Chevron 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2009 Annual Report 63

FS-PB

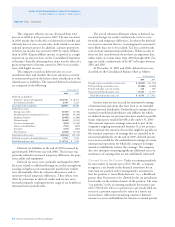

Note 21 Employee Benefit Plans – Continued

Level 1: Fair values of these assets are measured using

unadjusted quoted prices for the assets or the prices of identi-

cal assets in active markets that the plans have the ability

to access.

Level 2: Fair values of these assets are measured based

on quoted prices for similar assets in active markets; quoted

prices for identical or similar assets in inactive markets; inputs

other than quoted prices that are observable for the asset; and

inputs that are derived principally from or corroborated by

observable market data by correlation or other means. If the

asset has a contractual term, the Level 2 input is observable

for substantially the full term of the asset. The fair values for

Level 2 assets are generally obtained from third-party broker

quotes, independent pricing services and exchanges.

Level 3: Inputs to the fair value measurement are

unobservable for these assets. Valuation may be performed

using a financial model with estimated inputs entered into

the model.

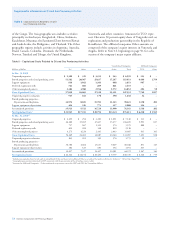

The fair value measurements of the company’s pension

plans for 2009 are below:

U.S. Int’l

Total Fair Value Level 1 Level 2 Level 3 Total Fair Value Level 1 Level 2 Level 3

Equities

U.S.1 $ 2,115 $ 2,115 $ – $ – $ 370 $ 370 $ – $ –

International 977 977 – – 492 492 – –

Collective Trusts/Mutual Funds2 1,264 3 1,261 – 789 94 695 –

Fixed Income

Government 713 149 564 – 506 54 452 –

Corporate 430 – 430 – 371 17 336 18

Mortgage-Backed Securities 149 – 149 – 2 – – 2

Other Asset Backed 90 – 90 – 19 – 19 –

Collective Trusts/Mutual Funds2 326 – 326 – 230 14 216 –

Mixed Funds3

8 8 – – 102 14 88 –

Real Estate4 479 – – 479 131 – – 131

Cash and Cash Equivalents 743 743 – – 207 207 – –

Other5

10 (57) 16 51 16 (3) 18 1

Total at December 31, 2009 $ 7,304 $ 3,938 $ 2,836 $ 530 $ 3,235 $ 1,259 $ 1,824 $ 152

1 U.S. equities include investments in the company’s common stock in the amount of $29 at December 31, 2009.

2 Collective Trusts/Mutual Funds for U.S. plans are entirely index funds; for International plans, they are mostly index funds. For these index funds, the Level 2 designation is based

on the restriction that advance notification of redemptions, typically two business days, is required.

3 Mixed funds are composed of funds that invest in both equity and fixed income instruments in order to diversify and lower risk.

4 The year-end valuations of the U.S. real estate assets are based on internal appraisals by the real estate managers, which are updates of third-party appraisals that occur at least once

a year for each property in the portfolio.

5 The “Other” asset category includes net payables for securities purchased but not yet settled (Level 1); dividends, interest- and tax-related receivables (Level 2); insurance contracts

and investments in private-equity limited partnerships (Level 3).

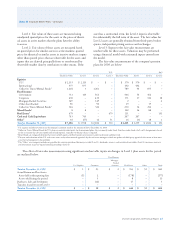

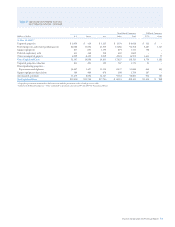

The effect of fair-value measurements using significant unobservable inputs on changes in Level 3 plan assets for the period

are outlined below:

Fixed Income

Mortgage-

Backed

U.S. Equities Corporate Securities Real Estate Other Total

Total at December 31, 2008 $ 1 $ 23 $ 2 $ 763 $ 52 $ 841

Actual Return on Plan Assets:

Assets held at the reporting date (1) 2 – (178) – (177)

Assets sold during the period – 5 – 8 – 13

Purchases, Sales and Settlements – (12) – 17 – 5

Transfers in and/or out of Level 3 – – – – – –

Total at December 31, 2009 $ – $ 18 $ 2 $ 610 $ 52 $ 682