Foot Locker 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

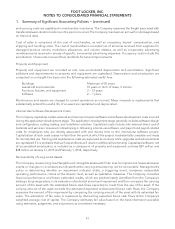

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

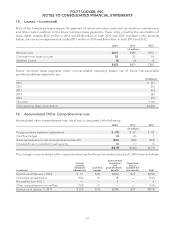

13. Long-Term Debt and Obligations Under Capital Leases

2014 2013

(in millions)

8.5% debentures payable 2022 $118 $118

Unamortized gain related to interest rate swaps

(1)

12 13

Obligations under capital leases 48

$134 $139

Less: current portion of obligations under capital leases 23

$132 $136

(1) In 2009, the Company terminated an interest rate swap at a gain. This gain is being amortized as part of interest expense over the

remaining term of the debt using the effective-yield method.

Interest expense related to long-term debt and the amortization of the associated debt issuance costs, was

$9 million for all years presented.

Maturities of long-term debt and minimum rent payments under capital leases in future periods are:

Long-Term

Debt Capital

Leases Total

(in millions)

2015 $— $2 $ 2

2016 —1 1

2017 —1 1

2018 − 2019 — — —

Thereafter 118 — 118

$118 $ 4 $122

Less: Imputed interest — — —

Current portion — 2 2

$118 $ 2 $120

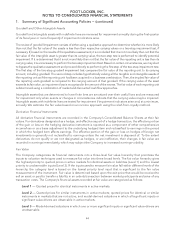

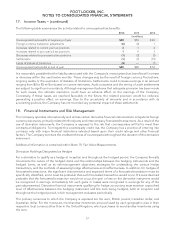

14. Other Liabilities

2014 2013

(in millions)

Straight-line rent liability $124 $116

Pension benefits 46 25

Income taxes 24 27

Postretirement benefits 18 14

Deferred taxes 14 18

Workers’ compensation and general liability reserves 99

Other 18 20

$253 $229

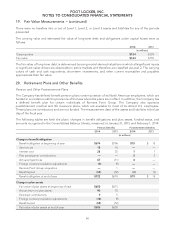

15. Leases

The Company is obligated under operating leases for almost all of its store properties. Some of the store leases

contain renewal options with varying terms and conditions. Management expects that in the normal course of

business, expiring leases will generally be renewed or, upon making a decision to relocate, replaced by leases

on other premises. Operating lease periods generally range from 5 to 10 years. Certain leases provide for

additional rent payments based on a percentage of store sales.

52