Chevron 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2009 Annual Report 57

FS-PB

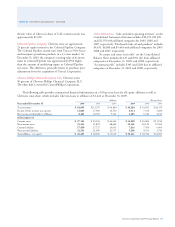

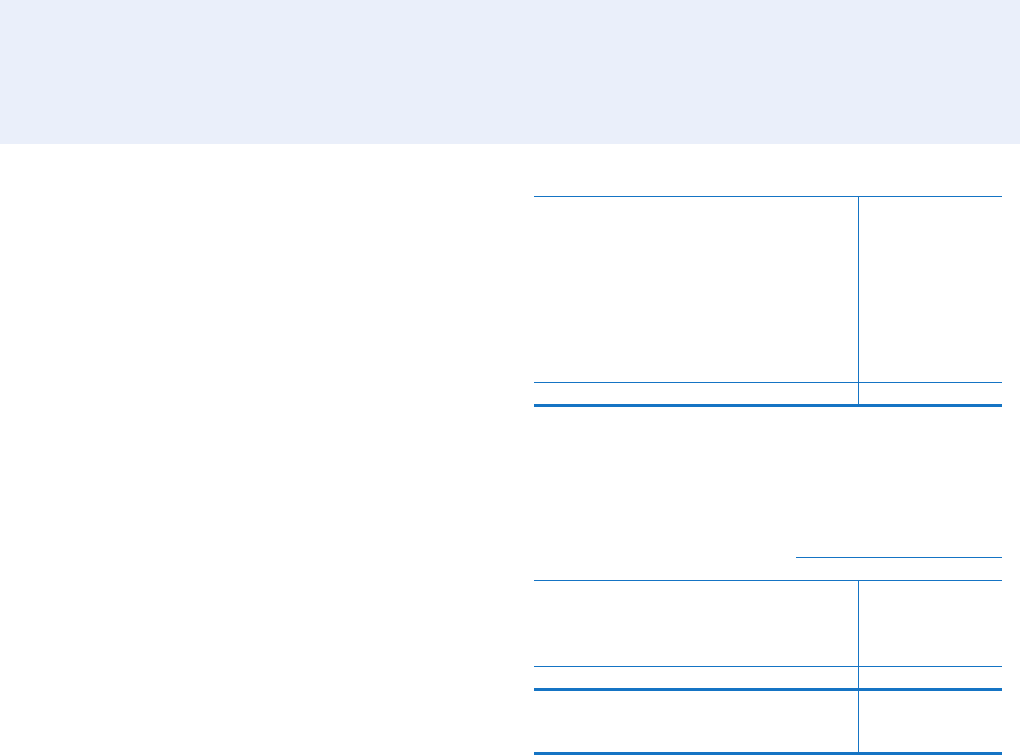

2009 2008 2007

Beginning balance at January 1 $ 2,118 $ 1,660 $ 1,239

Additions to capitalized exploratory

well costs pending the

determination of proved reserves 663 643 486

Reclassifications to wells, facilities

and equipment based on the

determination of proved reserves (174) (49) (23)

Capitalized exploratory well costs

charged to expense (172) (136) (42)

Ending balance at December 31 $ 2,435 $ 2,118 $ 1,660

The following table provides an aging of capitalized well

costs and the number of projects for which exploratory well

costs have been capitalized for a period greater than one year

since the completion of drilling.

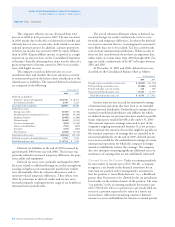

At December 31

2009 2008 2007

Exploratory well costs capitalized

for a period of one year or less $ 564 $ 559 $ 449

Exploratory well costs capitalized

for a period greater than one year 1,871 1,559 1,211

Balance at December 31 $ 2,435 $ 2,118 $ 1,660

Number of projects with exploratory

well costs that have been capitalized

for a period greater than one year* 46 50 54

* Certain projects have multiple wells or fields or both.

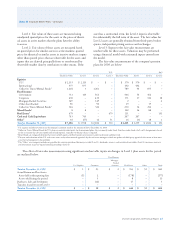

Of the $1,871 of exploratory well costs capitalized for more

than one year at December 31, 2009, $1,143 (28 projects)

is related to projects that had drilling activities under way

or firmly planned for the near future. The $728 balance

is related to 18 projects in areas requiring a major capital

expenditure before production could begin and for which

additional drilling efforts were not under way or firmly

planned for the near future. Additional drilling was not

deemed necessary because the presence of hydrocarbons

had already been established, and other activities were in

process to enable a future decision on project development.

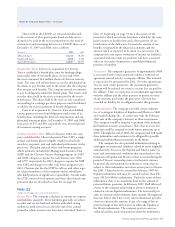

Note 18 New Accounting Standards – Continued

assess if it is the primary beneficiary of a variable-interest entity

(VIE), and, if so, the VIE must be consolidated. Adoption of

the standard is not expected to have a material impact on the

company’s results of operations, financial position or liquidity.

Extractive Industries – Oil and Gas (ASC 932), Oil and Gas

Reserve Estimation and Disclosures (ASU 2010-03) In January

2010, the FASB issued ASU 2010-03, which became effective

for the company on December 31, 2009. The standard

amends certain sections of ASC 932, Extractive Industries – Oil

and Gas, to align them with the requirements in the

Securities and Exchange Commission’s final rule, Modernization of

the Oil and Gas Reporting Requirements (the final rule). The

final rule was issued on December 31, 2008. Refer to Table

V – Reserve Quantity Information, beginning on page 76,

for additional information on the final rule and the impact

of adoption.

Note 19

Accounting for Suspended Exploratory Wells

Accounting standards for the costs of exploratory wells (ASC

932) provide that exploratory well costs continue to be capi-

talized after the completion of drilling when (a) the well has

found a sufficient quantity of reserves to justify completion

as a producing well and (b) the enterprise is making sufficient

progress assessing the reserves and the economic and operat-

ing viability of the project. If either condition is not met or

if an enterprise obtains information that raises substantial

doubt about the economic or operational viability of the proj-

ect, the exploratory well would be assumed to be impaired,

and its costs, net of any salvage value, would be charged

to expense. The accounting standards provide a number of

indicators that can assist an entity in demonstrating that suf-

ficient progress is being made in assessing the reserves and

economic viability of the project.

The following table indicates the changes to the com-

pany’s suspended exploratory well costs for the three years

ended December 31, 2009: