Chevron 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2009 Annual Report 77

RAC subteams also conduct in-depth reviews during the year of many of the fields that have the largest proved reserves

quantities. These reviews include an examination of the proved-reserve records and documentation of their alignment with

the Corporate Reserves Manual.

Revised Oil and Gas Reporting In December 2008,

the SEC issued its final rule, Modernization of Oil and Gas

Reporting (Release Nos. 33-8995; 34-59192; FR-78). The dis-

closure requirements under the final rule became effective for

the company with its Form 10-K filing for the year ending

December 31, 2009. The final rule changes a number of oil

and gas reserve estimation and disclosure requirements under

SEC Regulations S-K and S-X. Subsequently, the FASB

updated Extractive Industries – Oil and Gas (Topic 932)

to align the oil and gas reserves estimation and disclosure

requirements with the SEC’s final rule.

Among the principal changes in the final rule are

requirements to use a price based on a 12-month average for

reserve estimation and disclosure instead of a single end-of-

year price; expanding the definition of oil and gas producing

activities to include nontraditional sources such as bitumen

extracted from oil sands; permitting the use of new reliable

technologies to establish reasonable certainty of proved

reserves; allowing optional disclosure of probable and pos-

sible reserves; modifying the definition of geographic area

for disclosure of reserve estimates and production; amending

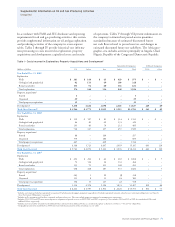

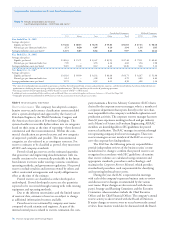

Table V Reserve Quantity Information – Continued

Summary of Net Oil and Gas Reserves

20091 20082 20072

Crude Oil Crude Oil Crude Oil

Liquids and Synthetic Oil in Millions of Barrels Condensate Synthetic Natural Condensate Natural Condensate Natural

Natural Gas in Billions of Cubic Feet NGLs Oil Gas NGLs Gas NGLs Gas

Proved Developed

Consolidated Companies

U.S. 1,122 – 2,314 1,158 2,709 1,238 3,226

Africa 820 – 978 789 1,209 758 1,151

Asia 926 – 5,062 1,094 4,758 722 4,344

Other 267 190 3,051 295 3,163 368 2,978

Total Consolidated 3,135 190 11,405 3,336 11,839 3,086 11,699

Affiliated Companies

TCO 1,256 – 1,830 1,369 1,999 1,273 1,762

Other 97 56 73 263 124 263 117

Total Consolidated and Affiliated Companies 4,488 246 13,308 4,968 13,962 4,622 13,578

Proved Undeveloped

Consolidated Companies

U.S. 239 – 384 312 441 386 451

Africa 426 – 2,043 596 1,847 742 1,898

Asia 245 – 2,798 362 3,238 301 2,863

Other 105 270 5,523 129 1,657 150 2,226

Total Consolidated 1,015 270 10,748 1,399 7,183 1,579 7,438

Affiliated Companies

TCO 690 – 1,003 807 1,176 716 986

Other 54 210 990 176 754 170 138

Total Consolidated and Affiliated Companies 1,759 480 12,741 2,382 9,113 2,465 8,562

Total Proved Reserves 6,247 726 26,049 7,350 23,075 7,087 22,140

1 Based on 12-month average price.

2 Based on year-end prices.

disclosures of proved reserve quantities to include separate

disclosures of synthetic oil and gas; expanding proved unde-

veloped reserves disclosures, including discussion of proved

undeveloped reserves that have remained undeveloped for five

years or more; and disclosure of the qualifications of the chief

technical person who oversees the company’s overall reserves

estimation process.

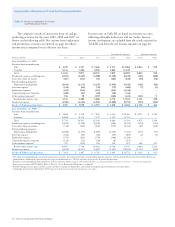

Effect of New Rules The most significant effect of the

company’s adopting the new guidance was the inclusion of

Canadian oil sands as synthetic oil in the consolidated

companies reserves. As indicated in Table V, on page 79,

an additional 460 million BOE were included at year-end

2009. The synthetic oil reported for affiliated companies

represents volumes reclassified from heavy crude oil to

synthetic oil, and does not represent additional reserves.

It was impracticable to estimate the remaining impact of

the new rules because of the cost and resources required

to prepare detailed field-level calculations. However, the

use of the 12-month average price had an upward effect on

reserves related to production-sharing and variable-royalty

contracts as the 12-month average price for crude oil and