Foot Locker 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

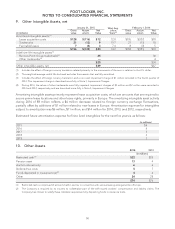

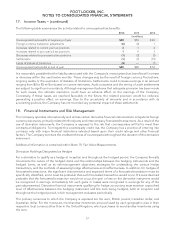

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2. Segment Information − (continued)

For the period ended January 31, 2015, the countries that comprised the majority of the sales and long-lived

assets for the international category were Germany, Italy, Canada, and France. No other individual country

included in the International category is significant.

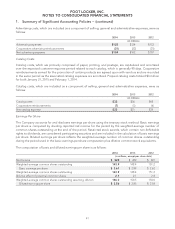

3. Impairment and Other Charges

2014 2013 2012

(in millions)

Charges recorded in connection with CCS-

Impairment of intangible assets $2 $— $7

Impairment of long-lived assets ——5

CCS store closure costs —2—

Total CCS charges $2 $ 2 $12

Other intangible asset impairments 2——

Total impairment and other charges $4 $ 2 $12

The Company acquired the CCS e-commerce business in 2008 and later expanded its operations to include

physical stores. During 2012, due to the continued underperformance of this business, impairment and other

charges totaling $12 million were recorded. This represented an impairment of the tradename of $7 million and

$5 million to writedown long-lived assets of the CCS stores. During 2013, the Company recorded $2 million of

store closing costs, primarily related to lease buy-out expenses, resulting from the decision to close the CCS

store locations. Finally, during 2014 the Company exited the e-commerce business and further impaired the

CCS tradename to its fair value, which was realized upon sale.

During 2014, the Company also recorded a non-cash impairment charge of $1 million to fully write down the

remaining value of the tradename related to the Company’s stores in the Republic of Ireland, reflecting

historical and projected underperformance. Additionally, the Company recorded a non-cash impairment charge

to fully write down the value of a private-label brand acquired as part of the Runners Point Group acquisition,

to reflect the exit of this product line.

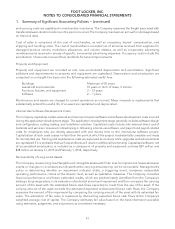

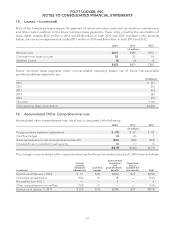

4. Other Income

Other income includes non-operating items, such as: gains from insurance recoveries; discounts/premiums

paid on the repurchase and retirement of bonds; royalty income; and the changes in fair value, premiums paid,

realized gains associated with foreign currency option contracts and property sales. Other income was

$9 million in 2014, $4 million in 2013, and $2 million in 2012.

For 2014, other income includes a $4 million gain on a sale of property, $2 million of royalty income, $2 million

of realized gain associated with foreign currency option contracts and $1 million of lease termination gains

related to the sales of leasehold interests. For 2013, other income includes $2 million of royalty income and

$2 million of lease termination gains related to the sales of leasehold interests. For 2012, other income primarily

includes royalty income.

48