Chevron 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Chevron Corporation 2009 Annual Report

FS-PB

the balance sheet date. In 2009, $350 of tax-exempt

Gulf Opportunity Zone bonds related to projects at the

Pascagoula Refinery were issued.

The company periodically enters into interest rate swaps

on a portion of its short-term debt. At December 31, 2009,

the company had no interest rate swaps on short-term debt.

See Note 10, beginning on page 46, for information

concerning the company’s debt-related derivative activities.

At December 31, 2009, the company had $5,100 of

committed credit facilities with banks worldwide, which

permit the company to refinance short-term obligations

on a long-term basis. The facilities support the company’s

commercial paper borrowings. Interest on borrowings under

the terms of specific agreements may be based on the London

Interbank Offered Rate or bank prime rate. No amounts were

outstanding under these credit agreements during 2009 or

at year-end.

At December 31, 2009 and 2008, the company classified

$4,190 and $4,950, respectively, of short-term debt as long-term.

Settlement of these obligations is not expected to require the

use of working capital in 2010, as the company has both the

intent and the ability to refinance this debt on a long-term basis.

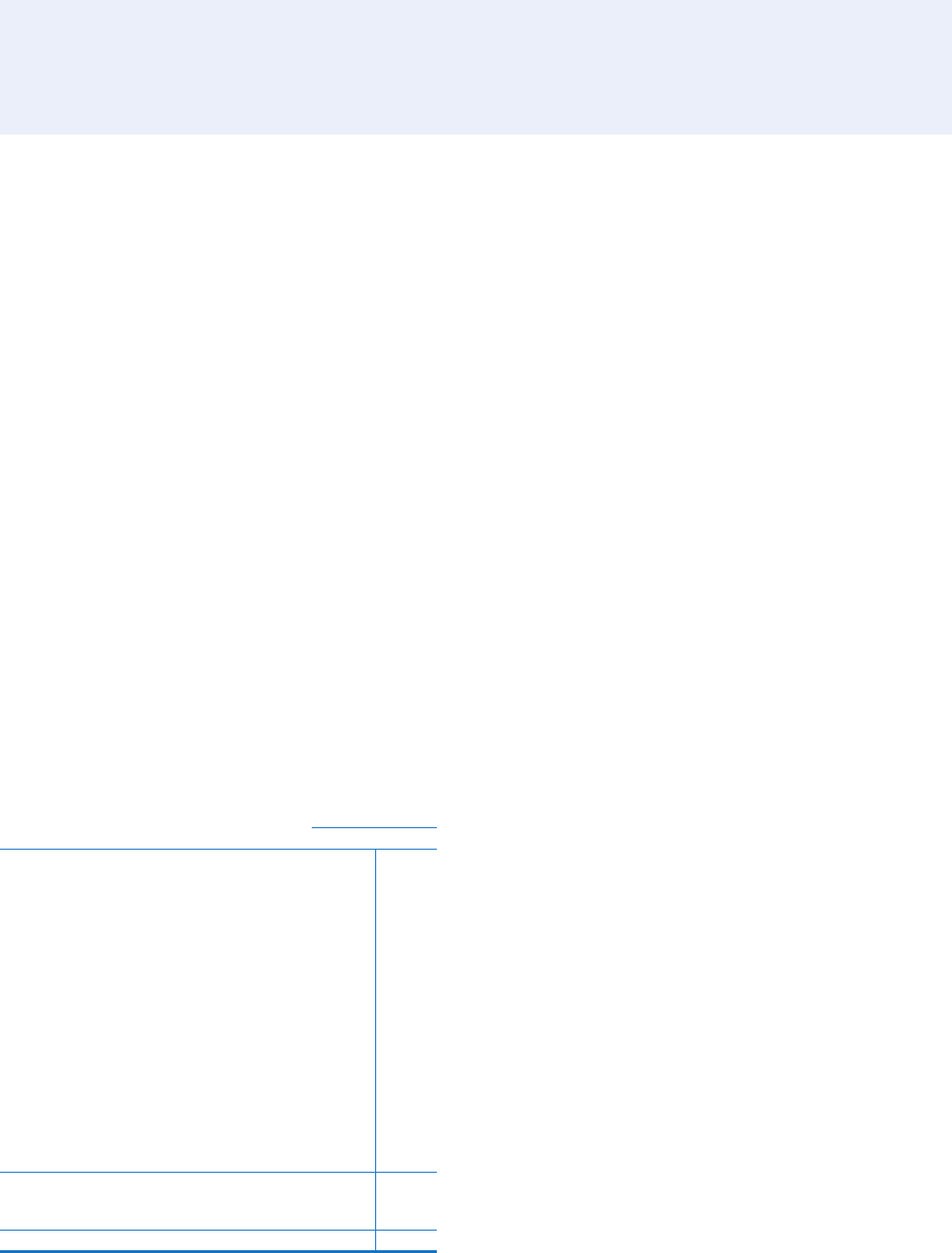

Note 17

Long-Term Debt

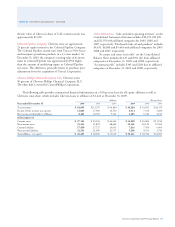

Total long-term debt, excluding capital leases, at December 31,

2009, was $9,829. The company’s long-term debt

outstanding at year-end 2009 and 2008 was as follows:

At December 31

2009 2008

3.95% notes due 2014 $ 1,997 $–

3.45% notes due 2012 1,500 –

4.95% notes due 2019 1,500 –

5.5% notes due 2009 – 400

8.625% debentures due 2032 147 147

7.327% amortizing notes due 20141 109 194

8.625% debentures due 2031 107 108

7.5% debentures due 2043 83 85

8% debentures due 2032 74 74

9.75% debentures due 2020 56 56

8.875% debentures due 2021 40 40

8.625% debentures due 2010 30 30

Medium-term notes, maturing from

2021 to 2038 (5.97%)2 38 38

Fixed interest rate notes, maturing 2011 (9.378%)2 19 21

Other foreign currency obligations – 13

Other long-term debt (6.69%)2 5 15

Total including debt due within one year 5,705 1,221

Debt due within one year (66) (429)

Reclassified from short-term debt 4,190 4,950

Total long-term debt $ 9,829 $ 5,742

1 Guarantee of ESOP debt.

2 Weighted-average interest rate at December 31, 2009.

Note 16 Short-Term Debt – Continued

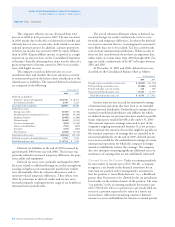

Long-term debt of $5,705 matures as follows: 2010 – $66;

2011 – $33; 2012 – $1,520; 2013 – $21; 2014 – $2,020; and

after 2014 – $2,045.

In 2009, $5,000 of public bonds was issued, and $400

of Texaco Capital Inc. bonds matured. In 2008, debt totaling

$822 matured, including $749 of Chevron Canada Funding

Company notes.

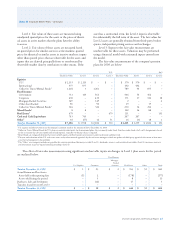

Note 18

New Accounting Standards

The FASB Accounting Standards Codification and the

Hierarchy of Generally Accepted Accounting Principles – a

replacement of FASB Statement No. 162 (FAS 168) In June

2009, the FASB issued FAS 168, which became effective

for the company in the quarter ending September 30, 2009.

This standard established the FASB Accounting Standards

Codification (ASC) system as the single authoritative source

of U.S. generally accepted accounting principles (GAAP) and

superseded existing literature of the FASB, Emerging Issues

Task Force, American Institute of CPAs and other sources.

The ASC did not change GAAP, but organized the literature

into about 90 accounting Topics. Adoption of the ASC did

not affect the company’s accounting.

Employer’s Disclosures About Postretirement Benefit Plan Assets

(FSP FAS 132(R)-1) In December 2008, the FASB issued

FSP FAS 132(R)-1, which was subsequently codified into ASC

715, Compensation – Retirement Benefits, and became effective

with the company’s reporting at December 31, 2009. This

standard amended and expanded the disclosure requirements

for the plan assets of defined benefit pension and other

postretirement plans. Refer to information beginning on page

59 in Note 21, Employee Benefits, for these disclosures.

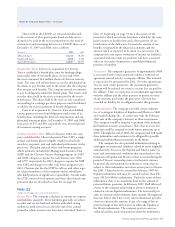

Transfers and Servicing (ASC 860), Accounting for Transfers

of Financial Assets (ASU 2009-16) The FASB issued ASU

2009-16 in December 2009. This standard became effective

for the company on January 1, 2010. ASU 2009-16 changes

how companies account for transfers of financial assets and

eliminates the concept of qualifying special-purpose entities.

Adoption of the guidance is not expected to have an impact

on the company’s results of operations, financial position

or liquidity.

Consolidation (ASC 810), Improvements to Financial Reporting

by Enterprises Involved With Variable Interest Entities (ASU

2009-17) The FASB issued ASU 2009-17 in December 2009.

This standard became effective for the company January 1,

2010. ASU 2009-17 requires the enterprise to qualitatively

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts