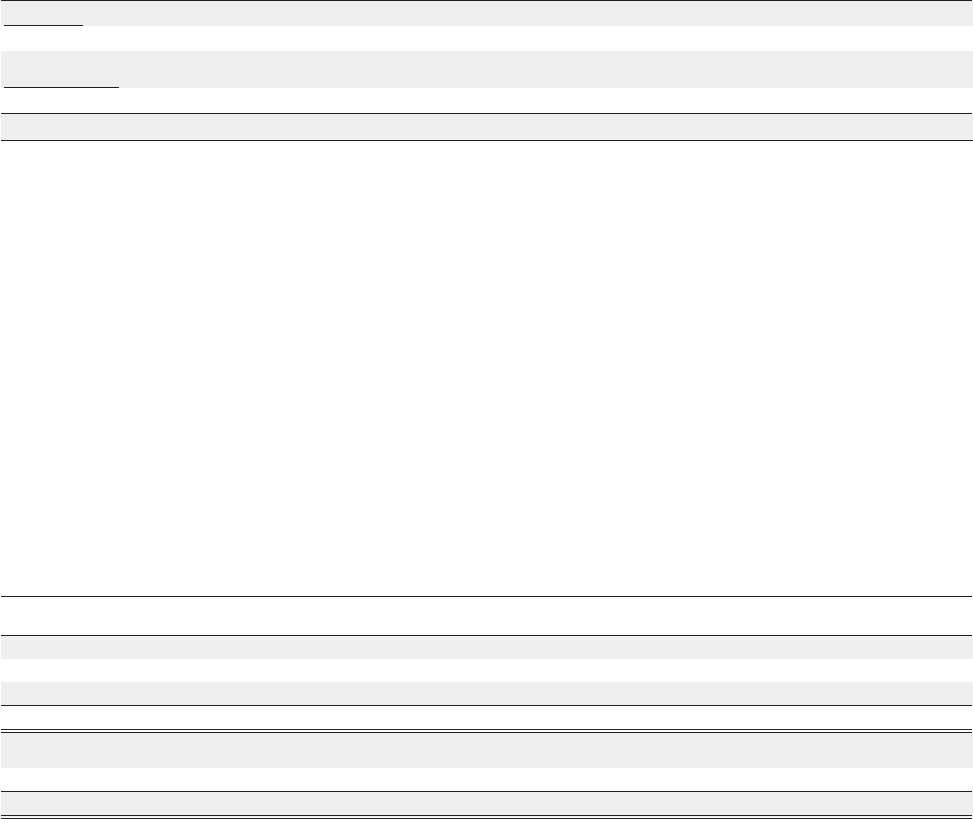

The following table provides a summary of the recognized assets and liabilities that are measured at fair value

on a recurring basis: As of January 31, 2015 As of February 1, 2014

(in millions)

Level 1 Level 2 Level 3 Level 1 Level 2 Level 3

Assets

Available-for-sale securities $— $6 $— $— $6 $—

Short-term investments —— — —9 —

Total Assets $— $6 $— $— $15 $—

Liabilities

Foreign exchange forward contracts —5 ——2 —

Total Liabilities $— $5 $— $— $2 $—

Available-for-sale securities are recorded at fair value with unrealized gains and losses reported, net of tax, in

other comprehensive income, unless unrealized losses are determined to be other than temporary. The fair

value of the auction rate security is determined by using quoted prices for similar instruments in active markets

and accordingly is classified as a Level 2 instrument.

The Company’s short-term investments matured during the second quarter of 2014. In the prior periods

presented, these investments represented corporate bonds with maturity dates within one year of the purchase

date. These securities were valued using model-derived valuations in which all significant inputs or significant

value-drivers were observable in active markets and therefore are classified as Level 2 instruments.

The Company’s derivative financial instruments are valued using market-based inputs to valuation models.

These valuation models require a variety of inputs, including contractual terms, market prices, yield curves, and

measures of volatility and therefore are classified as Level 2 instruments.

59