Chevron 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Chevron Corporation 2009 Annual Report

FS-PB

Note 12

Investments and Advances

Equity in earnings, together with investments in and advances

to companies accounted for using the equity method and other

investments accounted for at or below cost, is shown in the

table below. For certain equity affiliates, Chevron pays its share

of some income taxes directly. For such affiliates, the equity in

earnings does not include these taxes, which are reported on the

Consolidated Statement of Income as “Income tax expense.”

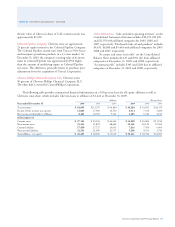

Investments and Advances Equity in Earnings

At December 31 Year ended December 31

2009 2008 2009 2008 2007

Upstream

Tengizchevroil $ 5,938 $ 6,290 $ 2,216 $ 3,220 $ 2,135

Petropiar/Hamaca 1,139 1,130 122 317 327

Petroboscan 832 816 171 244 185

Angola LNG Limited 1,853 1,191 (12) (8) 21

Other 686 725 118 206 204

Total Upstream 10,448 10,152 2,615 3,979 2,872

Downstream

GS Caltex Corporation 2,406 2,601 (191) 444 217

Caspian Pipeline Consortium 852 749 105 103 102

Star Petroleum Refining

Company Ltd. 873 877 (4) 22 157

Caltex Australia Ltd. 740 723 11 250 129

Colonial Pipeline Company 514 536 51 32 39

Other 1,773 1,664 311 354 318

Total Downstream 7,158 7,150 283 1,205 962

Chemicals

Chevron Phillips Chemical

Company LLC 2,327 2,037 328 158 380

Other 28 25 7 4 6

Total Chemicals 2,355 2,062 335 162 386

All Other

Other 507 567 83 20 (76)

Total equity method $ 20,468 $ 19,931 $ 3,316 $ 5,366 $ 4,144

Other at or below cost 690 989

Total investments and

advances $ 21,158 $ 20,920

Total United States $ 4,195 $ 4,002 $ 511 $ 307 $ 478

Total International $ 16,963 $ 16,918 $ 2,805 $ 5,059 $ 3,666

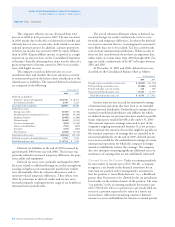

Descriptions of major affiliates, including significant

differences between the company’s carrying value of its

investments and its underlying equity in the net assets of

the affiliates, are as follows:

Tengizchevroil Chevron has a 50 percent equity ownership

interest in Tengizchevroil (TCO), a joint venture formed in

1993 to develop the Tengiz and Korolev crude-oil fields in

Kazakhstan over a 40-year period. At December 31, 2009, the

company’s carrying value of its investment in TCO was about

$200 higher than the amount of underlying equity in TCO’s

net assets. This difference results from Chevron acquiring

a portion of its interest in TCO at a value greater than the

underlying book value for that portion of TCO’s net assets.

See Note 7, on page 43, for summarized financial informa-

tion for 100 percent of TCO.

Petropiar Chevron has a 30 percent interest in Petropiar, a joint

stock company formed in 2008 to operate the Hamaca heavy-

oil production and upgrading project. The project, located in

Venezuela’s Orinoco Belt, has a 25-year contract term. Prior to

the formation of Petropiar, Chevron had a 30 percent interest

in the Hamaca project. At December 31, 2009, the company’s

carrying value of its investment in Petropiar was approximately

$195 less than the amount of underlying equity in Petropiar’s

net assets. The difference represents the excess of Chevron’s

underlying equity in Petropiar’s net assets over the net book

value of the assets contributed to the venture.

Petroboscan Chevron has a 39 percent interest in Petroboscan,

a joint stock company formed in 2006 to operate the

Boscan Field in Venezuela until 2026. Chevron previously

operated the field under an operating service agreement. At

December 31, 2009, the company’s carrying value of its

investment in Petroboscan was approximately $275 higher

than the amount of underlying equity in Petroboscan’s net

assets. The difference reflects the excess of the net book value

of the assets contributed by Chevron over its underlying

equity in Petroboscan’s net assets.

Angola LNG Ltd. Chevron has a 36 percent interest in Angola

LNG Ltd., which will process and liquefy natural gas produced

in Angola for delivery to international markets.

GS Caltex Corporation Chevron owns 50 percent of GS

Caltex Corporation, a joint venture with GS Holdings. The

joint venture imports, refines and markets petroleum prod-

ucts and petrochemicals, predominantly in South Korea.

Caspian Pipeline Consortium Chevron has a 15 percent

interest in the Caspian Pipeline Consortium, which provides

the critical export route for crude oil from both TCO and

Karachaganak.

Star Petroleum Refining Company Ltd. Chevron has a 64 per-

cent equity ownership interest in Star Petroleum Refining

Company Ltd. (SPRC), which owns the Star Refinery in

Thailand. The Petroleum Authority of Thailand owns the

remaining 36 percent of SPRC.

Caltex Australia Ltd. Chevron has a 50 percent equity owner-

ship interest in Caltex Australia Ltd. (CAL). The remaining

50 percent of CAL is publicly owned. At December 31, 2009,

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts