Foot Locker 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

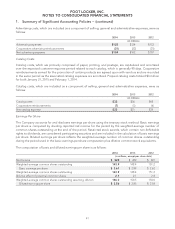

Pension and Postretirement Liabilities

Management reviews all assumptions used to determine its obligations for pension and postretirement

liabilities annually with its independent actuaries, taking into consideration existing and future economic

conditions and the Company’s intentions with regard to the plans. The assumptions used are:

Long-Term Rate of Return — The expected rate of return on plan assets is the long-term rate of return expected

to be earned on the plans’ assets and is recognized as a component of pension expense. The rate is based on

the plans’ weighted-average target asset allocation, as well as historical and future expected performance of

those assets. The target asset allocation is selected to obtain an investment return that is sufficient to cover the

expected benefit payments and to reduce future contributions by the Company. The expected rate of return on

plan assets is reviewed annually and revised, as necessary, to reflect changes in the financial markets and our

investment strategy. The weighted-average long-term rate of return used to determine 2014 pension expense

was 6.25 percent.

A decrease of 50 basis points in the weighted-average expected long-term rate of return would have increased

2014 pension expense by approximately $3 million. The actual return on plan assets in a given year typically

differs from the expected long-term rate of return, and the resulting gain or loss is deferred and amortized into

expense over the average life expectancy of its inactive participants.

Discount Rate — An assumed discount rate is used to measure the present value of future cash flow obligations

of the plans and the interest cost component of pension expense and postretirement income. The cash flows

are then discounted to their present value and an overall discount rate is determined. The discount rate is

determined by reference to the Bond:Link interest rate model based upon a portfolio of highly rated

U.S. corporate bonds with individual bonds that are theoretically purchased to settle the plan’s anticipated cash

outflows. The discount rate selected to measure the present value of the Company’s Canadian benefit

obligations was developed by using the plan’s bond portfolio indices, which match the benefit obligations. The

weighted-average discount rates used to determine the 2014 benefit obligations related to the Company’s

pension and postretirement plans were 3.43 percent and 3.40 percent, respectively.

Changing the weighted-average discount rate by 50 basis points would have changed the accumulated benefit

obligation of the pension plans at January 31, 2015 by approximately $35 million and $38 million, depending on

if the change was an increase or decrease, respectively. A decrease of 50 basis points in the weighted-average

discount rate would have increased the accumulated benefit obligation on the postretirement plan by

approximately $2 million. Such a decrease would not have significantly changed 2014 pension expense or

postretirement income.

Trend Rate — The Company maintains two postretirement medical plans, one covering certain executive

officers and key employees of the Company (‘‘SERP Medical Plan’’), and the other covering all other associates.

With respect to the SERP Medical Plan, a one percent change in the assumed health care cost trend rate would

change this plan’s accumulated benefit obligation by approximately $4 million and $3 million, depending on if

the change was an increase or decrease, respectively. With respect to the postretirement medical plan covering

all other associates, there is limited risk to the Company for increases in health care costs since, beginning in

2001, new retirees have assumed the full expected costs and then-existing retirees have assumed all increases

in such costs.

Mortality Assumptions — In 2014, the Company changed the mortality table used to calculate the present value

of pension and postretirement plan liabilities, excluding the SERP Medical Plan. We previously used the RP

2000 mortality table projected with scale AA to 2019 for males and to 2013 for females. In 2014, we used the RP

2000 mortality table with generational projection using scale AA for both males and females. This mortality

table was chosen after considering alternative tables including the RP-2014 table. We chose the RP 2000 table

because it resulted in the closest match to the Company’s actual experience. For the SERP Medical Plan, the

mortality assumption was updated to the RP 2014 table with generational projection using MP 2014. These

changes did not significantly affect the Company’s total obligations.

The Company expects to record postretirement income of approximately $1 million and pension expense of

approximately $16 million in 2015.

31