Foot Locker 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

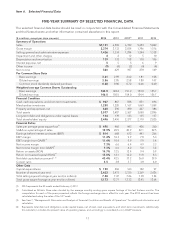

Item 6. Selected Financial Data

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA

The selected financial data below should be read in conjunction with the Consolidated Financial Statements

and the Notes thereto and other information contained elsewhere in this report.

($ in millions, except per share amounts) 2014 2013 2012

(1)

2011 2010

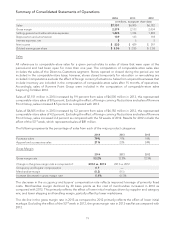

Summary of Operations

Sales $7,151 6,505 6,182 5,623 5,049

Gross margin 2,374 2,133 2,034 1,796 1,516

Selling, general and administrative expenses 1,426 1,334 1,294 1,244 1,138

Impairment and other charges 4212 5 10

Depreciation and amortization 139 133 118 110 106

Interest expense, net 5556 9

Other income (9) (4) (2) (4) (4)

Net income 520 429 397 278 169

Per Common Share Data

Basic earnings 3.61 2.89 2.62 1.81 1.08

Diluted earnings 3.56 2.85 2.58 1.80 1.07

Common stock dividends declared per share 0.88 0.80 0.72 0.66 0.60

Weighted-average Common Shares Outstanding

Basic earnings 143.9 148.4 151.2 153.0 155.7

Diluted earnings 146.0 150.5 154.0 154.4 156.7

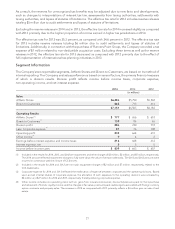

Financial Condition

Cash, cash equivalents, and short-term investments $ 967 867 928 851 696

Merchandise inventories 1,250 1,220 1,167 1,069 1,059

Property and equipment, net 620 590 490 427 386

Total assets 3,577 3,487 3,367 3,050 2,896

Long-term debt and obligations under capital leases 134 139 133 135 137

Total shareholders’ equity 2,496 2,496 2,377 2,110 2,025

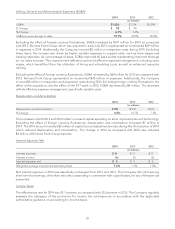

Financial Ratios

Sales per average gross square foot(2) $ 490 460 443 406 360

SG&A as a percentage of sales 19.9% 20.5 20.9 22.1 22.5

Earnings before interest and taxes (EBIT) $ 814 668 612 441 266

EBIT margin 11.4% 10.3 9.9 7.8 5.3

EBIT margin (non-GAAP)(3) 11.4% 10.4 9.9 7.9 5.4

Net income margin 7.3% 6.6 6.4 4.9 3.3

Net income margin (non-GAAP)(3) 7.3% 6.6 6.2 5.0 3.4

Return on assets (ROA) 14.7% 12.5 12.4 9.4 5.9

Return on invested capital (ROIC)(3) 15.0% 14.1 14.2 11.8 8.3

Net debt capitalization percent(3), (4) 43.4% 42.5 37.2 36.0 39.0

Current ratio 3.5 3.8 3.7 3.8 4.0

Other Data

Capital expenditures $ 190 206 163 152 97

Number of stores at year end 3,423 3,473 3,335 3,369 3,426

Total selling square footage at year end (in millions) 7.48 7.47 7.26 7.38 7.54

Total gross square footage at year end (in millions) 12.73 12.71 12.32 12.45 12.64

(1) 2012 represents the 53 weeks ended February 2, 2013.

(2) Calculated as Athletic Store sales divided by the average monthly ending gross square footage of the last thirteen months. The

computation for each of the years presented reflects the foreign exchange rate in affect for such year. The 2012 amount has been

calculated excluding the sales of the 53

rd

week.

(3) See Item 7, ‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations’’ for additional information and

calculation.

(4) Represents total debt and obligations under capital leases, net of cash, cash equivalents, and short-term investments. Additionally,

this calculation includes the present value of operating leases, and accordingly is considered a non-GAAP measure.

13