Chevron 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2009 Annual Report 23

FS-PB

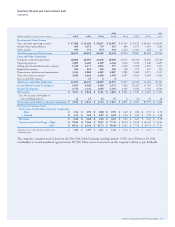

most of which can be liquidated or hedged effectively within

one day. The table below presents the 95 percent/one-day

VaR for each of the company’s primary risk exposures in the

area of derivative commodity instruments at December 31,

2009 and 2008. The lower amounts in 2009 were primarily

associated with a decrease in price volatility for these com-

modities during the year.

Millions of dollars 2009 2008

Crude Oil $ 17 $ 39

Natural Gas 4 5

Refined Products 19 45

Foreign Currency The company may enter into for-

eign-currency derivative contracts to manage some of its

foreign-currency exposures. These exposures include revenue

and anticipated purchase transactions, including foreign-

currency capital expenditures and lease commitments. The

foreign-currency derivative contracts, if any, are recorded at

fair value on the balance sheet with resulting gains and losses

reflected in income. There were no open foreign-currency

derivative contracts at December 31, 2009.

Interest Rates The company may enter into interest rate

swaps from time to time as part of its overall strategy to

manage the interest rate risk on its debt. Historically, under

the terms of the swaps, net cash settlements were based on

the difference between fixed-rate and floating-rate interest

amounts calculated by reference to agreed notional principal

amounts. Interest rate swaps related to a portion of the com-

pany’s fixed-rate debt, if any, may be accounted for as

fair value hedges. Interest rate swaps related to floating-

rate debt, if any, are recorded at fair value on the balance

sheet with resulting gains and losses reflected in income. At

year-end 2009, the company had no interest rate swaps on

floating-rate debt. The company’s only interest rate swaps on

fixed-rate debt matured in January 2009 and the company

had no interest rate swaps on fixed-rate debt at year-end 2009.

Transactions With Related Parties

Chevron enters into a number of business arrangements with

related parties, principally its equity affiliates. These arrange-

ments include long-term supply or offtake agreements and

long-term purchase agreements. Refer to Other Financial

Information in Note 24 of the Consolidated Financial

Statements, page 68, for further discussion. Management

believes these agreements have been negotiated on terms con-

sistent with those that would have been negotiated with an

unrelated party.

Litigation and Other Contingencies

MTBE Chevron and many other companies in the petro-

leum industry have used methyl tertiary butyl ether (MTBE)

as a gasoline additive. Chevron is a party to 50 pending

lawsuits and claims, the majority of which involve numerous

other petroleum marketers and refiners. Resolution of these

lawsuits and claims may ultimately require the company to

correct or ameliorate the alleged effects on the environment

of prior release of MTBE by the company or other parties.

Additional lawsuits and claims related to the use of MTBE,

including personal-injury claims, may be filed in the future.

The company’s ultimate exposure related to pending lawsuits

and claims is not determinable, but could be material to

net income in any one period. The company no longer uses

MTBE in the manufacture of gasoline in the United States.

Ecuador Chevron is a defendant in a civil lawsuit before

the Superior Court of Nueva Loja in Lago Agrio, Ecuador,

brought in May 2003 by plaintiffs who claim to be represen-

tatives of certain residents of an area where an oil production

consortium formerly had operations. The lawsuit alleges

damage to the environment from the oil exploration and

production operations and seeks unspecified damages to fund

environmental remediation and restoration of the alleged

environmental harm, plus a health monitoring program. Until

1992, Texaco Petroleum Company (Texpet), a subsidiary of

Texaco Inc., was a minority member of this consortium with

Petroecuador, the Ecuadorian state-owned oil company, as

the majority partner; since 1990, the operations have been

conducted solely by Petroecuador. At the conclusion of the

consortium and following an independent third-party envi-

ronmental audit of the concession area, Texpet entered into

a formal agreement with the Republic of Ecuador and

Petroecuador for Texpet to remediate specific sites assigned

by the government in proportion to Texpet’s ownership share

of the consortium. Pursuant to that agreement, Texpet conducted

a three-year remediation program at a cost of $40 million.

After certifying that the sites were properly remediated, the

government granted Texpet and all related corporate entities

a full release from any and all environmental liability arising

from the consortium operations.

Based on the history described above, Chevron

believes that this lawsuit lacks legal or factual merit. As to

matters of law, the company believes first, that the court

lacks jurisdiction over Chevron; second, that the law

under which plaintiffs bring the action, enacted in 1999,

cannot be applied retroactively; third, that the claims are

barred by the statute of limitations in Ecuador; and, fourth,

that the lawsuit is also barred by the releases from liability

previously given to Texpet by the Republic of Ecuador and

Petroecuador. With regard to the facts, the company believes

that the evidence confirms that Texpet’s remediation was

properly conducted and that the remaining environmental

damage reflects Petroecuador’s failure to timely fulfill its legal

obligations and Petroecuador’s further conduct since assum-

ing full control over the operations.

In April 2008, a mining engineer appointed by the

court to identify and determine the cause of environmental

damage, and to specify steps needed to remediate it, issued

a report recommending that the court assess $8 billion,

which would, according to the engineer, provide financial

compensation for purported damages, including wrongful

death claims, and pay for, among other items, environmental

remediation, health care systems and additional infrastruc-

ture for Petroecuador. The engineer’s report also asserted that

an additional $8.3 billion could be assessed against Chevron

for unjust enrichment. The engineer’s report is not binding

on the court. Chevron also believes that the engineer’s work