Chevron 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2009 Annual Report 53

FS-PB

Note 12 Investments and Advances – ContinuedNote 14 Litigation – Continued

given to Texpet by the Republic of Ecuador and Petroecua-

dor. With regard to the facts, the company believes that the

evidence confirms that Texpet’s remediation was properly

conducted and that the remaining environmental damage

reflects Petroecuador’s failure to timely fulfill its legal obliga-

tions and Petroecuador’s further conduct since assuming full

control over the operations.

In April 2008, a mining engineer appointed by the

court to identify and determine the cause of environmen-

tal damage, and to specify steps needed to remediate it,

issued a report recommending that the court assess $8,000,

which would, according to the engineer, provide financial

compensation for purported damages, including wrongful

death claims, and pay for, among other items, environmental

remediation, health care systems and additional infrastruc-

ture for Petroecuador. The engineer’s report also asserted

that an additional $8,300 could be assessed against Chevron

for unjust enrichment. The engineer’s report is not binding

on the court. Chevron also believes that the engineer’s work

was performed and his report prepared in a manner contrary

to law and in violation of the court’s orders. Chevron sub-

mitted a rebuttal to the report in which it asked the court

to strike the report in its entirety. In November 2008, the

engineer revised the report and, without additional evidence,

recommended an increase in the financial compensation for

purported damages to a total of $18,900 and an increase in

the assessment for purported unjust enrichment to a total of

$8,400. Chevron submitted a rebuttal to the revised report,

which the court dismissed. In September 2009, following

the disclosure by Chevron of evidence that the judge partici-

pated in meetings in which businesspeople and individuals

holding themselves out as government officials discussed

the case and its likely outcome, the judge presiding over the

case petitioned to be recused. In late September 2009, the

judge was recused, and in October 2009, the full chamber

of the provincial court affirmed the recusal, resulting in the

appointment of a new judge. Chevron filed motions to annul

all of the rulings made by the prior judge, but the new judge

denied these motions. The court has completed most of the

procedural aspects of the case and could render a judgment

at any time. Chevron will continue a vigorous defense of any

attempted imposition of liability.

In the event of an adverse judgment, Chevron would

expect to pursue its appeals and vigorously defend against

enforcement of any such judgment; therefore, the ultimate

outcome – and any financial effect on Chevron – remains

uncertain. Management does not believe an estimate of a rea-

sonably possible loss (or a range of loss) can be made in this

case. Due to the defects associated with the engineer’s report,

management does not believe the report has any utility in

calculating a reasonably possible loss (or a range of loss).

Moreover, the highly uncertain legal environment surround-

ing the case provides no basis for management to estimate a

reasonably possible loss (or a range of loss).

Note 15

Taxes

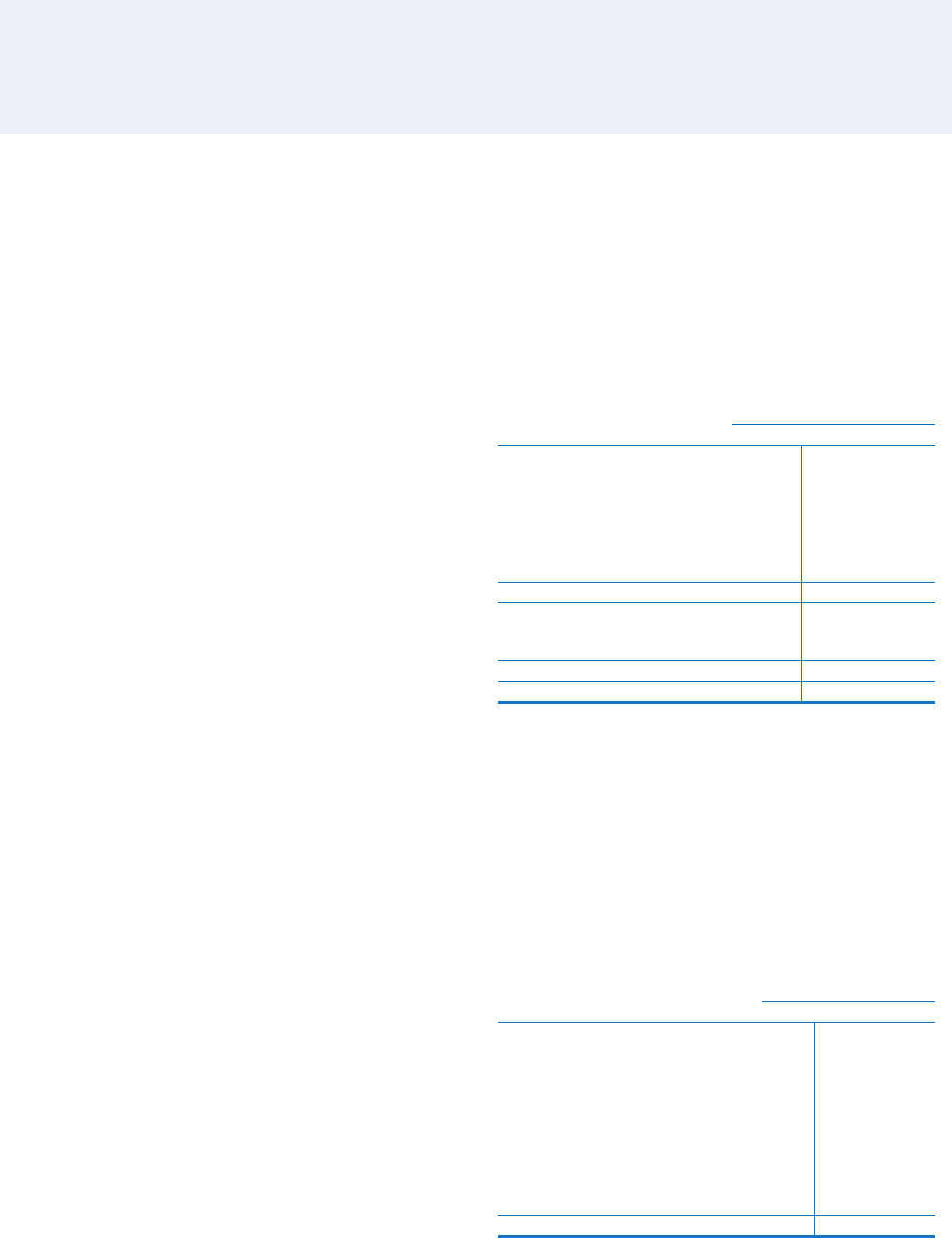

Income Taxes

Year ended December 31

2009 2008 2007

Taxes on income

U.S. Federal

Current $ 128 $ 2,879 $ 1,446

Deferred (147) 274 225

State and local

Current 216 528 356

Deferred 14 141 (18)

Total United States 211 3,822 2,009

International

Current 7,154 15,021 11,416

Deferred 600 183 54

Total International 7,754 15,204 11,470

Total taxes on income $ 7,965 $ 19,026 $ 13,479

In 2009, before-tax income for U.S. operations,

including related corporate and other charges, was $1,310,

compared with before-tax income of $10,765 and $7,886 in

2008 and 2007, respectively. For international operations,

before-tax income was $17,218, $32,292 and $24,388 in

2009, 2008 and 2007, respectively. U.S. federal income tax

expense was reduced by $204, $198 and $132 in 2009, 2008

and 2007, respectively, for business tax credits.

The reconciliation between the U.S. statutory federal

income tax rate and the company’s effective income tax rate is

explained in the following table:

Year ended December 31

2009 2008 2007

U.S. statutory federal income tax rate 35.0% 35.0% 35.0%

Effect of income taxes from inter-

national operations at rates different

from the U.S. statutory rate 10.4 10.1 8.2

State and local taxes on income, net

of U.S. federal income tax benefit 0.9 1.0 0.8

Prior-year tax adjustments (0.3) (0.1) 0.3

Tax credits (1.1) (0.5) (0.4)

Effects of enacted changes in tax laws 0.1 (0.6) (0.3)

Other (2.0) (0.7) (1.8)

Effective tax rate 43.0% 44.2% 41.8%