Foot Locker 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

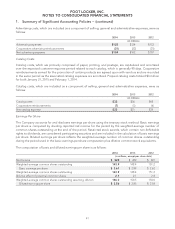

Income Taxes

In accordance with U.S. GAAP, deferred tax assets are recognized for tax credit and net operating loss

carryforwards, reduced by a valuation allowance, which is established when it is more likely than not that some

portion or all of the deferred tax assets will not be realized. Management is required to estimate taxable income

for future years by taxing jurisdiction and to use its judgment to determine whether or not to record a valuation

allowance for part or all of a deferred tax asset. Estimates of taxable income are based upon the Company’s

strategic long-range plans. A one percent change in the Company’s overall statutory tax rate for 2014 would

have resulted in a $5 million change in the carrying value of the net deferred tax asset and a corresponding

charge or credit to income tax expense depending on whether the tax rate change was a decrease or an

increase.

The Company has operations in multiple taxing jurisdictions and is subject to audit in these jurisdictions. Tax

audits by their nature are often complex and can require several years to resolve. Accruals of tax contingencies

require management to make estimates and judgments with respect to the ultimate outcome of tax audits.

Actual results could vary from these estimates.

The Company expects its 2015 effective tax rate to approximate 36.5 percent, excluding the effect of any

nonrecurring items that may occur. The actual tax rate will vary depending primarily on the level and mix of

income earned in the United States as compared with its international operations.

Recent Accounting Pronouncements

Descriptions of the recently issued accounting principles, if any, and the accounting principles adopted by the

Company during the year ended January 31, 2015 are included in the Summary of Significant Accounting

Policies note in ‘‘Item 8. Consolidated Financial Statements and Supplementary Data.’’

Disclosure Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of the federal securities laws. Other than

statements of historical facts, all statements which address activities, events, or developments that the

Company anticipates will or may occur in the future, including, but not limited to, such things as future capital

expenditures, expansion, strategic plans, financial objectives, dividend payments, stock repurchases, growth of

the Company’s business and operations, including future cash flows, revenues, and earnings, and other such

matters, are forward-looking statements. These forward-looking statements are based on many assumptions

and factors which are detailed in the Company’s filings with the Securities and Exchange Commission, including

the effects of currency fluctuations, customer demand, fashion trends, competitive market forces, uncertainties

related to the effect of competitive products and pricing, customer acceptance of the Company’s merchandise

mix and retail locations, the Company’s reliance on a few key suppliers for a majority of its merchandise

purchases (including a significant portion from one key supplier), pandemics and similar major health concerns,

unseasonable weather, deterioration of global financial markets, economic conditions worldwide, deterioration

of business and economic conditions, any changes in business, political and economic conditions due to the

threat of future terrorist activities in the United States or in other parts of the world and related U.S. military

action overseas, the ability of the Company to execute its business and strategic plans effectively with regard

to each of its business units, and risks associated with global product sourcing, including political instability,

changes in import regulations, and disruptions to transportation services and distribution.

For additional discussion on risks and uncertainties that may affect forward-looking statements, see ‘‘Risk

Factors’’ in Part I, Item 1A. Any changes in such assumptions or factors could produce significantly different

results. The Company undertakes no obligation to update forward-looking statements, whether as a result of

new information, future events, or otherwise.

32