Chevron 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2009 Annual Report 15

FS-PB

Net oil-equivalent production in 2009 averaged

717,000 barrels per day, up 6.9 percent from 2008 and

down 3.5 percent from 2007. The increase between 2008

and 2009 was mainly due to the start-up of the Blind Faith

Field in late 2008 and the Tahiti Field in the second quarter

2009. The decrease between 2007 and 2008 was mainly

due to normal field declines and the adverse impact of the

hurricanes. The net liquids component of oil-equivalent

production for 2009 averaged 484,000 barrels per day, up

approximately 15 percent from 2008 and 5 percent compared

with 2007. Net natural-gas production averaged 1.4 billion

cubic feet per day in 2009, down approximately 7 percent

from 2008 and about 18 percent from 2007.

Refer to the “Selected Operating Data” table on page

18 for the three-year comparative production volumes in

the United States.

International Upstream – Exploration and Production

Millions of dollars 2009 2008 2007

Earnings* $ 8,215 $ 14,584 $ 10,284

*Includes foreign currency effects: $ (571) $ 873 $ (417)

International upstream earnings of $8.2 billion in 2009

decreased $6.4 billion from 2008. Lower prices for crude oil

and natural gas reduced earnings by $7.0 billion, while for-

eign-currency effects and higher operating and depreciation

expenses decreased income by a total of $2.2 billion. Partially

offsetting these items were benefits of $2.3 billion result-

ing from an increase in sales volumes of crude oil and about

$500 million associated with asset sales and tax items related

to the Gorgon Project in Australia.

Earnings of $14.6 billion in 2008 increased $4.3 bil-

lion from 2007. Higher prices for crude oil and natural gas

increased earnings by $4.9 billion. Partially offsetting the

benefit of higher prices was an impact of about $1.8 billion

associated with a reduction of crude-oil sales volumes due to

timing of certain cargo liftings and higher depreciation and

operating expenses. Foreign-currency effects benefited earn-

ings by $873 million in 2008, compared with a reduction to

earnings of $417 million in 2007.

The company’s average realization for crude oil and

natural gas liquids in 2009 was $55.97 per barrel, compared

with $86.51 in 2008 and $65.01 in 2007. The average

natural-gas realization was $4.01 per thousand cubic feet in

2009, compared with $5.19 and $3.90 in 2008 and 2007,

respectively.

Net oil-equivalent production of 1.99 million barrels

per day in 2009 increased about 7 percent and 6 percent

from 2008 and 2007, respectively. The volumes for each year

included production from oil sands in Canada. Absent the

impact of prices on certain production-sharing and variable-

royalty agreements, net oil-equivalent production increased

4 percent in 2009 and 3 percent in 2008, when compared

with prior years’ production.

The net liquids component of oil-equivalent produc-

tion was 1.4 million barrels per day in 2009, an increase of

approximately 11 percent from 2008 and 5 percent from

2007. Net natural-gas production of 3.6 billion cubic feet per

day in 2009 was down 1 percent and up 8 percent from 2008

and 2007, respectively.

Refer to the “Selected Operating Data” table, on page

18, for the three-year comparative of international pro -

duction volumes.

U.S. Downstream – Refining, Marketing and Transportation

Millions of dollars 2009 2008 2007

Earnings $ (273) $ 1,369 $ 966

U.S. downstream operations lost $273 million in 2009,

an earnings decrease of approximately $1.6 billion from

2008. A decline in refined product margins resulted in a

negative earnings variance of $1.7 billion. Partially offsetting

were lower operating expenses, which benefited earnings by

$300 million. Earnings of $1.4 billion in 2008 increased

about $400 million from 2007 due mainly to improved

margins on the sale of refined products and gains on derivative

commodity instruments. Operating expenses were higher

between 2007 and 2008.

Sales volumes of refined products were 1.40 million bar-

rels per day in 2009, a decrease of 1 percent from 2008. The

decline was associated with reduced demand for jet fuel and

fuel oil, principally associated with the downturn in the U.S.

economy. Sales volumes of refined products were 1.41 million

barrels per day in 2008, a decrease of 3 percent from 2007.

Branded gasoline sales volumes of 617,000 barrels per day

in 2009 were up about 3 percent and down 2 percent from

2008 and 2007, respectively.

Refer to the “Selected Operating Data” table on page

18 for a three-year comparison of sales volumes of gaso -

line and other refined products and refinery-input volumes.

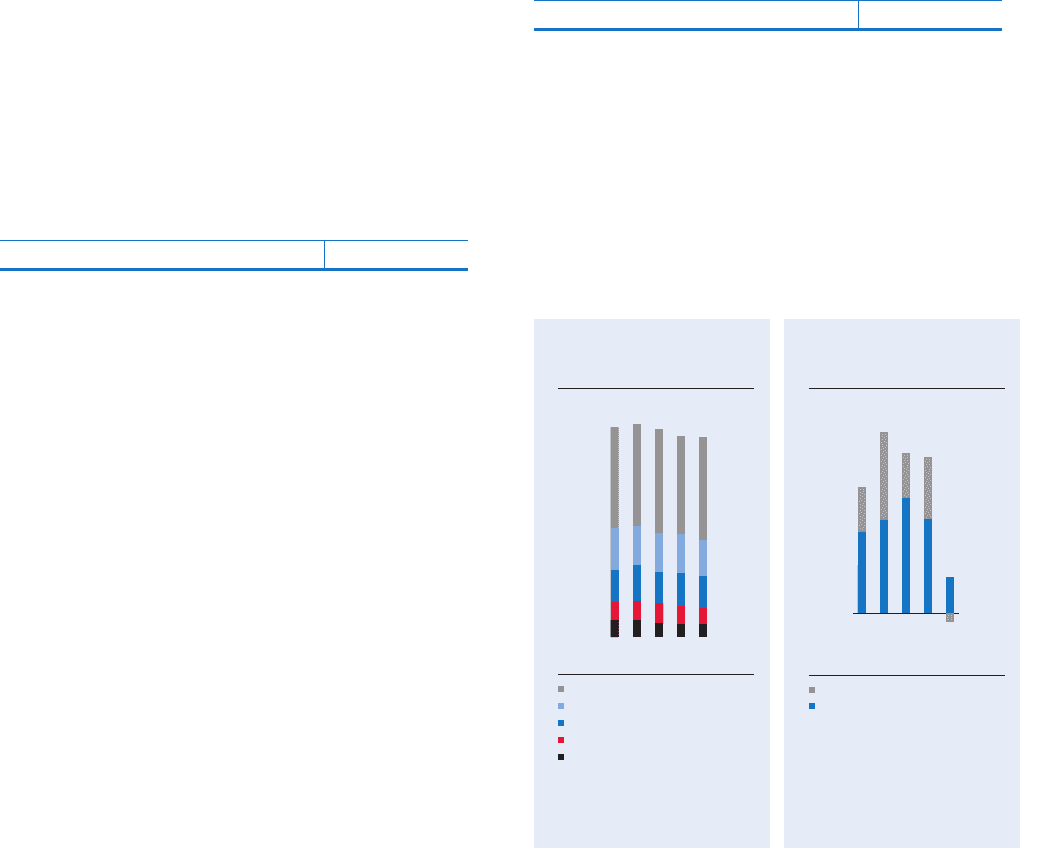

0

160 0

120 0

800

400

#018 – U.S. Gas & Other Rened

Prod Sales – v1

U.S. Gasoline & Other

Rened-Product Sales

Thousands of barrels per day

Gasoline

Jet Fuel

Gas Oils & Kerosene

Residual Fuel Oil

Other

Refined-product sales volumes

decreased about 1 percent from

2008 on lower sales of jet fuel

and fuel oil.

1,403

0605 07 08 09

Downstream earnings decreased

84 percent from 2008 due to lower

margins on the sale of refined

products.

*Includes equity in affiliates

United States

International

-0.5

4.5

3.5

2.5

0.5

1.5

Worldwide Rening, Marketing

& Transportation Earnings*

Billions of dollars

$0.6

0605 07 08 09

#019 – WW Rening, Marketing &

Trans Earnings – v3