Chevron 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

14 Chevron Corporation 2009 Annual Report

FS-PB

Venezuela In February 2010, a Chevron-led consortium

was named the operator of a heavy-oil project composed of

three blocks in the Orinoco Oil Belt of eastern Venezuela.

United States First oil was achieved at the 58 percent-

owned and operated Tahiti Field in the deepwater Gulf of

Mexico, reaching maximum total production of 135,000 bar-

rels of oil-equivalent per day. The company also discovered

crude oil at the Chevron-operated and 55 percent-owned

Buckskin prospect in the deepwater Gulf of Mexico. The first

appraisal well is scheduled to begin drilling in the second

quarter 2010.

Downstream

The company sold businesses during 2009 in Brazil, Haiti,

Nigeria, Benin, Cameroon, Republic of the Congo, Côte

d’Ivoire, Togo, Kenya, Uganda, India, Italy, Peru and Chile.

Other

Common Stock Dividends The quarterly common stock

dividend increased by 4.6 percent in July 2009, to $0.68 per

share. 2009 was the 22nd consecutive year that the company

increased its annual dividend payment.

Common Stock Repurchase Program The company did

not acquire any shares during 2009 under its $15 billion

repurchase program, which began in 2007 and expires in

September 2010. As of December 31, 2009, 119 million

common shares had been acquired under this program for

$10.1 billion.

Results of Operations

Major Operating Areas The following section presents the

results of operations for the company’s business segments –

upstream, downstream and chemicals – as well as for “all

other,” which includes mining, power generation businesses,

the various companies and departments that are managed at

the corporate level, and the company’s investment in Dynegy

prior to its sale in May 2007. Earnings are also presented for

the U.S. and international geographic areas of the upstream

and downstream business segments. (Refer to Note 11,

beginning on page 47, for a discussion of the company’s

“reportable segments,” as defined in accounting standards

for segment reporting (Accounting Standards Codification

(ASC) 280)). This section should also be read in conjunction

with the discussion in “Business Environment and Outlook”

on pages 10 through 13.

U.S. Upstream – Exploration and Production

Millions of dollars 2009 2008 2007

Earnings $ 2,216 $ 7,126 $ 4,532

U.S. upstream earnings of $2.2 billion in 2009 decreased

$4.9 billion from 2008. Lower prices for crude oil and

natural gas reduced earnings by about $5.2 billion between

periods, and gains on asset sales declined by approximately

$900 million. Partially offsetting these effects was a ben-

efit of about $1.3 billion resulting from an increase in net

oil-equivalent production. An approximate $600 million

benefit to income from lower operating expenses was more

than offset by higher depreciation expense. The benefit from

lower operating expenses was largely associated with absence

of charges for damages related to the 2008 hurricanes in the

Gulf of Mexico.

U.S. upstream earnings of $7.1 billion in 2008 increased

$2.6 billion from 2007. Higher average prices for crude oil

and natural gas increased earnings by $3.1 billion between

periods. Also contributing to the higher earnings were

gains of approximately $1 billion on asset sales, including

a $600 million gain on an asset-exchange transaction. Par-

tially offsetting these benefits were adverse effects of about

$1.6 billion associated with lower oil-equivalent production

and higher operating expenses, which included approximately

$400 million of expenses resulting from damage to facilities

in the Gulf of Mexico caused by hurricanes.

The company’s average realization for crude oil and

natural gas liquids in 2009 was $54.36 per barrel, compared

with $88.43 in 2008 and $63.16 in 2007. The average

natural-gas realization was $3.73 per thousand cubic feet

in 2009, compared with $7.90 and $6.12 in 2008 and

2 0 07, respectively.

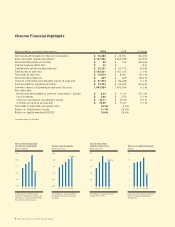

0

150 0

120 0

900

600

300

Exploration Expenses

Millions of dollars

United States

International

Exploration expenses increased

15 percent from 2008 due mainly

to higher well write-offs.

#016 – Exploration Expenses – v2

0605 07 08 09

$1,342

0.0

25.0

15.0

20.0

10.0

5.0

#017 – Worldwide Expl & Prod

Earnings – v2

Worldwide Exploration &

Production Earnings

Billions of dollars

Earnings decreased in 2009 on

lower average prices for crude oil

and natural gas.

United States

International

0605 07 08 09

$10.4