Chevron 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Chevron Corporation 2009 Annual Report

FS-PB

members of the Executive Committee also have individual

management responsibilities and participate in other commit-

tees for purposes other than acting as the CODM.

“All Other” activities include mining operations, power

generation businesses, worldwide cash management and

debt financing activities, corporate administrative functions,

insurance operations, real estate activities, alternative fuels

and technology companies, and the company’s interest in

Dynegy (through May 2007, when Chevron sold its interest).

The company’s primary country of operation is the

United States of America, its country of domicile. Other

components of the company’s operations are reported as

“International” (outside the United States).

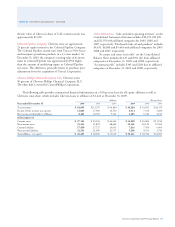

Segment Earnings The company evaluates the performance of

its operating segments on an after-tax basis, without consider-

ing the effects of debt financing interest expense or investment

interest income, both of which are managed by the company

on a worldwide basis. Corporate administrative costs and

assets are not allocated to the operating segments. However,

operating segments are billed for the direct use of corporate

services. Nonbillable costs remain at the corporate level in

“All Other.” Earnings by major operating area are presented

in the following table:

Year ended December 31

2009 2008 2007

Segment Earnings

Upstream

United States $ 2,216 $ 7,126 $ 4,532

International 8,215 14,584 10,284

Total Upstream 10,431 21,710 14,816

Downstream

United States (273) 1,369 966

International 838 2,060 2,536

Total Downstream 565 3,429 3,502

Chemicals

United States 198 22 253

International 211 160 143

Total Chemicals 409 182 396

Total Segment Earnings 11,405 25,321 18,714

All Other

Interest expense (22) – (107)

Interest income 46 192 385

Other (946) (1,582) (304)

Net Income Attributable

to Chevron Corporation $ 10,483 $ 23,931 $ 18,688

Note 11 Operating Segments and Geographic Data – Continued

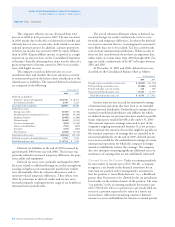

Segment Assets Segment assets do not include intercompany

investments or intercompany receivables. Segment assets at

year-end 2009 and 2008 are as follows:

At December 31

2009 2008

Upstream

United States $ 24,918 $ 26,071

International 74,937 72,530

Goodwill 4,618 4,619

Total Upstream 104,473 103,220

Downstream

United States 18,067 15,869

International 24,824 23,572

Total Downstream 42,891 39,441

Chemicals

United States 2,810 2,535

International 1,066 1,086

Total Chemicals 3,876 3,621

Total Segment Assets 151,240 146,282

All Other*

United States 7,125 8,984

International 6,256 5,899

Total All Other 13,381 14,883

Total Assets – United States 52,920 53,459

Total Assets – International 107,083 103,087

Goodwill 4,618 4,619

Tota l Assets $ 164,621 $ 161,165

* “All Other” assets consist primarily of worldwide cash, cash equivalents and

marketable securities, real estate, information systems, mining operations, power

generation businesses, alternative fuels and technology companies, and assets of

the corporate administrative functions.

Segment Sales and Other Operating Revenues Operating seg-

ment sales and other operating revenues, including internal

transfers, for the years 2009, 2008 and 2007, are presented

in the table on the following page. Products are transferred

between operating segments at internal product values that

approximate market prices.

Revenues for the upstream segment are derived primarily

from the production and sale of crude oil and natural gas,

as well as the sale of third-party production of natural gas.

Revenues for the downstream segment are derived from the

refining and marketing of petroleum products such as gaso-

line, jet fuel, gas oils, lubricants, residual fuel oils and

other products derived from crude oil. This segment also

generates revenues from the transportation and trading of

refined products, crude oil and natural gas liquids. Revenues

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts