Foot Locker 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

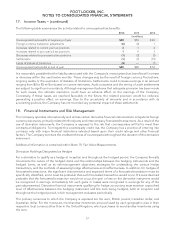

18. Financial Instruments and Risk Management − (continued)

For option and foreign exchange forward contracts designated as cash flow hedges of the purchase of

inventory, the effective portion of gains and losses is deferred as a component of Accumulated Other

Comprehensive Loss (‘‘AOCL’’) and is recognized as a component of cost of sales when the related inventory is

sold. The amount reclassified to cost of sales related to such contracts was not significant for any of the periods

presented. The effective portion of gains or losses associated with other forward contracts is deferred as a

component of AOCL until the underlying transaction is reported in earnings. The ineffective portion of gains

and losses related to cash flow hedges recorded to earnings was also not significant for any of the periods

presented. When using a forward contract as a hedging instrument, the Company excludes the time value of

the contract from the assessment of effectiveness. For all years presented, all of the Company’s hedged

forecasted transactions are less than twelve months, and the Company expects all derivative-related amounts

reported in AOCL to be reclassified to earnings within twelve months. During 2014, the net change in the fair

value of the foreign exchange derivative financial instruments designated as cash flow hedges of the purchase

of inventory resulted in a loss of $1 million and therefore increased AOCL. At January 31, 2015 there was a

$3 million loss included in AOCL.

The notional value of the contracts outstanding at January 31, 2015 was $63 million and these contracts extend

through January 2016.

Derivative Holdings Designated as Non-Hedges

The Company enters into foreign exchange forward contracts that are not designated as hedges in order to

manage the costs of certain foreign currency-denominated merchandise purchases and intercompany

transactions. Changes in the fair value of these foreign exchange forward contracts are recorded in earnings

immediately within selling, general and administrative expenses. The net change in fair value was not significant

for 2014, was $1 million for 2013, and was not significant for 2012. The notional value of the contracts

outstanding at January 31, 2015 was $34 million, and these contracts extend through October 2015.

The Company may mitigate the effect of fluctuating foreign exchange rates on the reporting of foreign

currency-denominated earnings by entering into currency option contracts. Changes in the fair value of these

foreign currency option contracts, which are designated as non-hedges, are recorded in earnings immediately

within other income. During 2014, the Company recorded realized gains of $1 million, net of premiums paid, in

connection with such contracts. The amounts recorded in prior years were not significant. There were no

contracts outstanding at January 31, 2015.

Fair Value of Derivative Contracts

The following represents the fair value of the Company’s derivative contracts. Many of the Company’s

agreements allow for a netting arrangement. The following is presented on a gross basis, by type of contract:

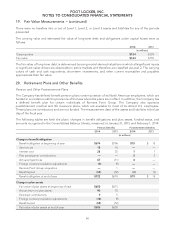

(in millions) Balance Sheet Caption 2014 2013

Hedging Instruments:

Foreign exchange forward contracts Current liabilities $4 $2

Non-hedging Instruments:

Foreign exchange forward contracts Current liabilities $1 $—

58