Foot Locker 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

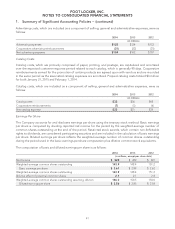

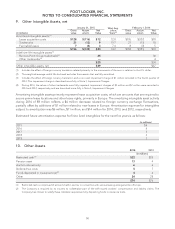

5. Merchandise Inventories

2014 2013

(in millions)

LIFO inventories $ 821 $ 746

FIFO inventories 429 474

Total merchandise inventories $1,250 $1,220

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as

calculated on a FIFO basis.

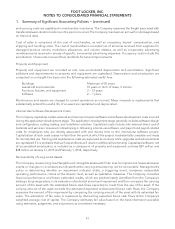

6. Other Current Assets

2014 2013

(in millions)

Net receivables $78 $99

Prepaid rent 77 75

Prepaid income taxes 34 35

Prepaid expenses and other current assets 32 34

Deferred taxes and costs 17 20

Income tax receivable 1—

$239 $263

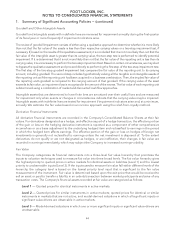

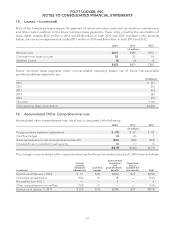

7. Property and Equipment, Net

2014 2013

(in millions)

Land $4 $6

Buildings:

Owned 44 44

Furniture, fixtures, equipment and software development costs:

Owned 900 888

Assets under capital leases 910

957 948

Less: accumulated depreciation (606) (621)

351 327

Alterations to leased and owned buildings

Cost 779 804

Less: accumulated amortization (510) (541)

269 263

$ 620 $ 590

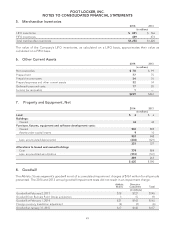

8. Goodwill

The Athletic Stores segment’s goodwill is net of accumulated impairment charges of $167 million for all periods

presented. The 2014 and 2013 annual goodwill impairment tests did not result in an impairment charge.

Athletic

Stores Direct-to-

Customers Total

(in millions)

Goodwill at February 2, 2013 $18 $127 $145

Goodwill from Runners Point Group acquisition 3 15 18

Goodwill at February 1, 2014 $21 $142 $163

Foreign currency translation adjustment (4) (2) (6)

Goodwill at January 31, 2015 $17 $140 $157

49