Chevron 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2009 Annual Report 49

FS-PB

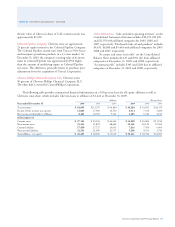

Segment Income Taxes Segment income tax expense for the

years 2009, 2008 and 2007 is as follows:

Year ended December 31

2009 2008 2007

Upstream

United States $ 1,225 $ 3,693 $ 2,541

International 7,686 15,132 11,307

Total Upstream 8,911 18,825 13,848

Downstream

United States (111) 815 520

International 182 813 400

Total Downstream 71 1,628 920

Chemicals

United States 54 (22) 6

International 46 47 36

Total Chemicals 100 25 42

All Other (1,117) (1,452) (1,331)

Total Income Tax Expense $ 7,965 $ 19,026 $ 13,479

Other Segment Information Additional information for the

segmentation of major equity affiliates is contained in Note

12, beginning on page 50. Information related to proper-

ties, plant and equipment by segment is contained in Note 13,

on page 52.

for the chemicals segment are derived primarily from the man-

ufacture and sale of additives for lubricants and fuels. “All

Other” activities include revenues from mining operations,

power generation businesses, insurance operations, real estate

activities and technology companies.

Other than the United States, no single country accounted

for 10 percent or more of the company’s total sales and other

operating revenues in 2009, 2008 and 2007.

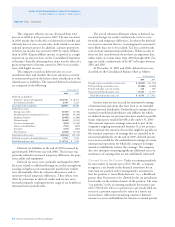

Year ended December 31

2009 2008 2007

Upstream

United States $ 9,164 $ 23,503 $ 18,736

Intersegment 10,278 15,142 11,625

Total United States 19,442 38,645 30,361

International 13,409 19,469 15,213

Intersegment 18,477 24,204 19,647

Total International 31,886 43,673 34,860

Total Upstream 51,328 82,318 65,221

Downstream

United States 57,846 87,515 70,535

Excise and similar taxes 4,573 4,746 4,990

Intersegment 190 447 491

Total United States 62,609 92,708 76,016

International 76,668 122,064 97,178

Excise and similar taxes 3,471 5,044 5,042

Intersegment 106 122 38

Total International 80,245 127,230 102,258

Total Downstream 142,854 219,938 178,274

Chemicals

United States 271 305 351

Excise and similar taxes – 2 2

Intersegment 194 266 235

Total United States 465 573 588

International 1,231 1,388 1,143

Excise and similar taxes 65 55 86

Intersegment 132 154 142

Total International 1,428 1,597 1,371

Total Chemicals 1,893 2,170 1,959

All Other

United States 665 815 757

Intersegment 964 917 760

Total United States 1,629 1,732 1,517

International 39 52 58

Intersegment 33 33 31

Total International 72 85 89

Total All Other 1,701 1,817 1,606

Segment Sales and Other

Operating Revenues

United States 84,145 133,658 108,482

International 113,631 172,585 138,578

Total Segment Sales and Other

Operating Revenues 197,776 306,243 247,060

Elimination of intersegment sales (30,374) (41,285) (32,969)

Total Sales and Other

Operating Revenues $ 167,402 $ 264,958 $ 214,091

Note 11 Operating Segments and Geographic Data – Continued