Chevron 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

16 Chevron Corporation 2009 Annual Report

FS-PB

International Downstream – Refining, Marketing and Transportation

Millions of dollars 2009 2008 2007

Earnings* $ 838 $ 2,060 $ 2,536

*Includes foreign currency effects: $ (213) $ 193 $ 62

International downstream earnings of $838 million in

2009 decreased about $1.2 billion from 2008. An approxi-

mate $2.6 billion decline between periods was associated

with weaker margins on the sale of gasoline and other refined

products and the absence of gains recorded in 2008 on com-

modity derivative instruments. Foreign-currency effects

produced a negative variance of $400 million. Partially off-

setting these items was a $1.0 billion benefit from lower

operating expenses associated mainly with contract labor,

professional services and

transportation costs and

about a $550 million

increase in gains on asset

sales primarily in certain

countries in Latin America

and Africa. Earnings in

2008 of $2.1 billion

decreased nearly $500 mil-

lion from 2007. Earnings in

2007 included gains of

approximately $1 billion on

the sale of assets, which

included marketing assets in

the Benelux region of

Europe and an interest in a

refinery. The $500 million

other improvement between

years was associated primar-

ily with a benefit from gains

on derivative commodity

instruments that was only

partially offset by the

impact of lower margins

from sales of refined prod-

ucts. Foreign-currency

effects increased earnings by $193 million in 2008, compared

with $62 million in 2007.

Refined-product sales volumes were 1.85 million bar-

rels per day in 2009, about 8 percent lower than in 2008

due mainly to the effects of asset sales and lower demand.

Refined-product sales volumes were 2.02 million barrels per

day in 2008, about level with 2007.

Refer to the “Selected Operating Data” table, on page

18, for a three-year comparison of sales volumes of gaso-

line and other refined products and refinery-input volumes.

Chemicals

Millions of dollars 2009 2008 2007

Earnings* $ 409 $ 182 $ 396

*Includes foreign currency effects: $ 15 $ (18) $ (3)

The chemicals segment includes the company’s Oronite

subsidiary and the 50 percent-owned Chevron Phillips

Chemical Company LLC (CPChem). In 2009, earnings were

$409 million, compared with $182 million and $396 million

in 2008 and 2007, respectively. For CPChem, the earnings

improvement from 2008 to 2009 reflected lower utility and

manufacturing costs as well as the absence of an impairment

recorded in 2008. These benefits were partially offset by

lower margins on the sale of

commodity chemicals. For

Oronite, earnings increased

in 2009 due to higher mar-

gins on sales of lubricant

and fuel additives, the effect

of which more than offset

the impact of lower sales

volumes. In 2008, segment

earnings were $182 million,

compared with $396 million

in 2007. Earnings declined

in 2008 due to lower sales

volumes of commodity

chemicals by CPChem.

Higher expenses for planned

maintenance activities also

contributed to the earnings

decline. Earnings also

declined for Oronite due to

lower volumes and higher

operating expenses.

All Other

Millions of dollars 2009 2008 2007

Net Charges* $ (922) $ (1,390) $ (26)

*Includes foreign currency effects: $ 25 $ (186) $ 6

All Other includes mining operations, power generation

businesses, worldwide cash management and debt financing

activities, corporate administrative functions, insurance oper-

ations, real estate activities, alternative fuels and technology

companies, and the company’s interest in Dynegy, Inc. prior

to its sale in May 2007.

Net charges in 2009 decreased $468 million from 2008

due to lower provisions for environmental remediation at sites

0

600

200

100

300

400

500

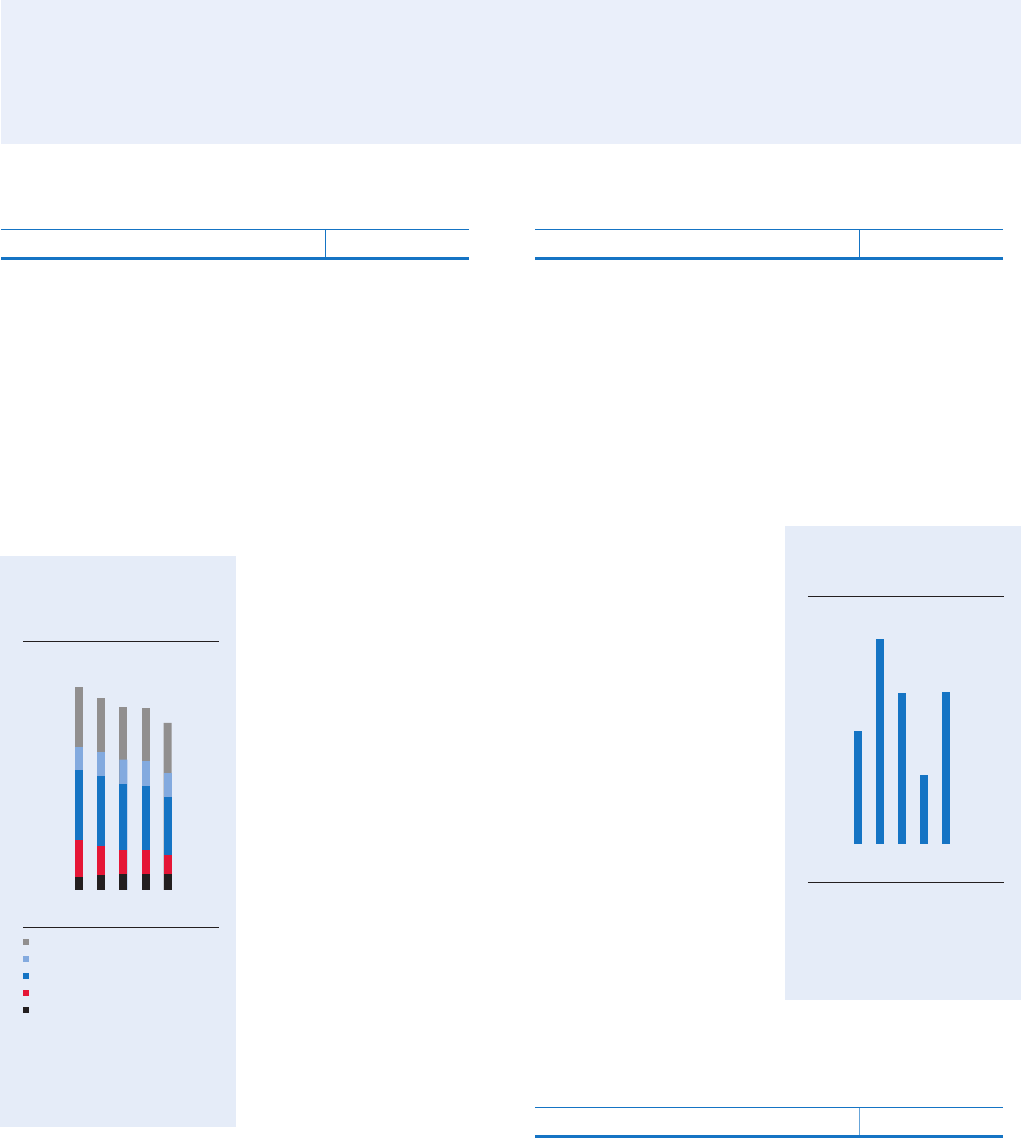

Worldwide Chemicals

Earnings*

Millions of dollars

Chemicals earnings increased about

125 percent from 2008 due to higher

margins on select commodity

chemical products and lower utility

and manufacturing expenses.

*Includes equity in affiliates

0605 07 08 09

$409

#021 – WW Chemicals Earnings – v2

0

2500

2000

150 0

1000

500

#020 – Int’l. Gasoline & Other

Rened – v2

International Gasoline &

Other Rened-Product

Sales*

Thousands of barrels per day

Sales volumes of refined products

were down 8 percent from 2008 due

to asset sales and weak economic

conditions which depressed demand.

*Includes equity in affiliates

Gasoline

Jet Fuel

Gas Oils & Kerosene

Residual Fuel Oil

Other

0605 07 08 09

1,851