Foot Locker 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

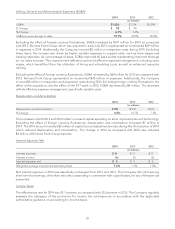

insurance and benefit programs, certain foreign exchange transaction gains and losses, and other items.

Depreciation and amortization included in corporate expense was $13 million, $12 million, and $13 million in

2014, 2013, and 2012, respectively.

Corporate expense increased by $5 million in 2014, as compared with 2013. This increase is primarily related to

incentive compensation and legal costs, which increased $8 million and $2 million, respectively. Additionally,

depreciation and amortization included in corporate expense increased by $1 million. These increases were

partially offset by the annual adjustment to the allocation of corporate expense to the operating divisions,

which reduced corporate expense by $4 million. In addition, acquisition and integration costs related to

Runners Point Group were $4 million less in the current year.

Corporate expense decreased by $32 million to $76 million in 2013, as compared with 2012. The allocation of

corporate expenses to the operating divisions was increased thereby reducing corporate expense by

$27 million for 2013. In addition, incentive compensation decreased by $11 million and legal expenses, which

in 2012 included a litigation charge, decreased by $4 million. Additionally, depreciation and amortization

expense decreased by $1 million. These decreases were partially offset by $6 million of costs related to the

Company’s acquisition and integration of Runners Point Group, as well as an increase of $5 million for

share-based compensation expense.

Liquidity and Capital Resources

Liquidity

The Company’s primary source of liquidity has been cash flow from earnings, while the principal uses of cash

have been to: fund inventory and other working capital requirements; finance capital expenditures related to

store openings, store remodelings, Internet and mobile sites, information systems, and other support facilities;

make retirement plan contributions, quarterly dividend payments, and interest payments; and fund other cash

requirements to support the development of its short-term and long-term operating strategies. The Company

generally finances real estate with operating leases. Management believes its cash, cash equivalents, and future

cash flow from operations will be adequate to fund these requirements.

As of January 31, 2015, the Company had $537 million of cash and cash equivalents held in foreign jurisdictions.

Because we plan to permanently reinvest our foreign earnings, in accordance with U.S. GAAP, we have not

provided for U.S. federal and state income taxes or foreign withholding taxes that may result from potential

future remittances of undistributed earnings of foreign subsidiaries. Depending on the source, amount, and

timing of a repatriation, some tax may be payable. The Company believes that its cash invested domestically

and future domestic cash flows are sufficient to satisfy domestic requirements.

The Company may also from time to time repurchase its common stock or seek to retire or purchase

outstanding debt through open market purchases, privately negotiated transactions, or otherwise. Such

repurchases, if any, will depend on prevailing market conditions, liquidity requirements, contractual restrictions,

and other factors. The amounts involved may be material. As of January 31, 2015, approximately $65 million

was remaining on the share repurchase program. On February 17, 2015, the Board of Directors approved a new

3-year, $1 billion share repurchase program extending through January 2018, replacing the Company’s previous

$600 million program.

Also on February 17, 2015, the Board of Directors declared a quarterly dividend of $0.25 per share to be paid

on May 1, 2015. This dividend represents a 14 percent increase over the Company’s previous quarterly per share

amount.

Any material adverse change in customer demand, fashion trends, competitive market forces, or customer

acceptance of the Company’s merchandise mix and retail locations, uncertainties related to the effect of

competitive products and pricing, the Company’s reliance on a few key suppliers for a significant portion of its

merchandise purchases and risks associated with global product sourcing, economic conditions worldwide, the

effects of currency fluctuations, as well as other factors listed under the heading ‘‘Disclosure Regarding

Forward-Looking Statements,’’ could affect the ability of the Company to continue to fund its needs from

business operations.

24