Chevron 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FS-PB

78 Chevron Corporation 2009 Annual Report

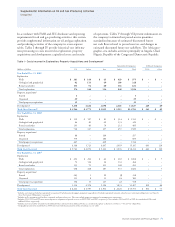

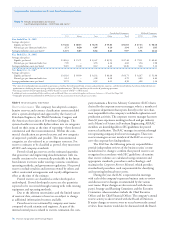

Supplemental Information on Oil and Gas Producing Activities

natural gas for 2009 was lower than the 2009 year-end

spot prices applicable under the old rules. The ability to use

new technologies in reserves determination did not impact

reserves significantly, as most reserve additions and revisions

were based on conventional technologies.

Proved Undeveloped Reserve Quantities At the end of

2009, proved undeveloped oil-equivalent reserves for consoli-

dated companies totaled 3.1 billion barrels. Approximately

58 percent of the reserves are attributed to natural gas, of

which about half were located in Australia in the Other

regions. Crude oil, condensate and NGLs accounted for

about 33 percent of the total, with the largest concentra-

tion of these reserves in Africa, Asia and the United States.

Synthetic oil accounted for the balance of the reserves and

were located in Canada in the Other regions.

Proved undeveloped reserves of equity affiliates amounted

to 1.3 billion oil-equivalent barrels. At year-end, crude oil, con-

densate and NGLs represented 58 percent of the total reserves,

with the TCO affiliate accounting for the majority of the

amount. Natural gas represented 26 percent of the total, with

over half of these reserves at TCO. The balance is attributed to

synthetic oil in Venezuela in the Other regions.

In 2009, worldwide proved undeveloped oil-equivalent

reserves increased by 480 million barrels for consolidated

companies and decreased 19 million barrels for equity affili-

ates. The largest increase for consolidated companies was in

the Other regions, resulting primarily from initial recognition

of reserves for the Gorgon Project in Australia and addition

of synthetic oil reserves related to Canadian oil sands with

adoption of the new definition of oil and gas activity. Proved

undeveloped reserves decreased in Asia, Africa, and the

United States, as a result of development drilling and other

activities, which reclassified reserves to proved developed.

Proved undeveloped reserves decreased for affiliated com-

panies. This was primarily associated with a 146 million barrel

reclassification to proved developed as a result of the TCO

production capacity added with the completion of the Sour

Gas Injection/Second Generation Plant Projects (SGI/SGP).

The decrease at TCO was partially offset by increased proved

undeveloped reserves in Venezuela and for Angola LNG due to

reservoir performance and additional drilling opportunities.

There were no material downward revisions of proved

undeveloped reserves for consolidated or affiliated companies.

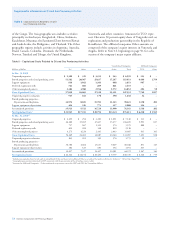

Investment to Convert Proved Undeveloped to Proved

Developed Reserves During 2009, investments totaling about

$6.9 billion were made by consolidated companies and equity

affiliates to advance the development of proved undeveloped

reserves. In the Africa region, $2.5 billion was expended on

various projects, including offshore development projects in

Nigeria and Angola, which advanced development drilling,

and the completion of a Nigerian natural gas processing proj-

ect. In the Asia region, expenditures during the year totaled

$1.5 billion, which included construction on a gas processing

facility in Thailand and development drilling at a steam-

flood project in Indonesia. In the United States, expenditures

totaled $1.7 billion for three offshore development projects in

the Gulf of Mexico and various smaller development projects.

In the Other regions, development expenditures totaled $1.2

billion for a variety of projects including development activi-

ties in Australia and the United Kingdom.

During the year, eight major development projects that

were placed into service resulted in the recognition of proved

developed reserves.

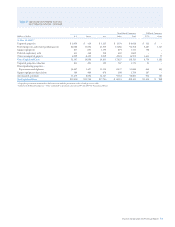

Proved Undeveloped Reserves for 5 Years or More Reserves

that remain proved undeveloped for five or more years are a result

of several physical factors that affect optimal project development

and execution, such as the complex nature of the development

project in adverse and remote locations, physical limitations of

infrastructure or plant capacities that dictate project timing, com-

pression projects that are pending reservoir pressure declines, and

contractual limitations that dictate production levels.

Proved undeveloped oil-equivalent reserves for consoli-

dated and affiliated companies totaled 4.4 billion barrels at

year-end 2009. Of this total, 1.7 billion barrels corresponds

to proved undeveloped oil-equivalent reserves that have

remained undeveloped for five years or more.

Consolidated companies held approximately 700 million

barrels of the proved undeveloped reserves over five years.

In Africa, approximately 400 million barrels were related to

deepwater projects under development. The Asia region held

approximately 100 million barrels related to compression and

contract restrictions. The Other regions held about 100 mil-

lion barrels related to compression projects in Australia. The

balance relates to capacity constraints and various projects in

the United States.

At year end, affiliated companies held about 1.0 billion

barrels of proved undeveloped reserves over five years. TCO

accounted for 800 million oil-equivalent barrels of reserves,

which was primarily related to plant capacity limitations.

The balance related to capacity limitations at a synthetic oil

project in Venezuela.

Annually, the company assesses whether any changes

have occurred in facts or circumstances, such as changes to

development plans, regulations or government policies, which

would warrant a revision to reserve estimates. For 2009, this

assessment did not result in any material changes in reserves

classified as proved undeveloped. Over the past three years,

the ratio of proved undeveloped reserves to total proved

reserves has ranged between 35 and 39 percent. The consis-

tent completion of major capital projects has kept the ratio in

a narrow range over this time period.

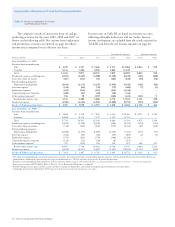

Proved Reserve Quantities At December 31, 2009,

oil-equivalent reserves for the company’s consolidated opera-

tions were 8.3 billion barrels. (Refer to the term “Reserves”

on page 8 for the definition of oil-equivalent reserves.)

Approximately 22 percent of the total reserves were located

Table V Reserve Quantity Information – Continued