Foot Locker 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

20. Retirement Plans and Other Benefits − (continued)

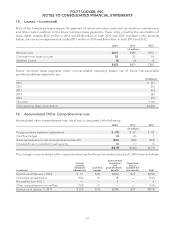

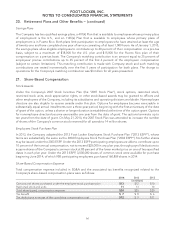

Pension Benefits Postretirement Benefits

2014 2013 2014 2013

(in millions)

Funded status $ (36) $ (24) $(19) $(15)

Amounts recognized on the balance sheet:

Other assets $13 $4 $— $—

Accrued and other liabilities (3) (3) (1) (1)

Other liabilities (46) (25) (18) (14)

$ (36) $ (24) $(19) $(15)

Amounts recognized in accumulated other

comprehensive loss, pre-tax:

Net loss (gain) $394 $399 $ (6) $(13)

Prior service cost 11——

$395 $400 $ (6) $(13)

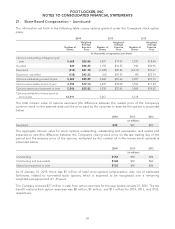

As of January 31, 2015 and February 1, 2014, the Canadian qualified pension plan’s assets exceeded its

accumulated benefit obligation. Information for those pension plans with an accumulated benefit obligation in

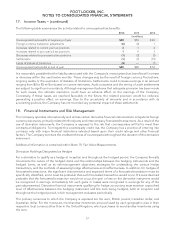

excess of plan assets is as follows:

2014 2013

(in millions)

Projected benefit obligation $662 $603

Accumulated benefit obligation 662 603

Fair value of plan assets 613 575

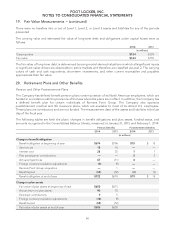

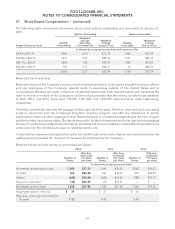

The following tables set forth the changes in accumulated other comprehensive loss (pre-tax) at January 31,

2015:

Pension

Benefits Postretirement

Benefits

(in millions)

Net actuarial loss (gain) at beginning of year $399 $(13)

Amortization of net (loss) gain (15) 3

Loss arising during the year 15 4

Foreign currency fluctuations (5) —

Net actuarial loss (gain) at end of year

(1)

$394 $ (6)

Net prior service cost at end of year

(1)

1—

Total amount recognized $395 $ (6)

(1) The amounts in accumulated other comprehensive loss that are expected to be recognized as components of net periodic benefit

cost (income) during the next year are approximately $14 million and $(2) million related to the pension and postretirement plans,

respectively. The net prior service cost did not change during the year.

61