Foot Locker 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

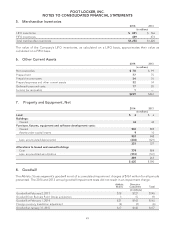

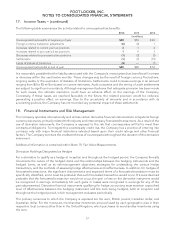

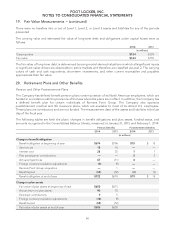

17. Income Taxes − (continued)

A reconciliation of the significant differences between the federal statutory income tax rate and the effective

income tax rate on pre-tax income is as follows:

2014 2013 2012

Federal statutory income tax rate 35.0% 35.0% 35.0%

State and local income taxes, net of federal tax benefit 3.2 3.5 3.2

International income taxed at varying rates (1.9) (1.6) (0.4)

Foreign tax credits (2.5) (2.5) (1.8)

Domestic/foreign tax settlements (0.6) (1.1) (2.2)

Federal tax credits (0.2) (0.2) (0.2)

Other, net 2.7 2.2 1.0

Effective income tax rate 35.7% 35.3% 34.6%

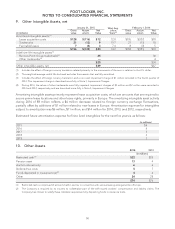

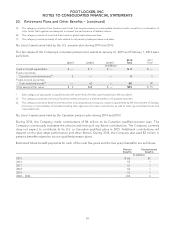

Deferred income taxes are provided for the effects of temporary differences between the amounts of assets

and liabilities recognized for financial reporting purposes and the amounts recognized for income tax purposes.

Items that give rise to significant portions of the Company’s deferred tax assets and deferred tax liabilities are

as follows:

2014 2013

(in millions)

Deferred tax assets:

Tax loss/credit carryforwards and capital loss $9 $12

Employee benefits 65 55

Property and equipment 137 147

Straight-line rent 33 30

Goodwill and other intangible assets —6

Other 38 33

Total deferred tax assets 282 283

Valuation allowance (6) (6)

Total deferred tax assets, net $276 $277

Deferred tax liabilities:

Merchandise inventories 96 85

Goodwill and other intangible assets 17 —

Other 111

Total deferred tax liabilities $114 $96

Net deferred tax asset $162 $181

Balance Sheet caption reported in:

Deferred taxes $221 $241

Other current assets 34

Accrued and other current liabilities (48) (46)

Other liabilities (14) (18)

$162 $181

55